Newsletters Are Shorting; Breadth Swings; No Highs; Big Outflow; Buying Stampede

This is an abridged version of our Daily Report.

Get shorty

While individual investors in the AAII survey became pessimistic a week ago, this week there were more than 50% bears in the survey for the first time in 5 years. That has made a different in other surveys, too. According to one measure of newsletter writers’ recommended exposure to equity indexes, we’ve reached a true extreme in pessimism that has preceded excellent returns in stocks.

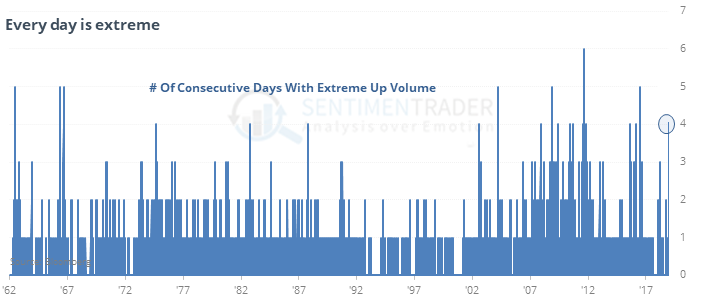

Swings in breadth

The NYSE Up Volume Ratio has swung to an extreme reading on back-to-back-to-back-to-back days.

This is something that has led to an average return of 20% in the S&P 500 over the next year with only a single loss.

No highs

Among S&P 500 stocks, there have been no 52-week highs for six straight days, while more than 10% of stocks in the index fell to a 52-week low. This is the longest such streak since at least 1990.

Get out…of everything

Investors pulled more than $46 billion from equity and bond funds in mid-December, the 2nd-most in more than 20 years.

Stampede

More than 50% of securities on the NYSE traded on an uptick at the same time for the 2nd day in a row. It was the most lopsided buying stampede since 1990.