Oil funds suffer massive adverse actions

For all the unprecedented action over the past month, nothing beats the moves in oil.

Shares outstanding in the most popular fund, USO, have gone parabolic. While this has triggered the usual round of "this won't end well for mom and pop" kinds of comments, it's not that simple. Every time USO has plunged, shares outstanding have skyrocketed, a combination of buy-the-dippers and short-sellers scrambling to trade the fund.

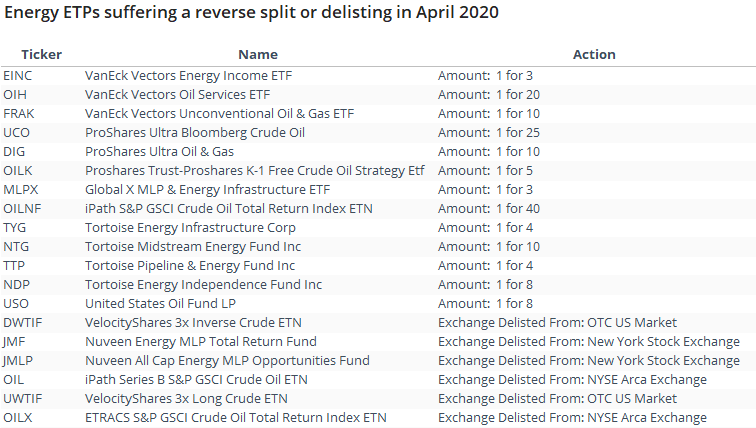

It's been a heck of a ride for some of the other funds, too, especially if they're leveraged. That has triggered a rash of corporate actions like reverse splits or even outright delistings, just this month alone.

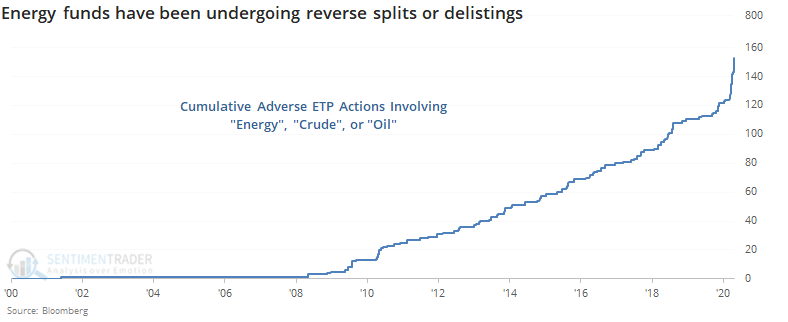

Cumulatively since the year 2000, nearly 160 of these funds have suffered an adverse corporate action, meaning either a reverse split or a delisting.

When we look at the rate of change in these adverse actions, it has proved to be a modest contrary indicator for crude oil and energy shares.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A closer look at USO, who owns it, and who's buying, along with rates of change in adverse actions

- The average sector has seen its McClellan Oscillator turn negative

- That negative breadth momentum is also on the NYSE, after what had been a positive surge

- The Chicago Fed National Activity barometer has plunged

- Tech shares' outperformance is nearing a record

- The IBB biotech fund's optimism is near a record high

- News stories have been dominated by oil and increasingly, FOMO (Fear Of Missing Out)