New-Month Gap Down After A Big Surge

Stocks are backing off after the best gain in months on Friday. Optimism had reached the highest level in months as well, and when we see big gains like that in the context of a downtrend, high optimism tends to lead to sub-par short-term returns.

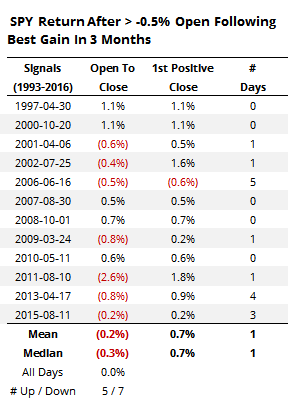

Futures are pricing in a gap down of about -0.5%. When such a gap down comes on the heels of a large gain, it tends to follow through to the downside throughout the day, but then rebound at some point in the next several sessions:

We can see from the table that there was a close above the open at some point in the next week in 11 out of 12 instances, typically within one trading day.

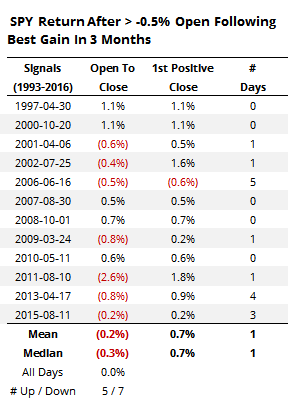

There is a similar tendency for any gap down of -0.5% or more on the first day of a month:

Again, open-to-close returns were mediocre, but 22 out of 24 instances saw SPY close above that open at some point in the next week, typically right away.

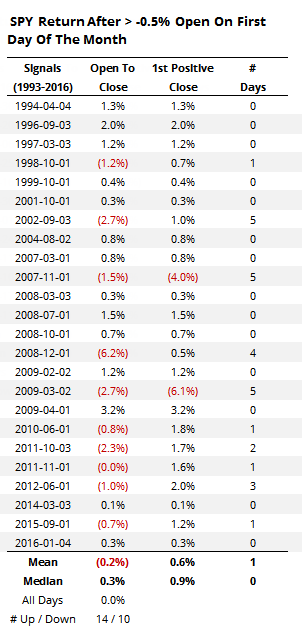

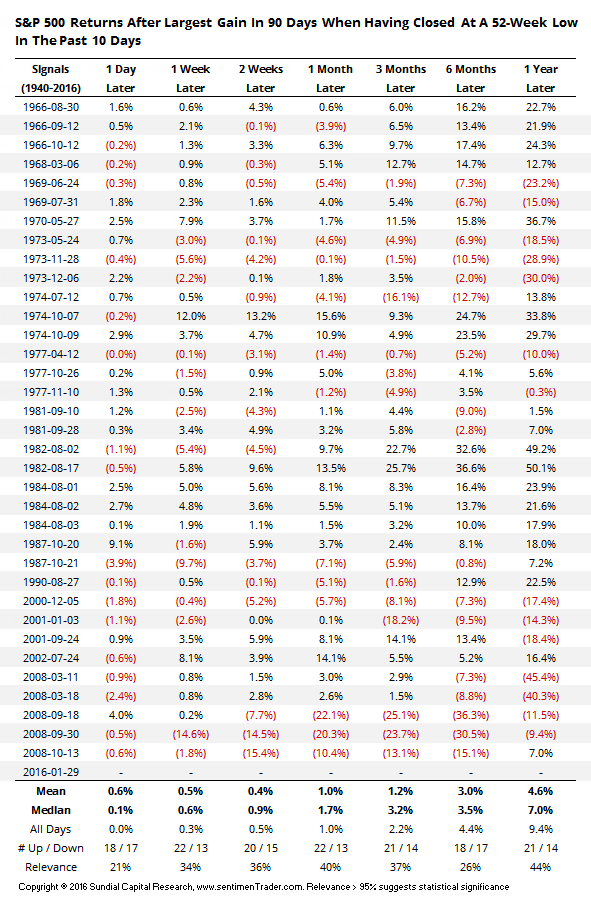

If we put Friday's thrust into context, it was the largest gain in the S&P in more than 90 days, after the index had closed at a 52-week low in the past two weeks. Common wisdom is that this is a typical bear-market relief rally that's bound to roll over to new lows.

The table below suggest that record is mixed:

On a longer-term basis, it was telling if buyers persisted. After these large one-day jumps off of a low, if the S&P was higher 3 trading days later, then it added to its gains over the next six months 64% of the time, averaging +6.2%. But if the S&P was lower 3 days later, then six months later it was higher only 31% of the time, averaging -2.3%.

Momentum doesn't die easily, and we've seen some upside momentum recently. As much as we can rely on historical price patterns and seasonality, it argues that some very short-term weakness that burns off Friday's surge in optimism should lead to another poke higher in the days ahead, and that would be a good sign longer-term as well.