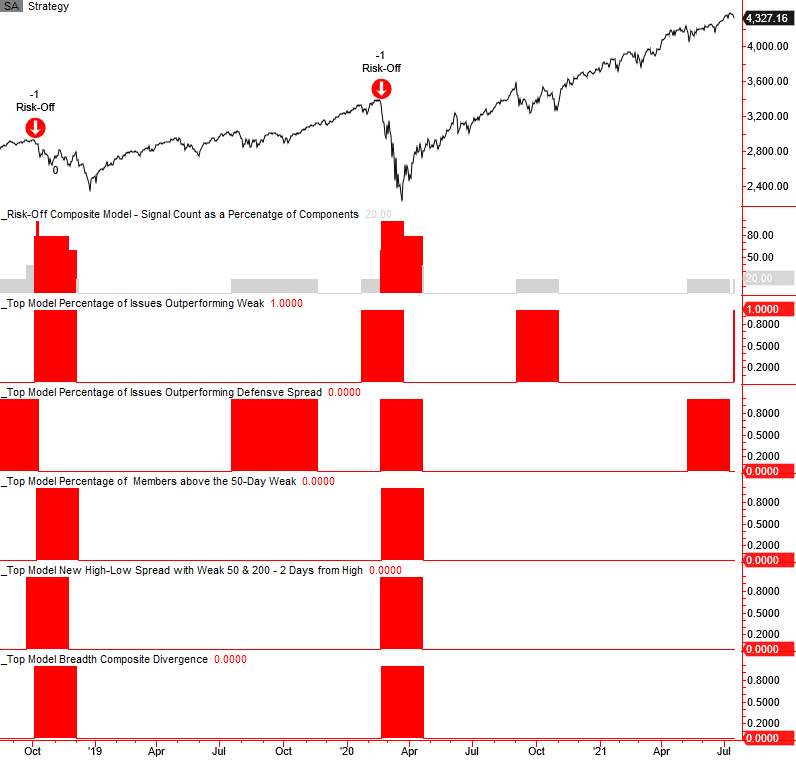

New Risk-Off Signal

The percentage of S&P 500 members outperforming the index on a rolling 21-day basis registered a risk-off warning alert at the close of trading on 7/16/21. With the new signal, the Risk-Off Composite Model count as a percentage of components increases to 20%.

For a note with more details on the percentage of members outperforming the index risk-off signal, please click here.

For a note with more details about the Risk-Off Composite Model, please click here.

CURRENT DAY CHART

While the indicators had reached the model threshold levels for a signal weeks ago, the price momentum component had failed to turn down. On Friday, the S&P 500 index closed below the 87th percentile of its 2-month range, and the alert triggered as all conditions turned true.

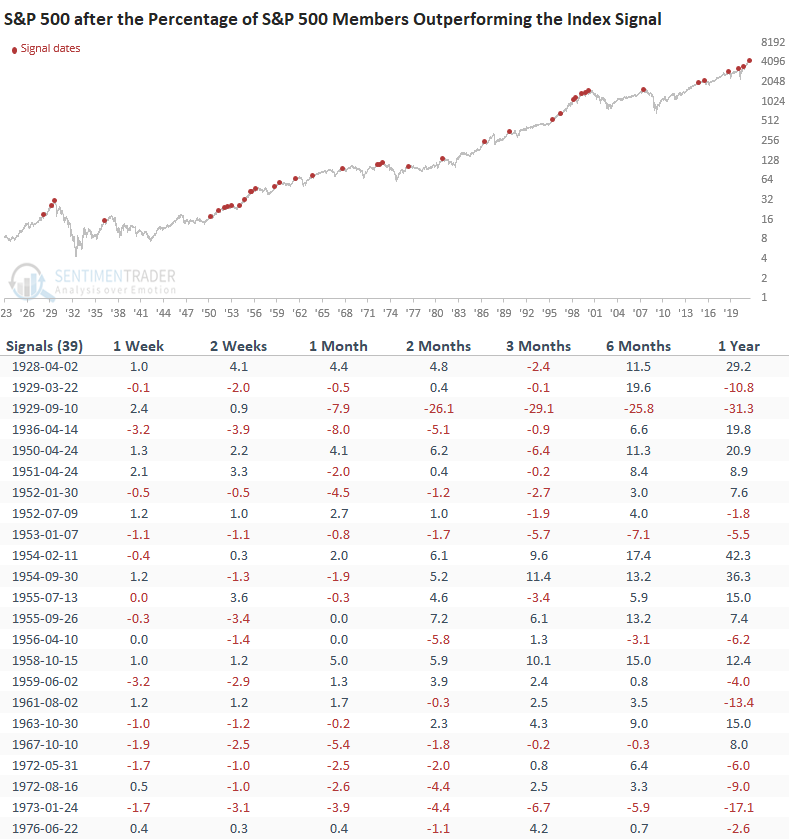

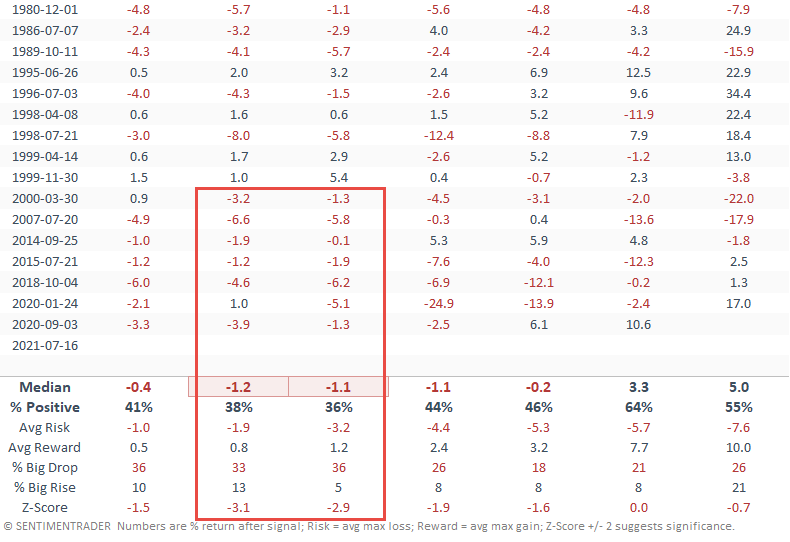

HOW THE SIGNALS PERFORMED

Results are weak across almost all timeframes with a very unfavorable risk/reward profile in the 2-4 week window.

RISK-OFF COMPOSITE MODEL

The signal count as a percentage of components remains below the threshold level of 60% for a composite risk-off warning alert.

Please remember, the risk-off composite model is not a component in the Tactical Composite Trend Model. I use it as a secondary risk management tool for short-term trading.

You can follow the TCTM and the Risk-Off Composite Model on the TCTM "Live Page" on the website. Click here.