Newsletter Optimism Ebbs As Gaps Pile Up

This is an abridged version of our Daily Report.

Ebbing optimism

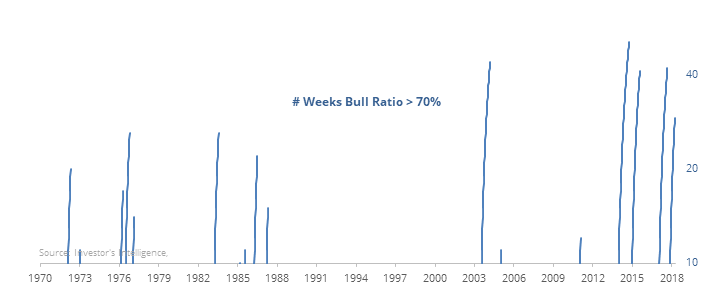

Newsletter writers have continued to pull back their stock market expectations. The Investor’s Intelligence Bull Ratio is now below 70% for the first time in more than six months.

Other times a long streak of optimism ended, stocks showed subpar returns, until either optimism returned or declined enough to be neutral at most.

Every day an emotional swing

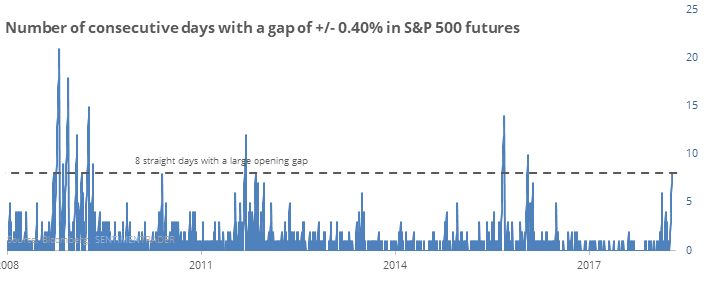

For the past 8 days, S&P 500 futures have opened far from where they closed the prior day. That’s one of the longest streaks of emotional opening volatility since 1982.

Short-term returns were negative after other streaks, but long-term returns were very good.

Dollar doldrums

Two years ago, there was more than $250 million invested in the Rydex Strong Dollar mutual fund. Now it’s down to a lowly $7.9 million, a decline of 97%.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |