Newsletter writers are fully risk-on

As markets started to recover from the September swoon, optimism bounced back from almost-neutral levels. By mid-November, it climbed into excessive territory. Now there are signs it's reached a euphoric stage.

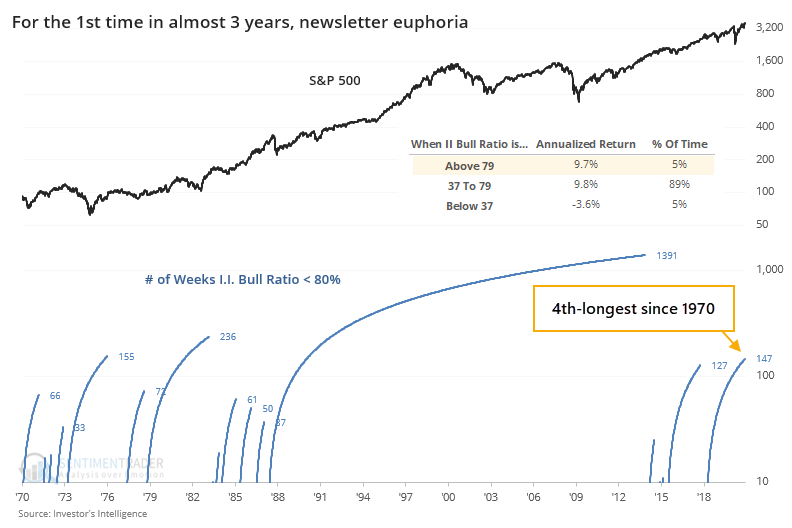

Among many examples, the latest survey of newsletter writer recommendations from Investor's Intelligence shows a Bull Ratio that's above 80% (rounded). The Bull Ratio is simply the percentage of those expecting higher prices relative to all of them that expressed an opinion either way.

This is the first time it's at 80% or above since January 2018, ending the 4th-longest streak of "not euphoria." That long streak without euphoria starting in the late 1980s was such an outlier that we had to use a log chart to show the streaks.

One of the biggest stumbling blocks with contrary analysis is the tendency to think that everything is contrarian, all the time. But we can see from the chart above that when the Bull Ratio is above 79%, where it has been on about 5% of the weeks since 1970, the S&P 500's forward return was an annualized +9.7%. When the Bull Ratio was below 37%, that return dropped to -3.6%. That's the opposite of what we should expect with a consistent contrarian indicator.

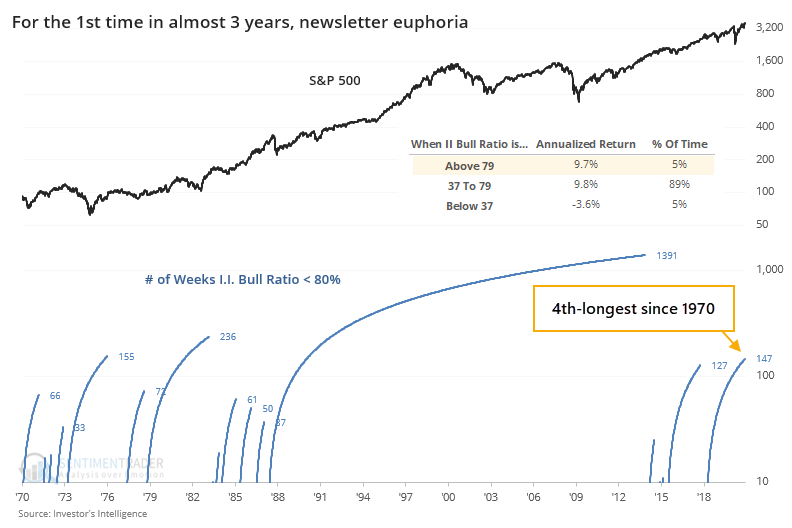

We can also see that below, looking at the S&P 500's performance after the I.I. survey reached the euphoria stage for the 1st time in at least 6 months.

Far from being a signal to sell stocks, it was actually a decent buy signal. Once newsletters went all-in on the market, it led to further gains over the next 2-4 weeks every time, with a positively skewed risk/reward ratio and probability of a big rise vs. big drop.

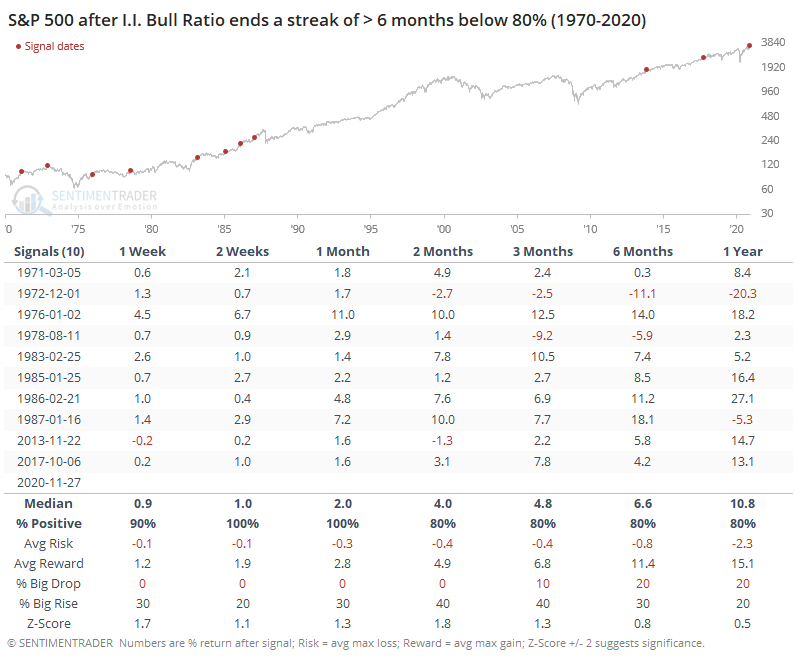

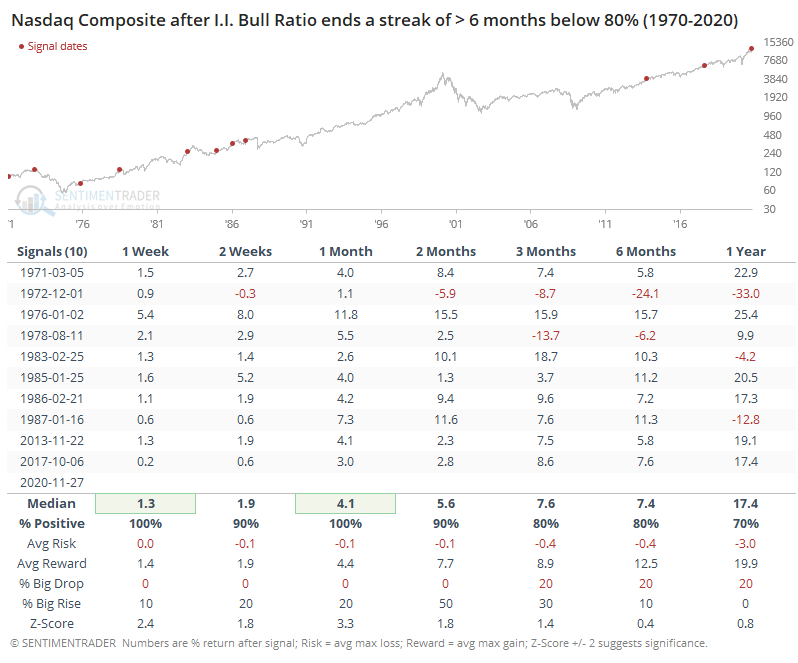

Returns in a higher-beta index like the Nasdaq Composite were even better.

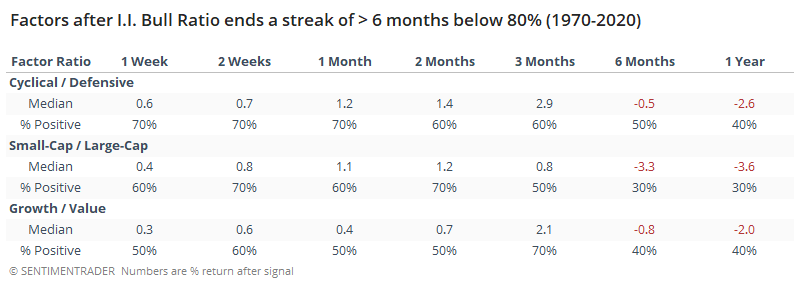

If we look at ratios of major factors, then we can also see that a risk-on attitude paid off more often than not over the short- to medium-term. By 6 months later, however, the high optimism weighed on riskier stocks relative to safer ones.

The highly optimistic results of this survey will probably trigger a lot of attention, as it's a widely-followed measure of sentiment. We can certainly cherry-pick some instances when a high level of optimism immediately preceded a big decline in stocks. Objectively, however, it has not been helpful to expect an imminent decline. And when newsletters get all bulled up like they are now, it has more consistently led to further gains over the short- to medium-term.