No yen to buy the yen

Key Points

- The Japanese Yen tends to be very indecisive during the first quarter, which can make it very difficult to trade

- Non-futures traders can trade the Yen using shares of the Invesco CurrencyShares Japanese Yen Trust ETF (FXY)

- Trader sentiment is throwing something of a curveball at the moment

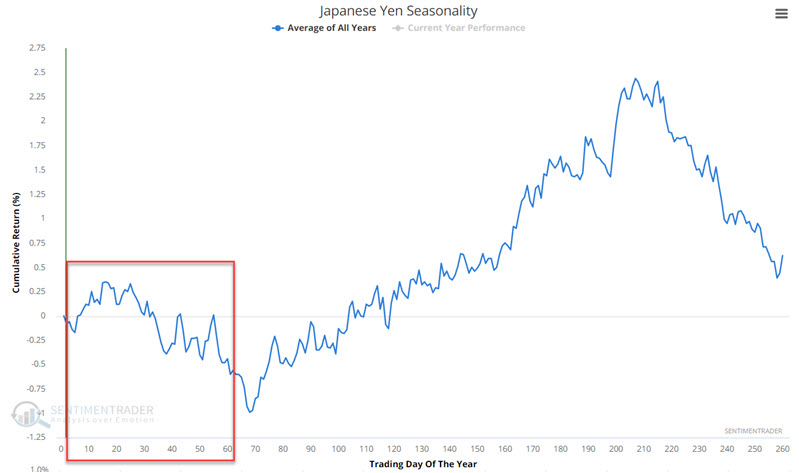

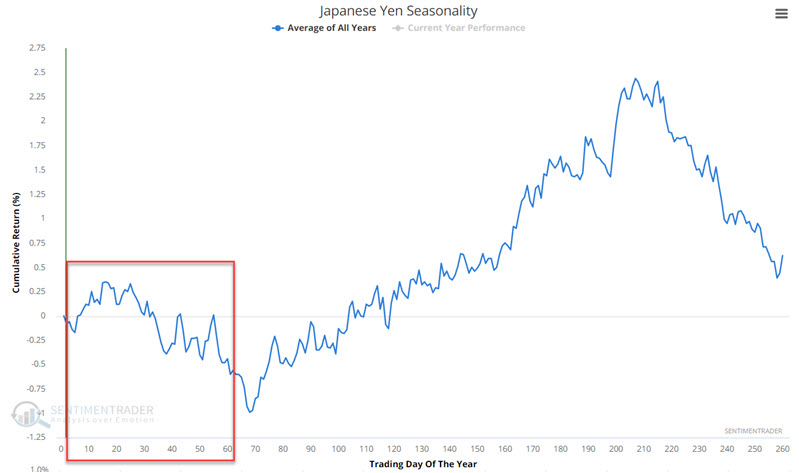

Yen Seasonality

The chart below displays the Annual Seasonal Trend for the Japanese Yen. As you can see, the action in the first quarter of the year tends to be choppy and entirely lacking in trend. This creates a challenging trading environment for bulls and bears.

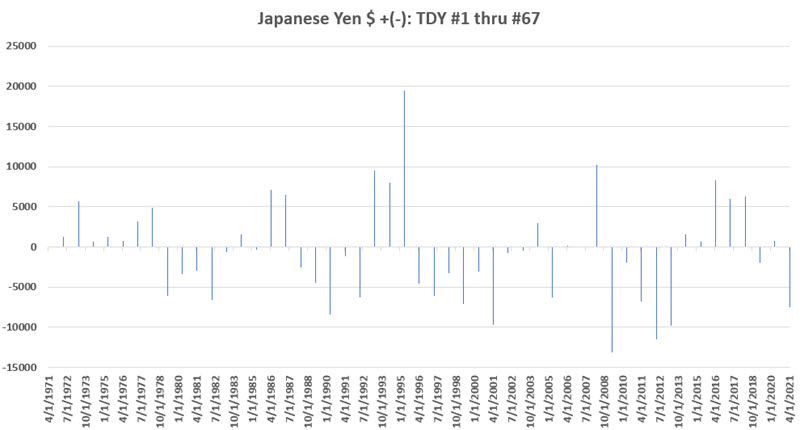

The chart below displays the $ +(-) achieved by holding a long position in the Japanese Yen during each year's first 67 trading days since 1971.

The chart below displays the cumulative $ +(-) achieved by holding a long position in Japanese Yen futures during every year's first 67 trading days since 1971.

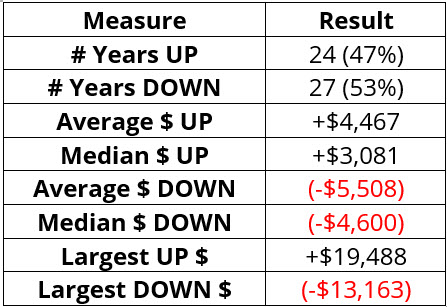

We see in the charts above a decided lack of a long-term "edge" one way or the other. This "gut" observation is born out by the performance results displayed in the table below. As you can see, there are no discernible tendencies to hang one's hat on.

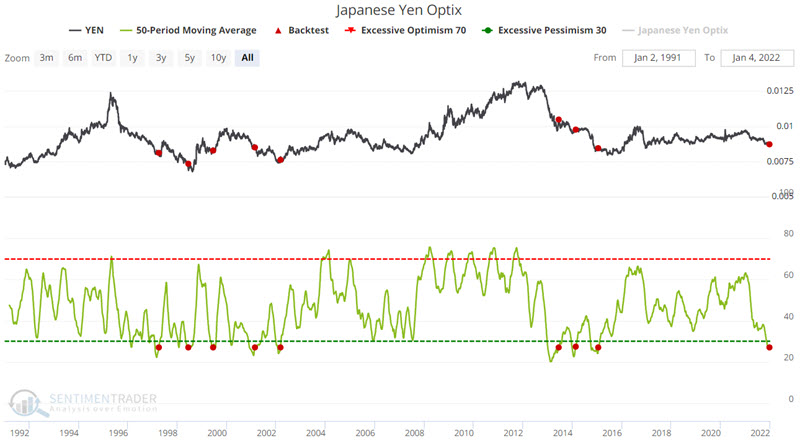

Yen Optix

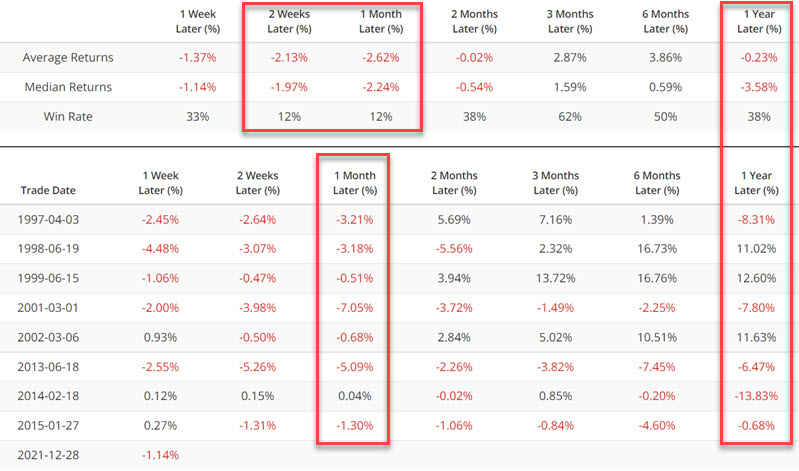

For most markets, a persistently low level of Optix tends to be bullish for that market. The Yen is an exception to the rule. The chart below displays those instances when the 50-day average for Yen Optix crossed above 27.

The table below displays the performance results for the Yen following previous instances. Typically, we would expect to see positive results following a low-level reversal. But as I mentioned, the Yen is an exception to this rule.

The 2-week and 1-month returns for the Yen following previous signals have been decidedly unfavorable. Even 12-month returns have overall been negative.

An alternative to Japanese Yen futures

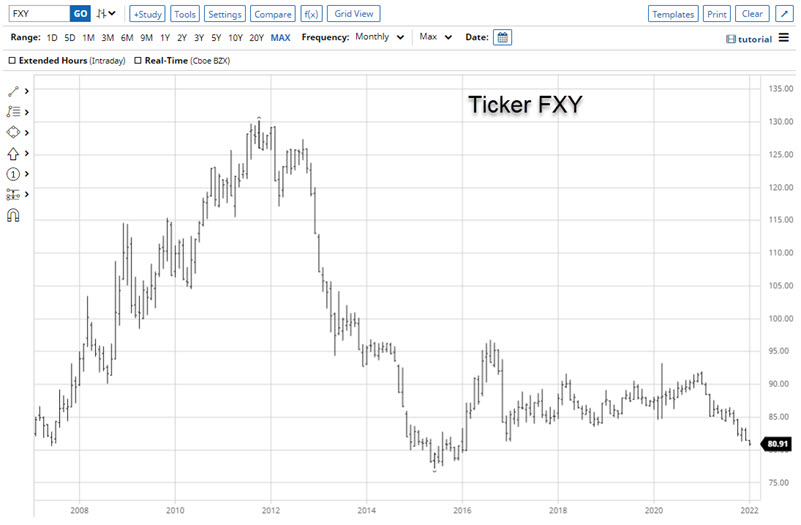

The chart below displays a long-term chart for the Invesco CurrencyShares Japanese Yen Trust ETF (FXY).

A non-futures trader can trade the Japanese Yen using shares of FXY just as they would buy and sell stock. As you can see, FXY has recently plunged to a 5-year low.

What the research tells us...

Different traders look at different factors. Some traders will look at the chart above, see a market in the throes of a significant long-term decline, and consider trading the short side. Others will look at the same chart, see a market overdue for a substantial bounce, and consider trading the long side. From our perspective, the long-term downtrend combined with the history of the Optix signals highlighted above suggests continuing to focus on the short side. However, the highly unpredictable nature of historical Yen performance during the 1st quarter suggests that this may well be a market worth steering clear of for the time being.