No Pessimism Even As Small-Caps Struggle

No pessimism

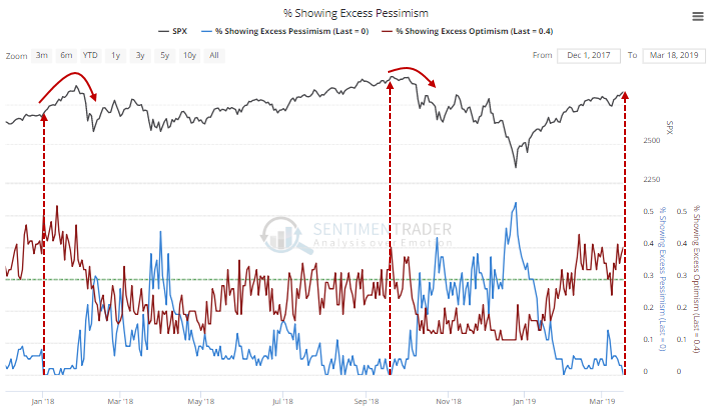

On Monday, the last of our core indicators that was showing a hint of pessimism dropped off. At the same time, 40% of them were showing optimism. The last two times that happened, the S&P formed a kind of rounded peak.

Since 1999, many of the positive returns were clustered in 2017, a year when trend-following momentum ruled everything. If we exclude that single year from the results, then it got quite a bit uglier with risk more than twice as high as reward over the next 2-3 months.

Small-cap struggle

While the S&P 500 moved to a 100-day high, the small-cap Russell 2000 held more than 2% below its own 100-day high. That tends to concern investors who like to see everything in gear, but it wasn’t a good warning sign. More than anything, it led to better performance in the Russell versus the S&P over the next few months.

Spicy

ETFs focused on Indian stocks have had a remarkable month, up 12% or more since mid-February. The 10-day Optimism Index for PIN an INDA are now hitting extremes. According to the Backtest Engine, when the 10-day average for PIN has been this high, it added to its gains over the next week only 20% of the time.

Waxing Brazilian

Even though the Ibovespa index of Brazilian stocks has been hitting new highs, its McClellan Summation Index is struggling. Since 1999, when this has happened, the Ibovespa showed a positive return three months later only 30% of the time.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.