No Capitulation; No Breadth Thrust

This is an abridged version of our Daily Report.

No capitulation

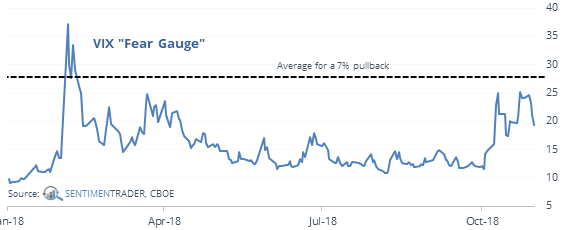

The VIX “fear gauge” never really spiked during the October pullback, suggesting no capitulation from investors.

That’s not really true, and it doesn’t matter for forward returns. History is riddled with bottoms that weren’t accompanied by capitulation, so it’s not a necessary condition. And the VIX may be influenced by the blow-up of related funds in February.

Large pullbacks from a high when the VIX did not spike out-performed those pullbacks with a larger jump in the VIX.

Still no thrust

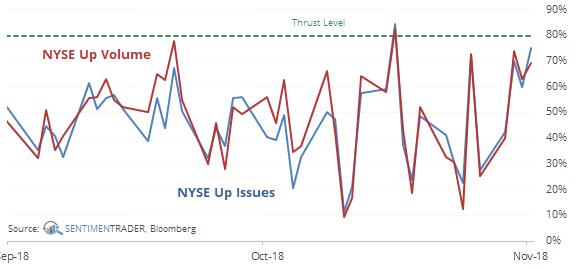

Buying interest hasn’t been very broad the past 3 days with no breadth thrust.

Even though the S&P 500 has rallied 1% for 3 days straight, and that has been a good sign, the best sustained bottoms have come when investors have shown more eager interest.

Wall Street isn’t very optimistic

Analysts price target changes on S&P 500 companies have averaged -25 over the past two weeks. According to the Backtest Engine, when Wall Street has been this negative for this long, the S&P 500 rallied over the next two weeks 95% of the time.

A failed bounce failure

In the October 18 report, we looked at failed bounces in the ACWI All World Excluding U.S. index. If it continued lower over the next two weeks, the longer-term returns also tended to be negative.