Newly positive economic surprises suggest higher stock prices

Key points:

- The Citigroup economic surprise index has turned positive

- The change ends a streak of 72 days in negative territory

- Similar crosses above zero have led to solid 1-year forward returns

Using economic surprises as a stock market signal

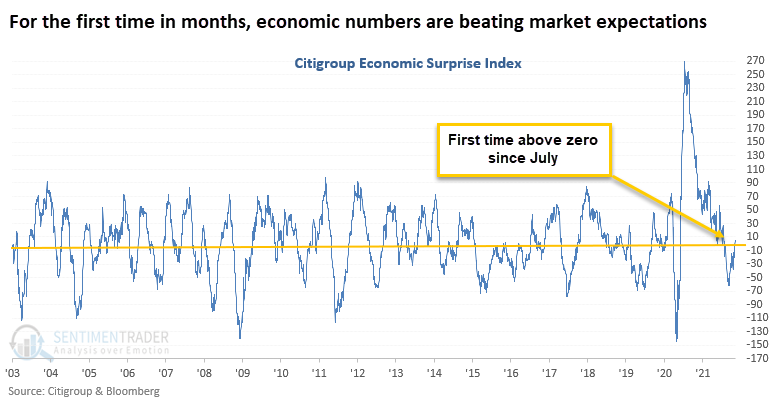

According to Bloomberg, the Citigroup economic surprise index measures data surprises relative to market expectations. A positive reading means that data releases have been stronger than expected and a negative reading means that data releases have been worse than expected.

After a surge in positive economic reports a year ago, economists adjusted their expectations and subsequent reports failed to meet those higher standards. Now that conditions are (somewhat) normalizing, reports are once again beating economists' expectations.

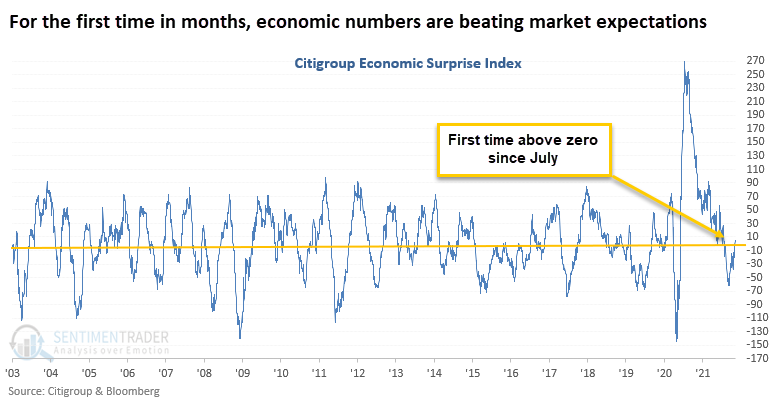

In recent days, the Citigroup economic surprise index crossed above zero.

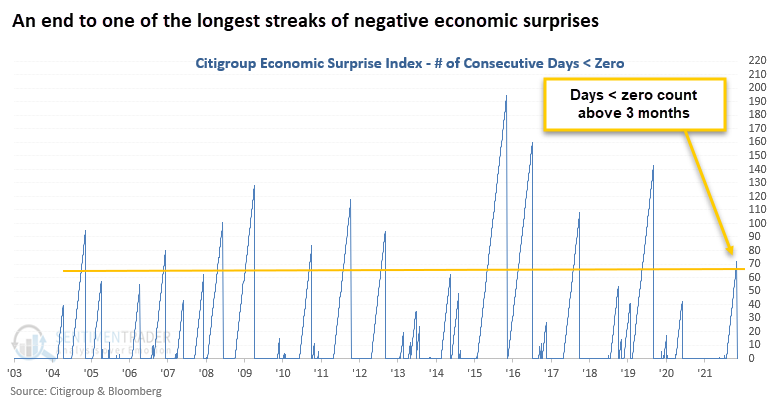

This move into positive territory ended a streak of more than 70 days below zero. That was one of the longer streaks of negative surprises since 2003.

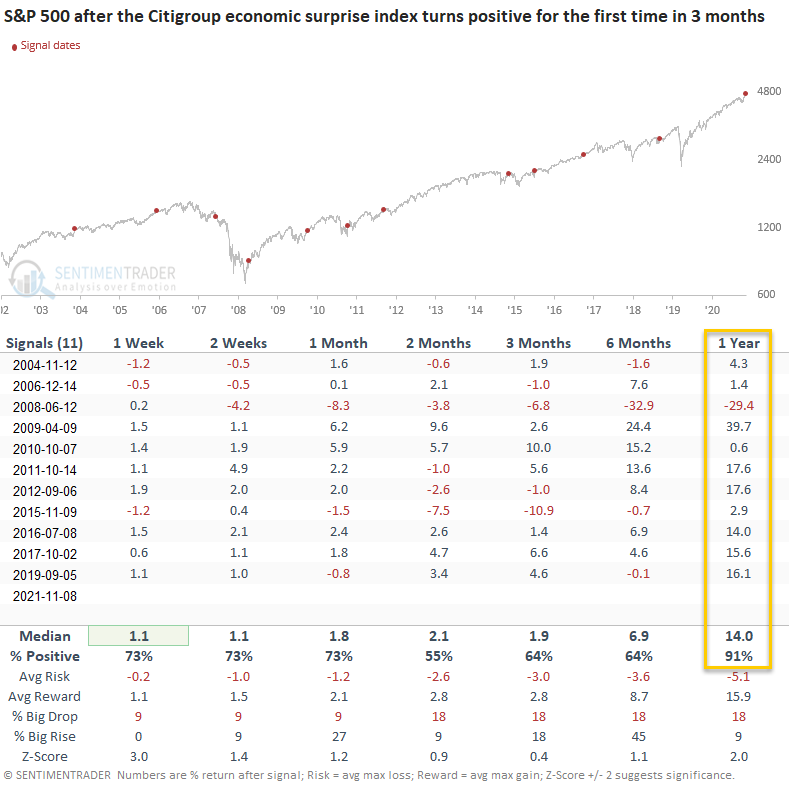

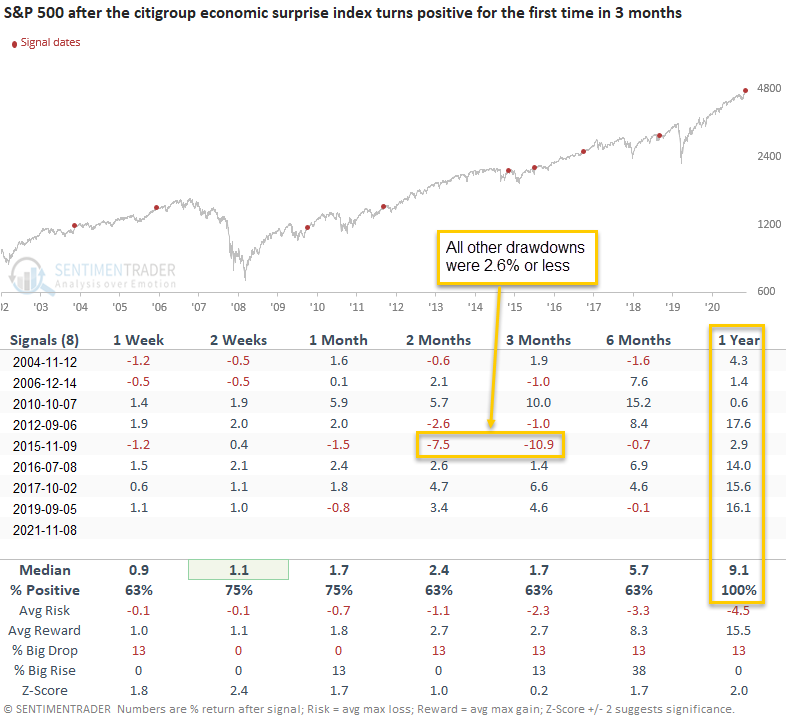

Reversals in the Economic Surprise Index preceded gains 91% of the time

This signal has triggered 11 other times over the past 18 years. After the others, future returns were positive across all time frames. A year later, the S&P 500 was higher 91% of the time, with one untimely signal during the financial crisis.

If we add a filter for when the S&P 500 is trading above its 200-day moving average, as is the case now, the S&P was higher 100% of the time over the next year.

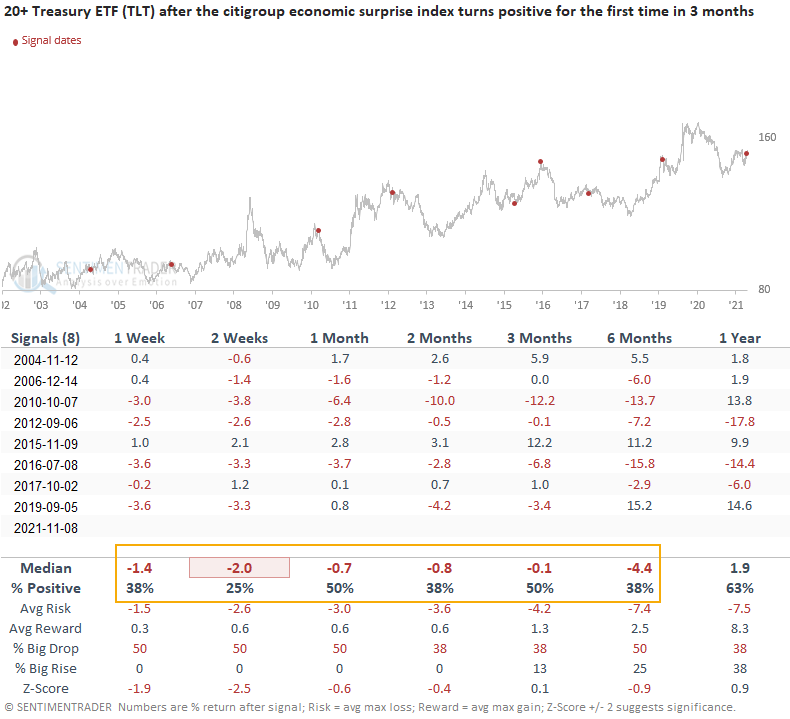

Why bond yields may rise

Looking at those same signal dates, but for returns in the TLT fund, returns were weak. Over the next couple of weeks, TLT declined after 6 out of the 8 signals, and it showed a negative average return across all time frames up to 6 months later.

What the research tells us...

When the Citigroup economic surprise index reverses from an extended period of worse than expected data to a period of better than expected data, stocks and bond yields have tended to rise.