No letup in leverage

Despite a hefty loss in stocks on Monday, options traders not only focused 2-to-1 on equity call options, they actually increased their pace from where they left off last week. It seems like it's going to take more of a wallop to let air out of that balloon.

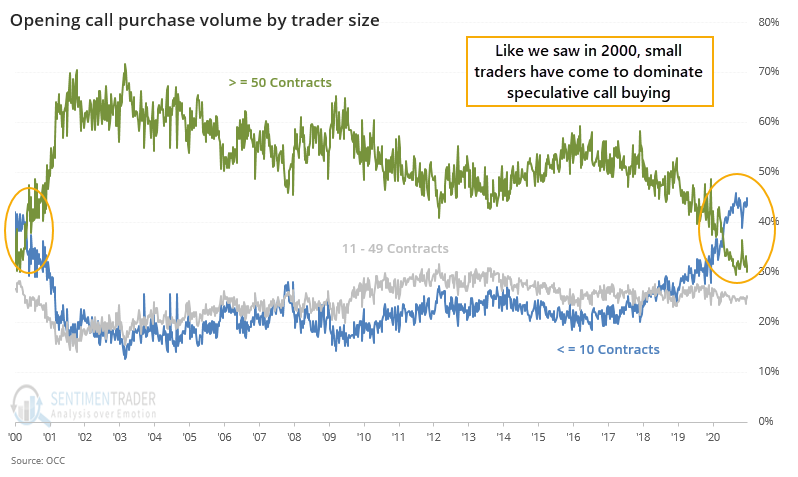

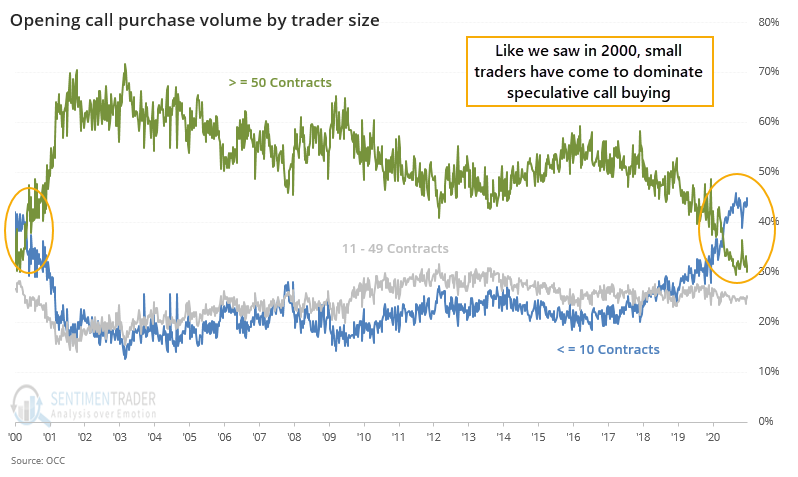

In June, we started to discuss the ramp higher in options trading, especially among the smallest of traders, and especially especially in the focus on speculative strategies. It reached a fever pitch near the end of August and into early September, settled back some as losses accrued, then came back in force during December.

Their enthusiasm didn't let up as they closed out the year. To end last week, the smallest of traders accounted for 45% of all opening call purchases, dwarfing the largest traders who accounted for only 30% of volume. That's the 2nd-widest spread since 2000, barely exceeded by the last week in August through the first week in September.

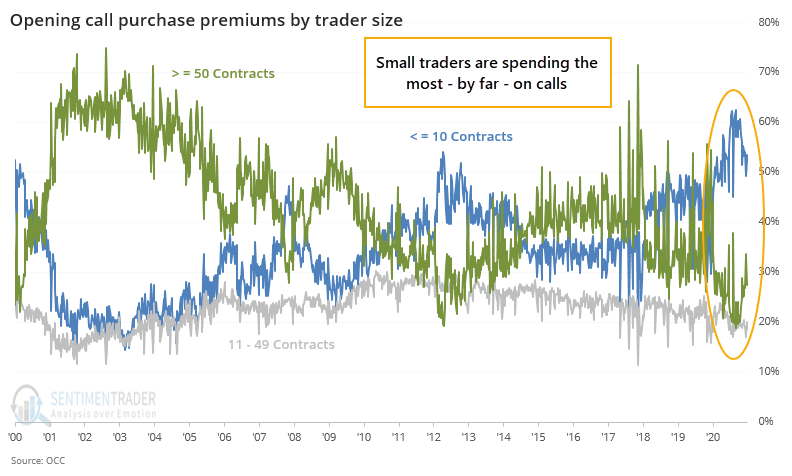

When it comes to the amount of money spent on those options, it's an even starker difference. The smallest of traders accounted for 54% of all call opening premiums spent, versus only 28% for the largest traders. This is not quite as extreme as it was in late August and early September when options were more expensive, but it still exceeds anything we've seen before.

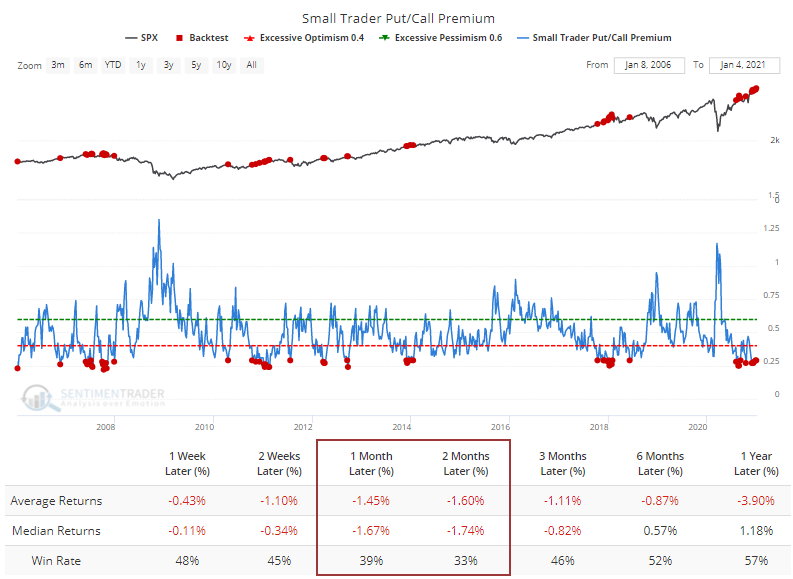

During the last week of December, the smallest of traders spent nearly $3.50 buying call options to open for every $1 in puts they bought. The Backtest Engine shows the results of other times they were so confident. That 1-2 month time frame was unkind.

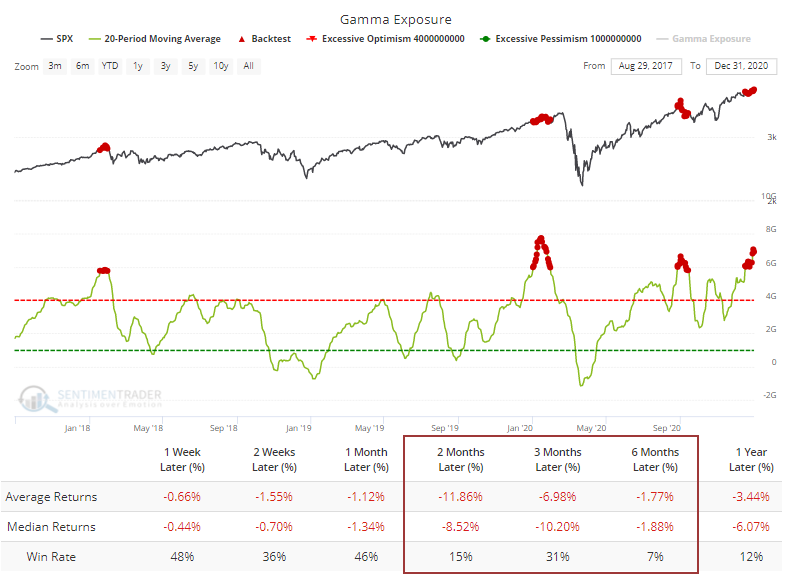

Dealers often take the other side of these trades, and according to Squeezemetrics, they're heavily positioned to sell underlying stock on any meaningful move higher. The 20-day average of Gamma Exposure has neared a record high. Other times it approached these levels, forward returns were horrid.

Options market data has been troubling for a while, and while stocks have levitated, the danger hasn't gone away. By the looks of things, it's gotten even worse. The most reliable sentiment measures tend to be those that focus on real money and leveraged instruments. That's when emotion has the greatest impact. When we look at some of the most leveraged vehicles available to investors, there is widespread evidence of extreme speculation. It would be awfully rare for markets to accommodate that with gains.