Oil and energy funds suffer record adverse actions

For all the unprecedented action over the past month, nothing beats the moves in oil.

The reasons for front-month oil futures going negative have been well-documented, as have most other aspects of the volatile commodity. One thing that sticks out is the numerous exchange-traded products focused on energy and oil, and how fund companies are reacting.

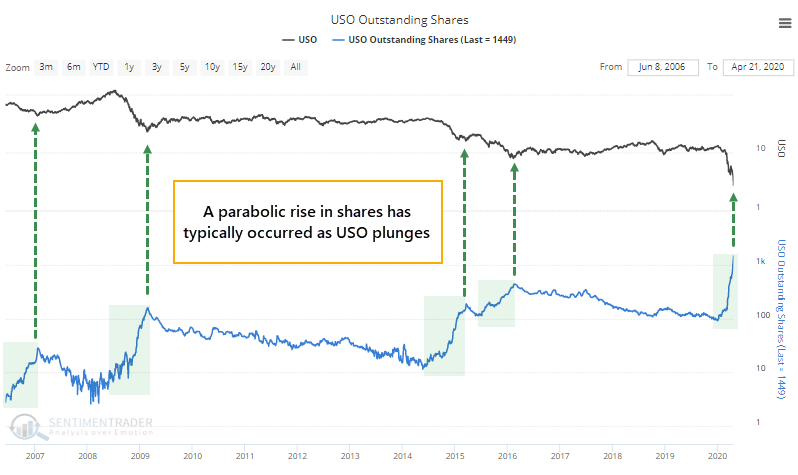

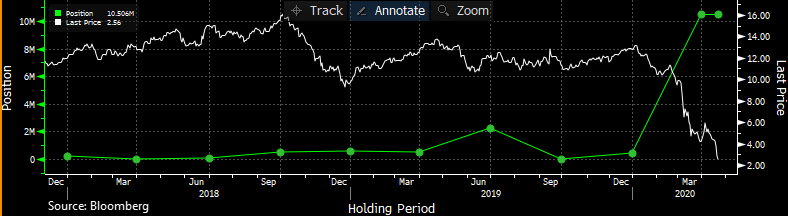

Shares outstanding in the most popular fund, USO, have gone parabolic. While this has triggered the usual round of "this won't end well for mom and pop" kinds of comments, it's not that simple. Every time USO has plunged, shares outstanding have skyrocketed, a combination of buy-the-dippers and short-sellers scrambling to trade the fund. The chart below uses a log scale for both USO and its shares.

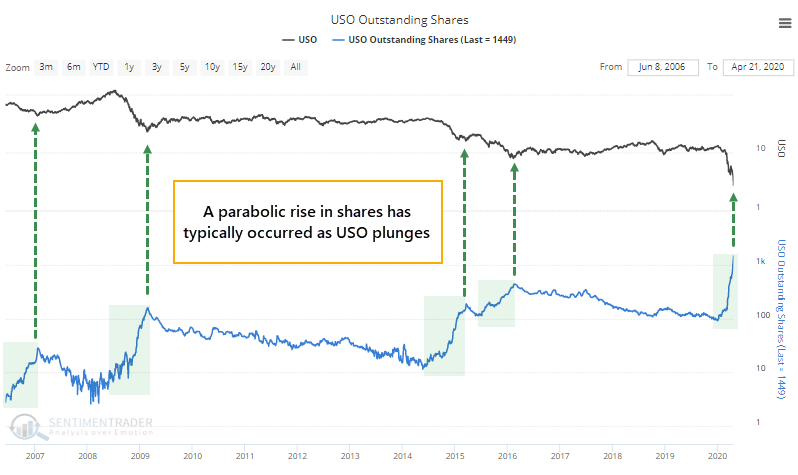

The turnover in the fund has been remarkable. In recent days, the dollar value of shares traded in USO has hit a record relative to the most popular fund in the world. Other times it exceeded 5% of the value of shares traded in SPY roughly equated with turning points, but it was not very consistent.

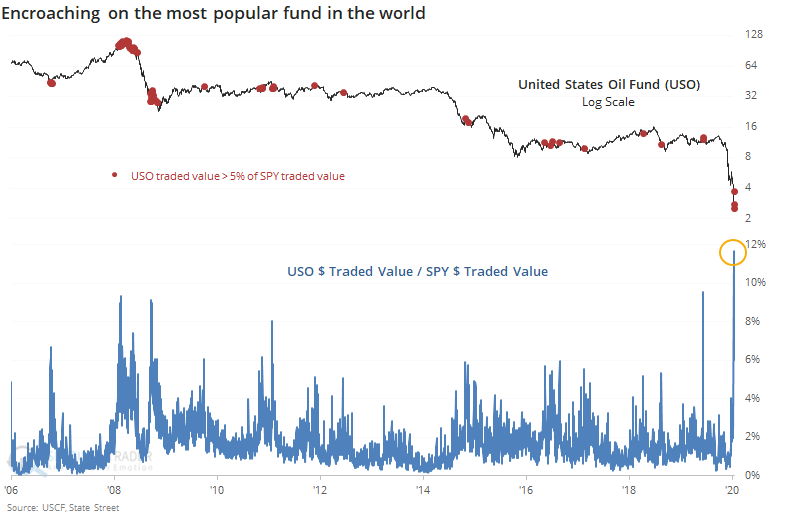

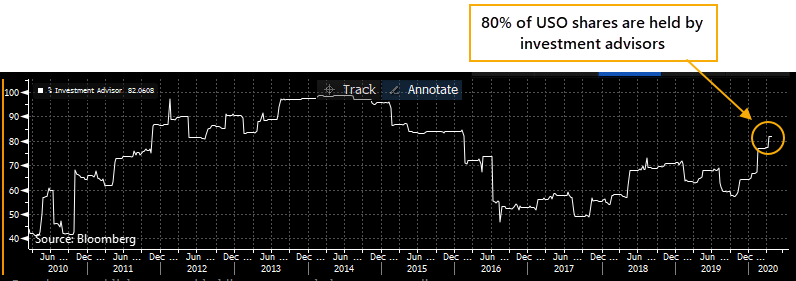

It's not just mom and pop, though. While underlying ownership is sometimes hard to decipher, more than 80% of USO's outstanding shares are held by investment advisors, up from less than 60% last fall.

Among those advisors, the biggest holder is XR Securities, which made a dramatic increase to its position in the latest quarter, for what that's worth.

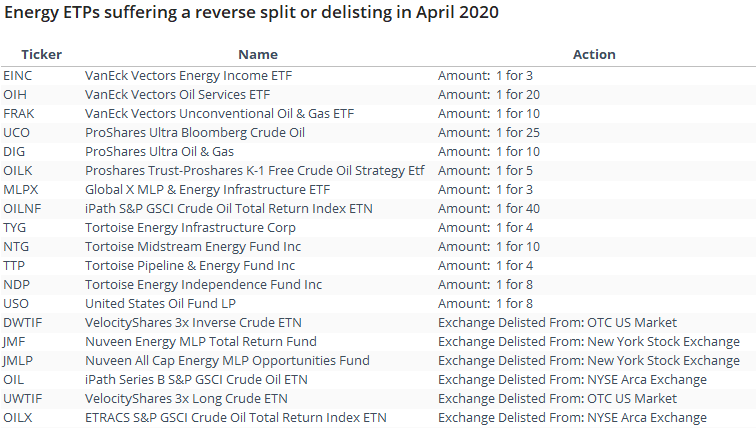

It's been a heck of a ride for some of the other funds, too, especially if they're leveraged. That has triggered a rash of corporate actions like reverse splits or even outright delistings, just this month alone.

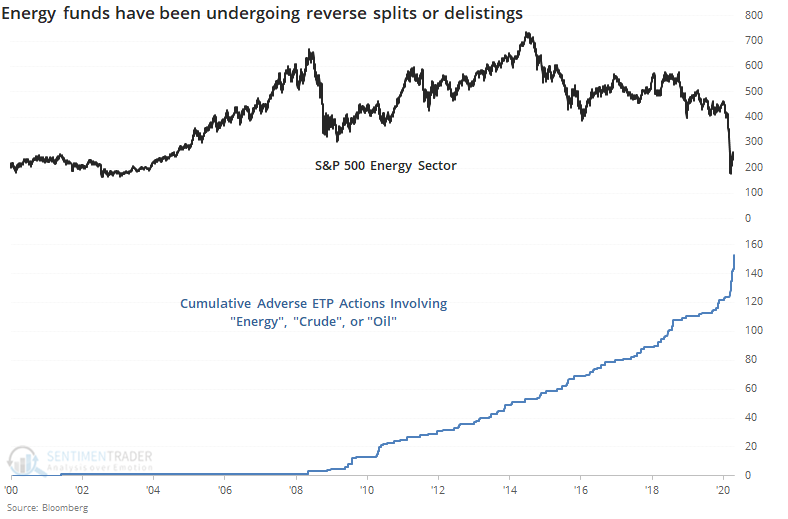

Cumulatively since the year 2000, nearly 160 of these funds have suffered an adverse corporate action, meaning either a reverse split or a delisting.

It seems like this should be an excellent contrary sign, but the record has been mixed.

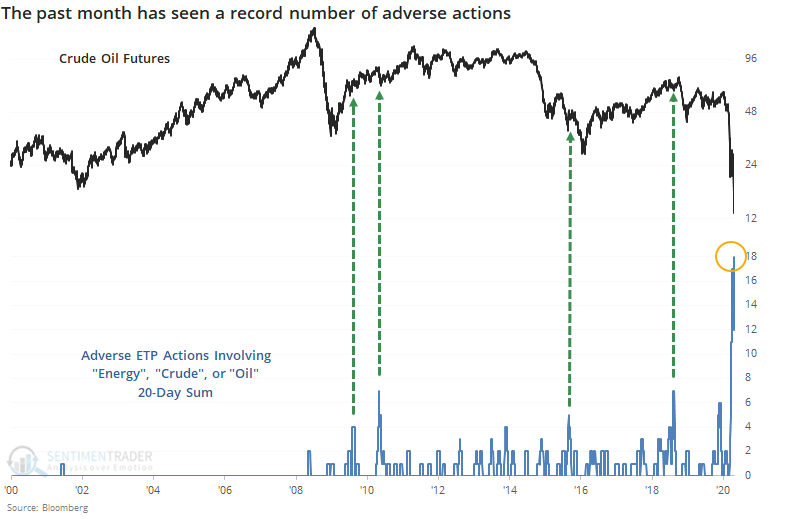

If we compare the ETP actions to crude oil itself, it's even less consistent.

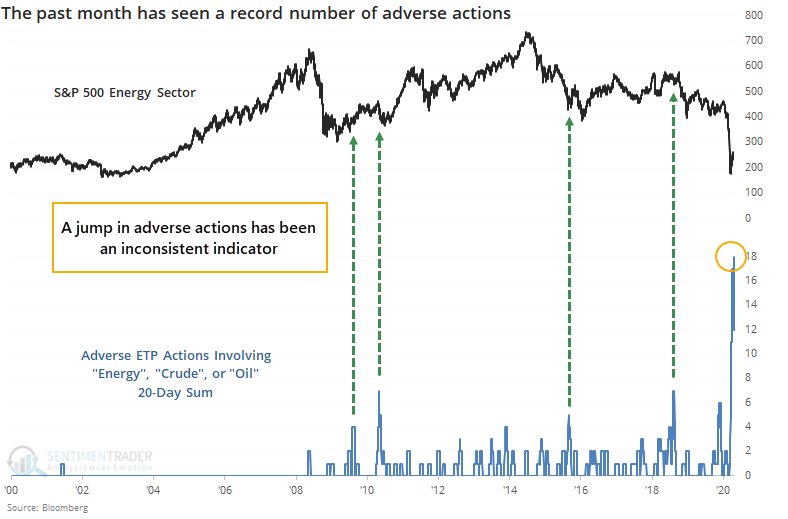

We haven't seen anything like the past month in oil, and the adverse fund actions reflect that. Over the past 20 days, the surge in funds going through either a reverse split or delisting is nearly 3 times the next-greatest spike since these funds' inceptions.

It seems like this recent bout of actions should be a sign that volatility has become so great, and pessimism so prevalent, that it's bullish for the energy sector. We could say that generally, that's the case, including other times we've seen it in other markets, but it's not a slam-dunk signal, and often takes a long time to play out.