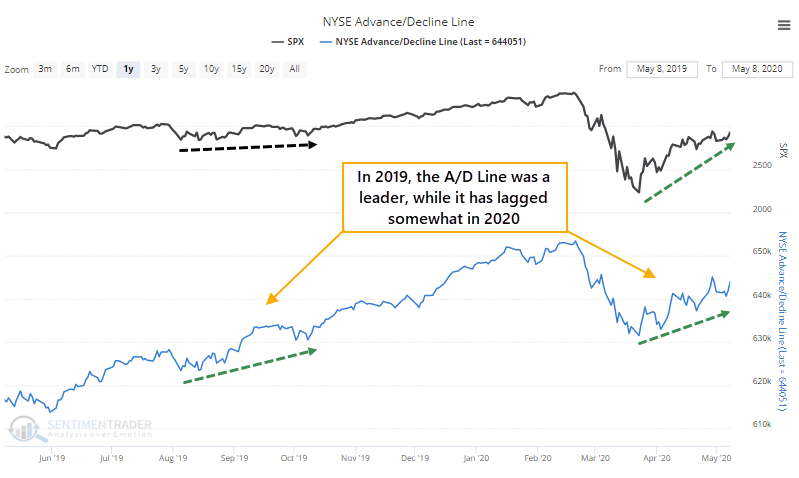

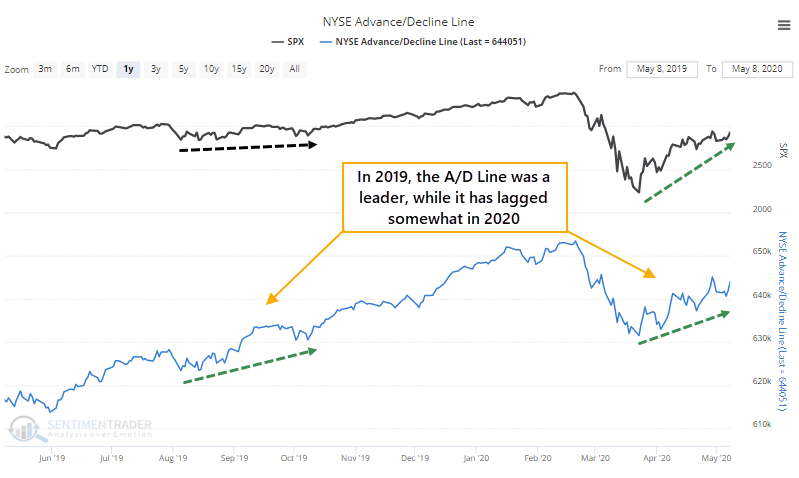

Not much oomph as the Advance/Decline Line lags

Stocks have been doing very well and approached new highs for the recovery late last week. Well, the indexes did, anyway.

There was a big breadth thrust in the initial kick-off from the low, but since then, there have been more signs that not all securities are coming along for the ride. By Friday, the S&P recovered more than 30% off its low, but the Cumulative Advance/Decline Line for the NYSE hasn't seen nearly as much of a bump. Even the line specifically for the S&P 500 itself has been lagging.

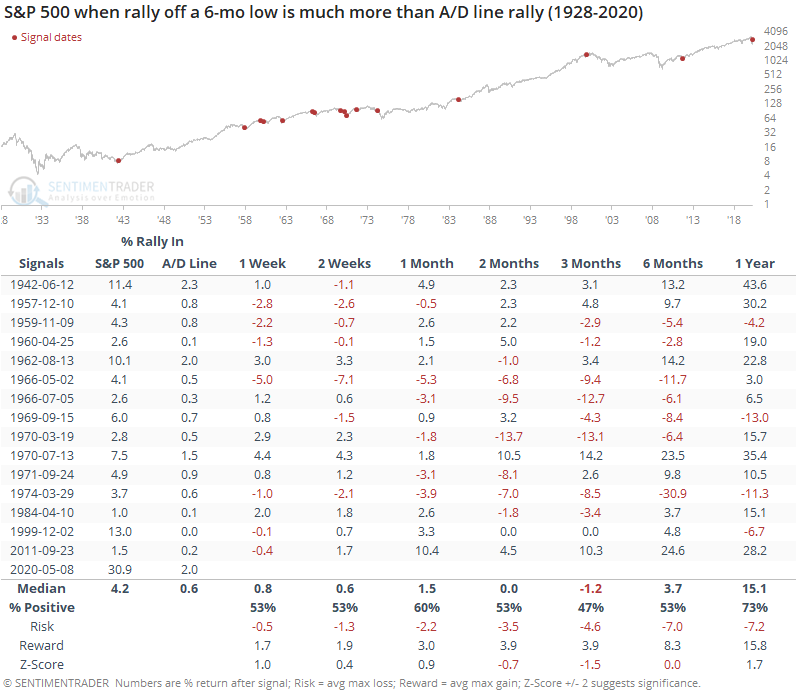

Below, we can see every time the S&P rallied off a 6-month low for 33 days as it has now. But these signals only show the times when the rally in the S&P index was much more than the rally in the A/D Line. For most of these, stocks saw a healthy gain but the A/D Line was barely above its low.

Returns weren't terrible, but over the next three months, the S&P was negative more often than positive, with more risk than reward.

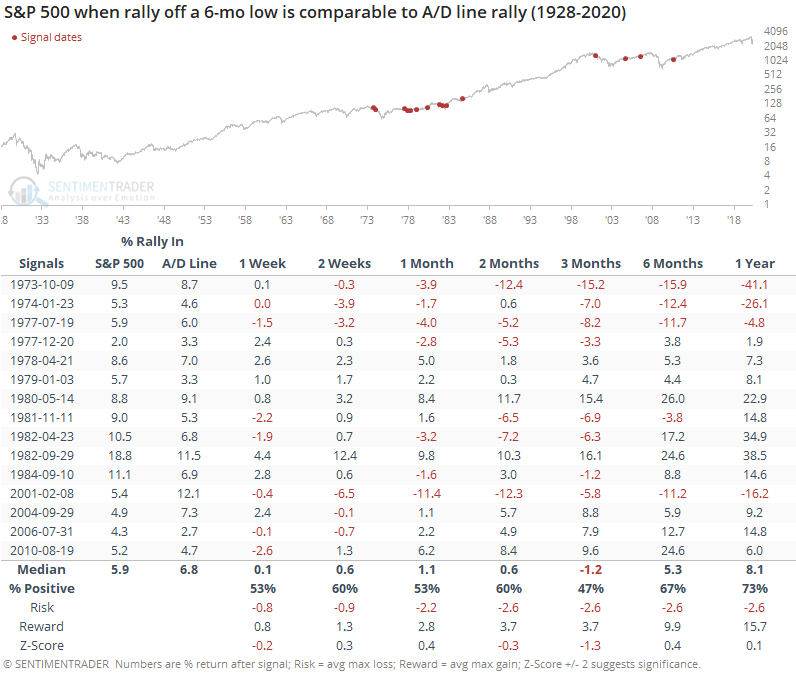

To see if it has made any difference, we can compare the returns after those signals to times when the rally in the S&P was more comparable to rallies in the A/D Line.

Even though breadth was much better in these cases, and the index wasn't outpacing the average stock by much, returns over the next three months still weren't great. Risk was less than in the first table, but overall returns were still uninspiring.

The reason is simply that stocks had already rallied for a month and a half following a low, so the initial kick of buying interest had mostly been used up. It didn't matter much that the A/D Line was lagging, as forward returns mostly followed the same path. There is a very slight negative skew to the returns following lows when breadth was lagging, but not enough to consider it an outright negative.