No Volatility As Utilities' Breadth Impresses

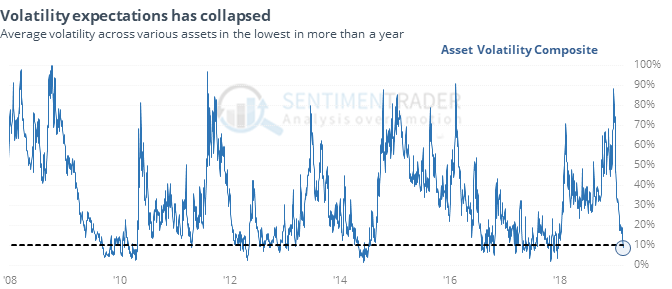

No volatility

Volatility expectations across assets have plunged. The VIX and its related measures for stocks, bonds, oil, gold, and bonds is hovering near multi-year or even multi-decade lows.

Since 1990, it has been unusual to see the “volatility of everything” collapse at the same time, and it has usually been for bonds, less so for the dollar.

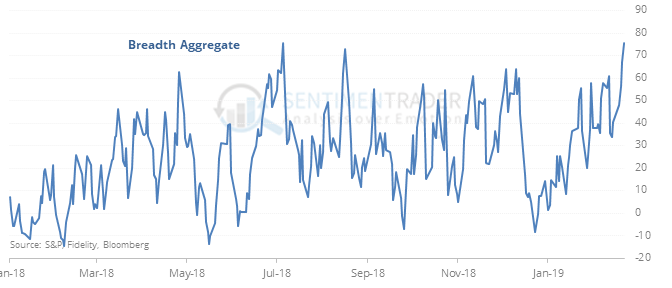

Thrusty Utilities

The Utilities sector has made a good move over the past couple of months. While lagging other sectors, for such a traditional slow-mover, the gains have been good and its breadth has been even better.

Most of the stocks are in uptrends on every time frame and hitting new highs and overbought levels. That has almost always preceded a breather for the sector.

Correlated rallies

The S&P 500 has rallied more than 10% over the past couple of months off its 52-week low, with Industrials leading while Utilities lag. Of the 29 similar rallies since 1928, the ones with the highest sector correlation to this rally saw further gains over the next two months only 29% of the time.

Nice move

The Shanghai Composite has rallied 20% from a 52-week low. Its performance over the next week had a high correlation to its medium- and long-term returns, suggesting further buying interest would be a very good sign. Monday’s session with only 2 declining stocks was among the best in 20 years, a very bad sign during bear markets, again suggesting more buying interest would hint that the market is in a longer-term bull.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.