Notes rise, gold and dollar fall, in election response

On Wednesday, stocks soared in reaction to the initial election results. Despite the risks in extrapolating day-to-day movements to a longer time frame, especially in reaction to a news event, prior positive reactions have tended to stick.

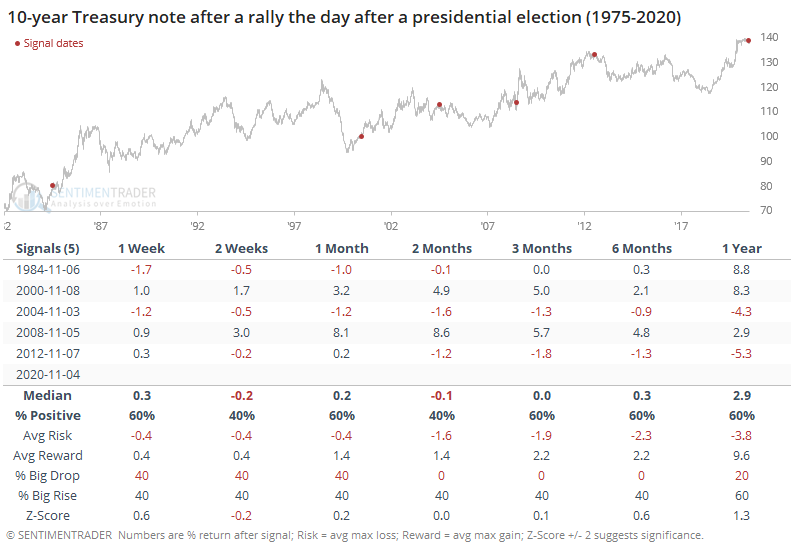

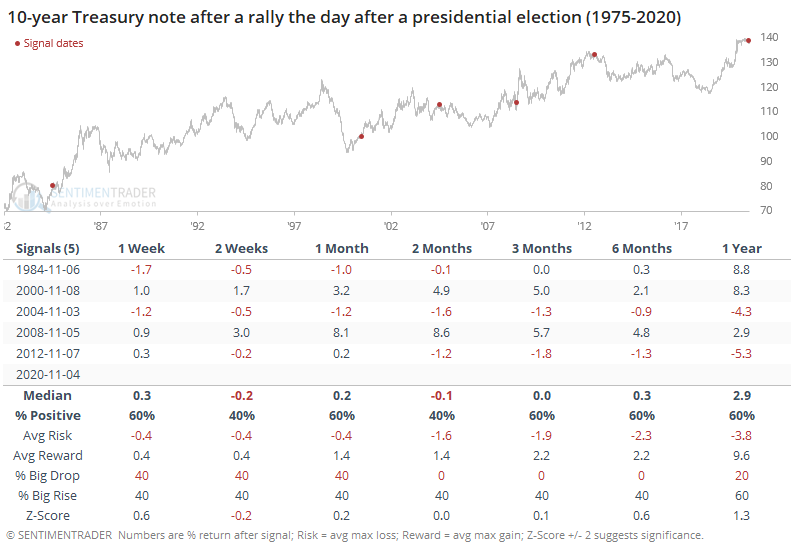

So, it was a great day for many stocks. Bonds, too, reacted well, with a gain of more than 0.6% in 10-year Treasury note futures. It doesn't seem like much, but a daily change of +/- 0.5% in note futures is a pretty big deal.

At the risk of making the same extrapolation mistake, the table below shows those times when 10-year note futures rallied the day after a presidential election.

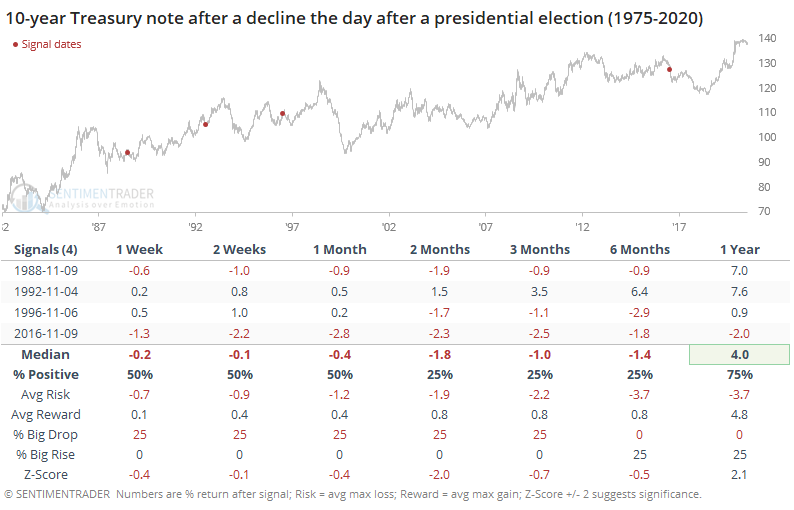

Kind of a mixed bag, but more positive than not. At least, it was more consistent than when traders sold bonds in reaction to election results.

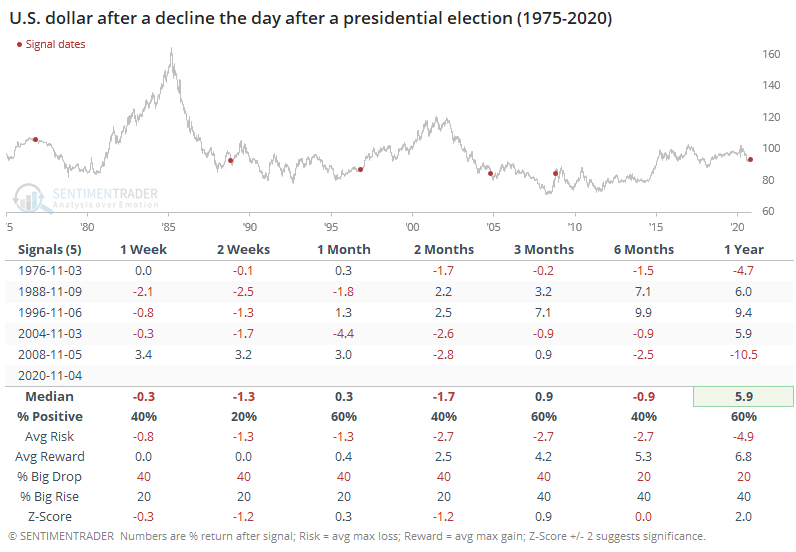

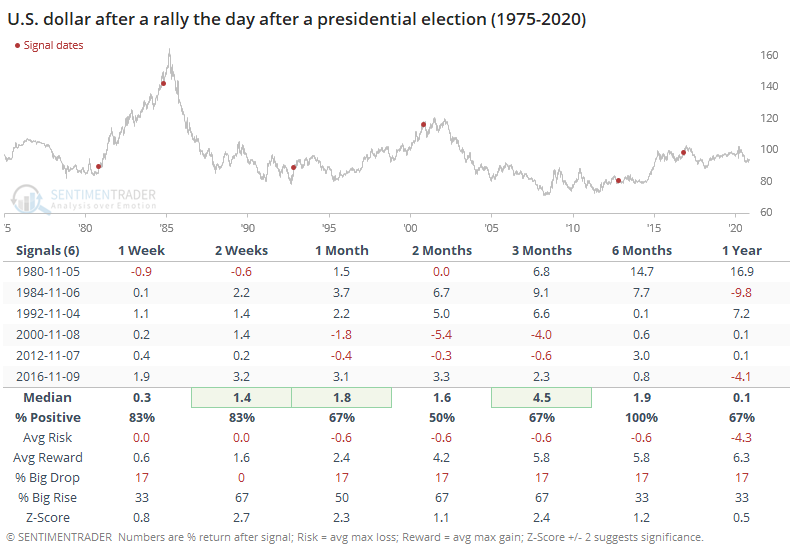

As traders (investors?) bought stocks and bonds, the dollar fell. That typically led to some more selling in the weeks ahead, but a mixed bag after that.

The buck tended to hold up better when it rose the day after an election.

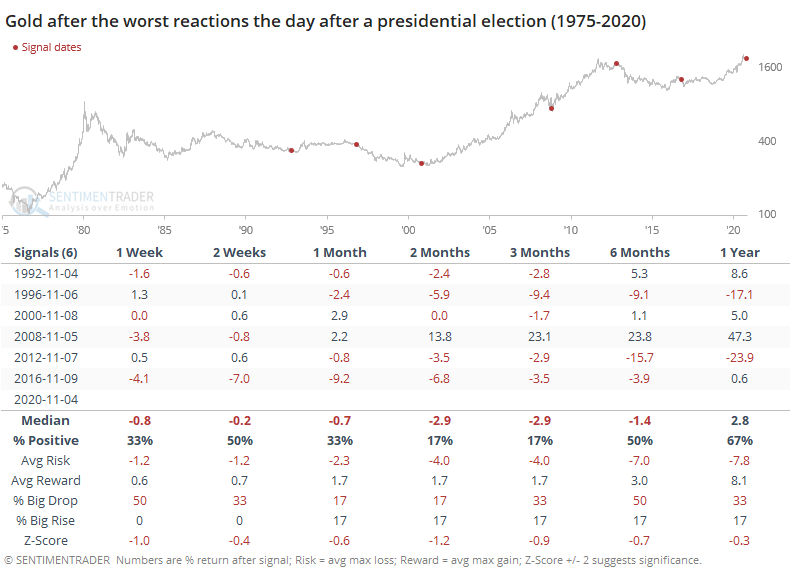

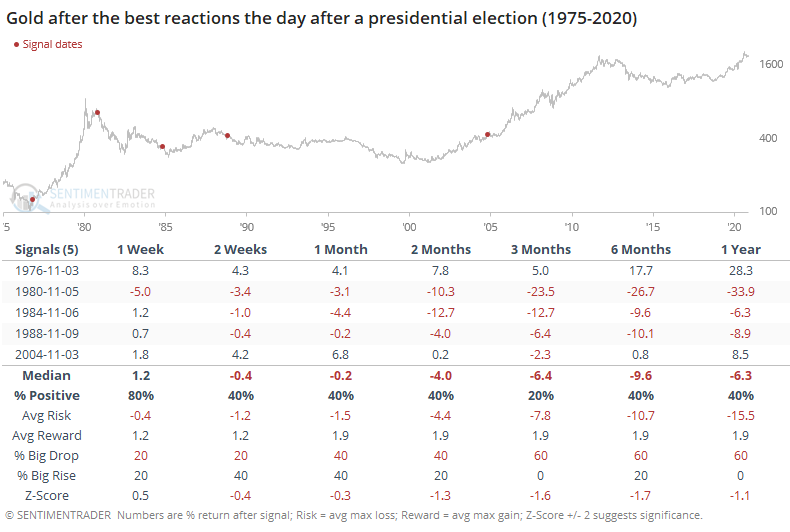

Gold also fell initially. There was an even smaller sample size for these reactions, so we'll include the times when gold had the least impressive reaction to an election, which was either a loss for the day or a gain of less than 0.5%.

After these signals, gold managed to rebound over the next 2-3 months only once. That sounds bad, but it didn't have much better chance when it reacted well (more than a 0.5% gain) the day after.

Relying on knee-jerk reactions to a guide to the coming weeks and months is usually foolhardy. The only reason we've bothered to spend time on it is that initial reactions to a presidential election have been relatively consistent at indicating future demand.

This is a good sign for stocks, and maybe a mild positive for bond prices. It's a modest negative for the dollar, but gold didn't show enough of a difference between reactions to even hint at an edge.