No safe havens

So much for a safe haven

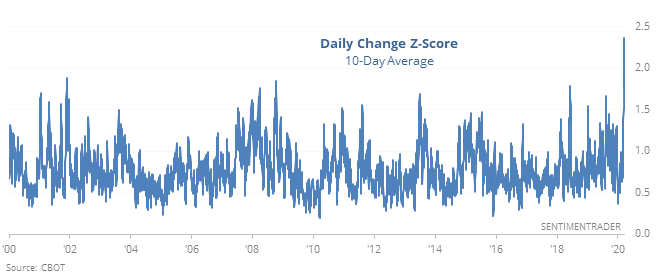

The normally staid bond market has been gyrating wildly, and it’s unlike any investors have experienced for decades. The daily percentage changes in 10-year Treasury note futures has averaged nearly 2.5 standard deviations over the last two weeks. The only time that exceeds this was the blow-off peak in October 1998.

Going back to 1982, for bonds this kind of volatility coincided roughly with two peaks and one trough. For stocks, it proved to be a boon…eventually.

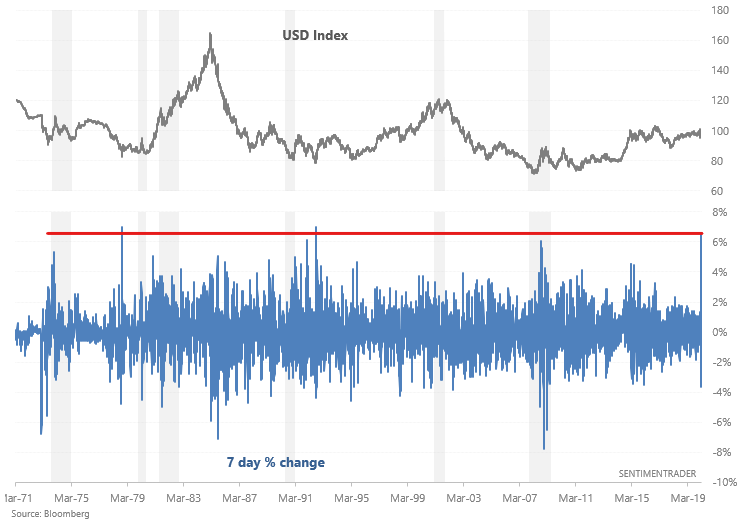

Huge dollar spikes

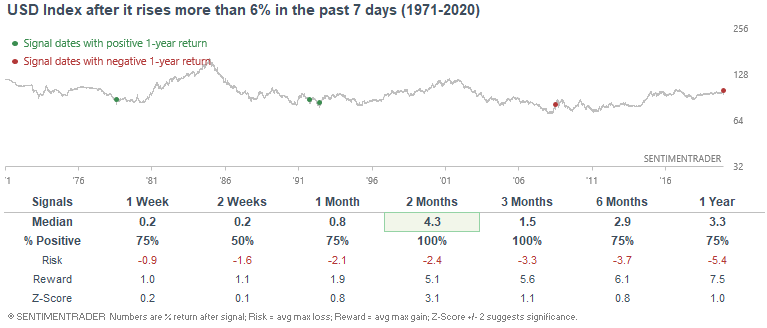

The U.S. Dollar Index spiked over the past 7 days as investors and traders scramble for cash. The spike we just saw was even larger than during the worst of the 2008 crisis.

When the USD Index spiked more than 6% in the past 7 days, it rallied further before peaking as the momentum didn't let up for a while.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Fiscal and monetary crisis responses in 2020 vs 2008

- A time-scaled price comparison to the 1929 crash

- Breadth has never been worse

- News articles are piling on to the bear market and recession ideas

- Investors have moved back into equity mutual funds

- Hedge funds have low exposure to stocks

- Wall Street is panicking

- Investors are fleeing weak companies

- Sentiment in Germany has plunged

- The yield curve is jumping with a (for now) low unemployment rate

- Most days are closing within 15% of their intraday high or low

- Commodities in one sense have never crashed this much