Newsletter writers are uber-bullish on stocks

Key points:

- The percentage of bulls in the Investors Intelligence sentiment survey increased above 63%

- Similar periods with a high level of bulls preceded a multi-week pullback/consolidation for the S&P 500

- A broad sentiment composite indicates that the upward momentum in the S&P 500 may decelerate

The granddaddy of sentiment surveys shifts to extreme optimism

Last week, Investors Intelligence released its weekly sentiment survey, which measures the percentage of newsletter writers that are bullish, bearish, or neutral on the stock market.

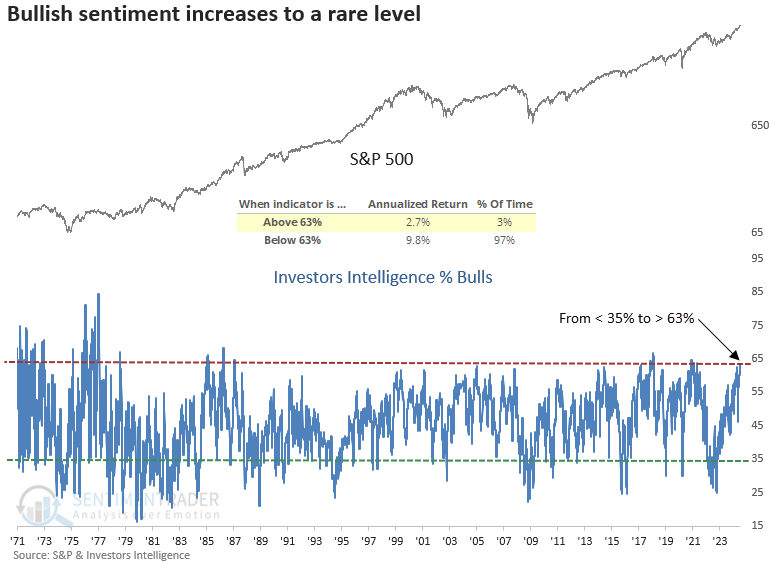

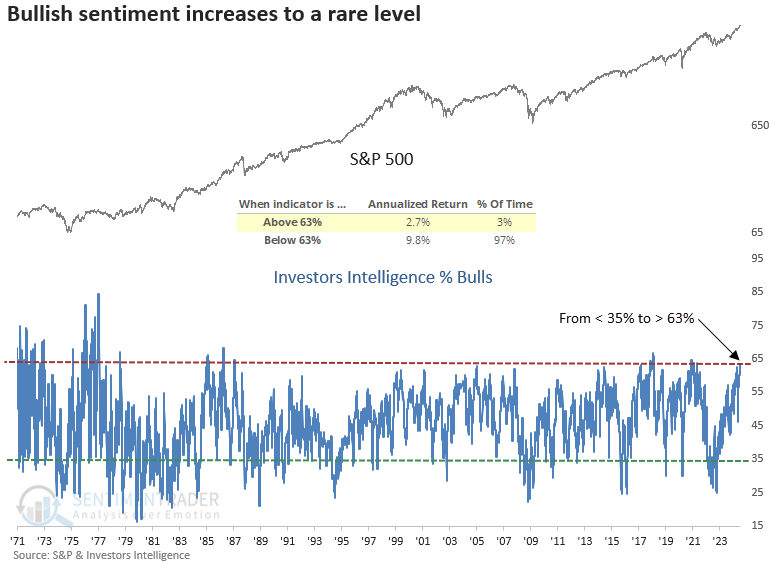

For the first time since the bear market low in 2022, the percentage of survey members with a bullish outlook increased above 63%, a level obtained only 3% of the time since 1971.

The chart below shows that readings above 63% produced annualized returns of 2.7%, far less than those below that level and the 7.9% annualized return (price-only) for the S&P 500 since 1971.

A significant number of bulls often led to a challenging short-term outlook for stocks

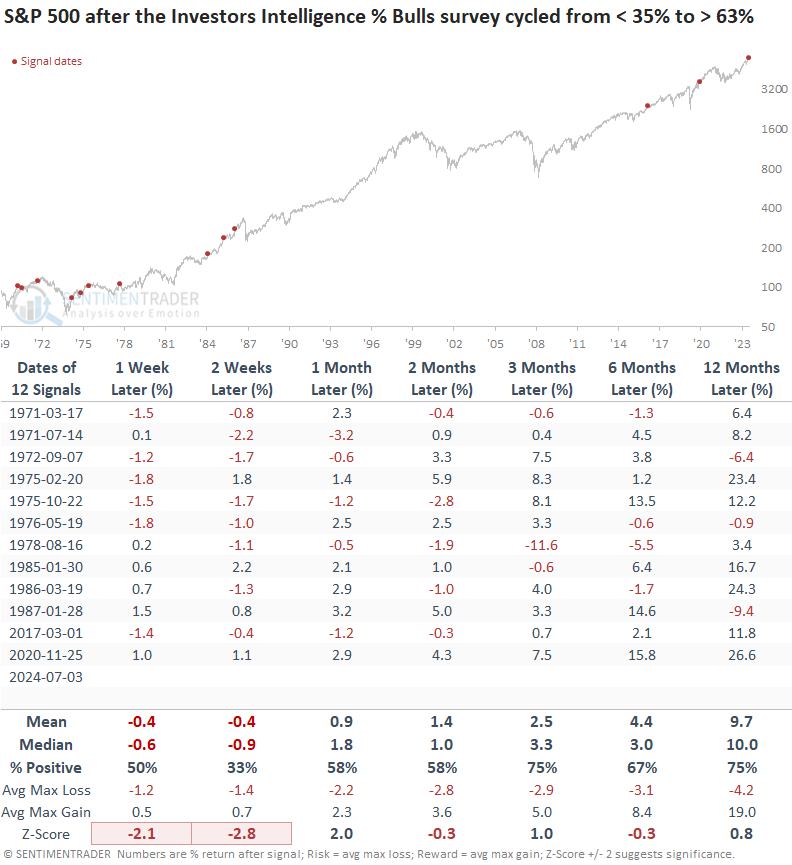

Whenever bullish sentiment in the Investors Intelligence survey cycled from below 35% to above 63%, the S&P 500 tended to struggle in the ensuing two weeks, posting a win rate of only 33%.

After the setback, stocks rebounded over the next three months, gaining 75% of the time with a median increase of 3.3%. During this period, the world's most benchmarked index experienced only one significant loss of over -10%, which happened in 1978.

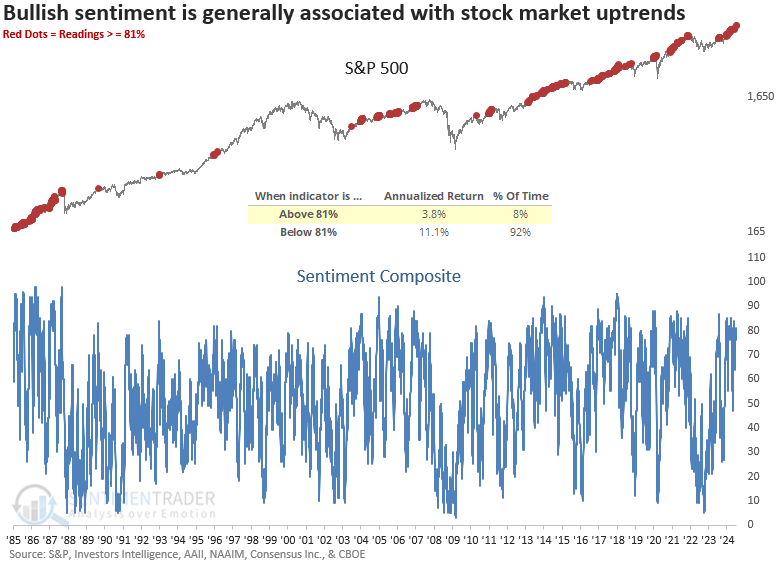

A broad composite shows bullish sentiment

A composite that contains sentiment indicators from Investors Intelligence, the American Association of Individual Investors, the National Association of Active Managers, Consensus Inc., and the CBOE currently resides at 81%, a level exhibited in only 8% of instances since 1983.

When the composite surpasses 81%, the S&P 500 displays an annualized return of 3.8%, less than half the index's annualized return since 1983.

What the research tells us...

The Investors Intelligence survey, the oldest of its kind, indicates a notable increase in bullish sentiment. Historically, such readings have often been followed by short-term challenges for the S&P 500, though the long-term outlook has remained positive. Typically, bullish sentiment persists until an unexpected event surprises market participants, prompting them to reconsider their positive stance. Predicting what will trigger this shift is impossible, which is why it's most effective to wait until the indicators reverse from an extreme.