New lows signal risk-off

Key points:

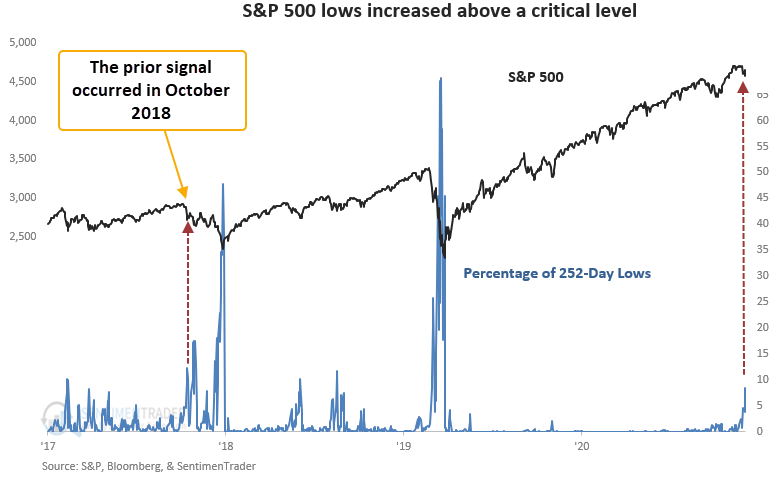

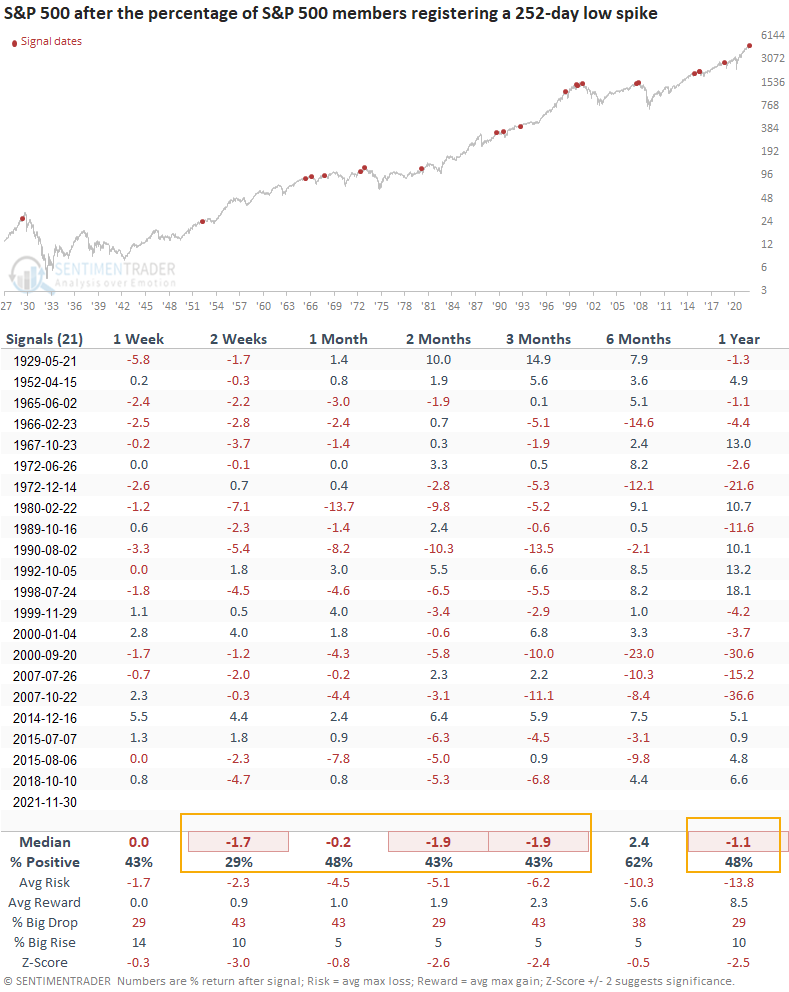

- The percentage of 252-day lows surged above a critical level on Tuesday

- At the same time, the S&P 500 is down less than 5% from its recent high

- Similar conditions preceded negative returns from 2-12 weeks later

New lows are expanding, triggering a new risk-off signal

A new signal from a voting member in the TCTM Risk Warning Model registered an alert on Tuesday. The component is called the New Lows Spike Model.

The model identifies when the percentage of S&P 500 members registering a 252-day low exceeds 7.7%. At the same time, the S&P 500 must be down 5% or less from its most recent high. According to our data, new lows increased to 8.38%, with the S&P 500 down 2.92% from its high.

When new lows expand, history suggests more risk than reward

New lows are one of the most critical breadth measures to monitor in a bull market, especially long-duration ones. When they expand to current levels with the market near a high, something is amiss with market participation. The shot across the bow is a warning that we should be alert to rising risks. As always, it's essential to use a weight-of-the-evidence approach and not rely upon any single indicator.

The previous risk-off signal from October 2018 led to a substantial decline for the S&P 500.

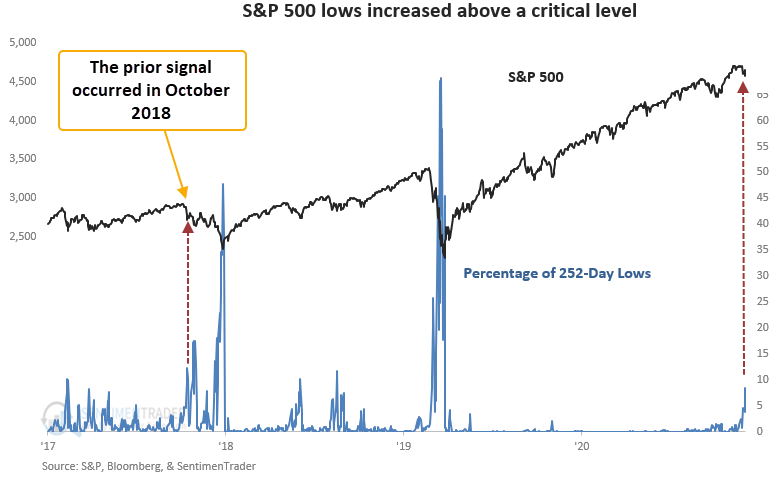

Similar signals preceded weak returns across almost all time frames

This signal triggered 21 other times over the past 93 years. After the others, future returns and win rates were weak on a short and medium time frame with several unfavorable risk/reward profiles, especially the 2-week window. The long-term results, while soft, are influenced by whether a signal marked a correction or a bear market peak. i.e., corrections show favorable 1-year returns.

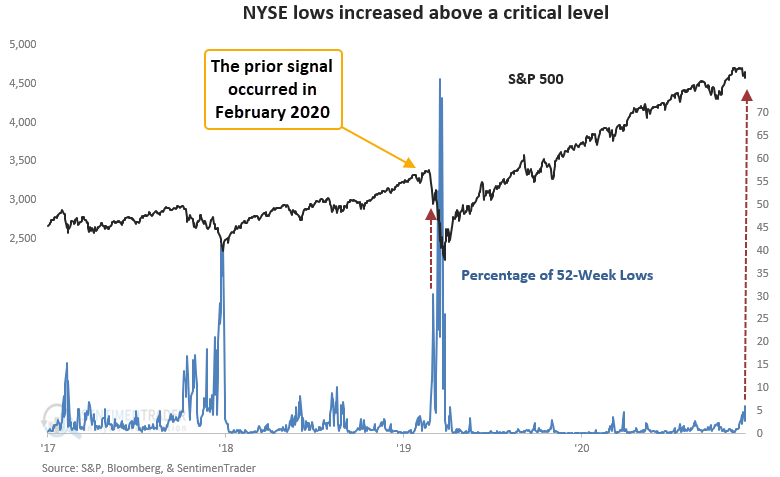

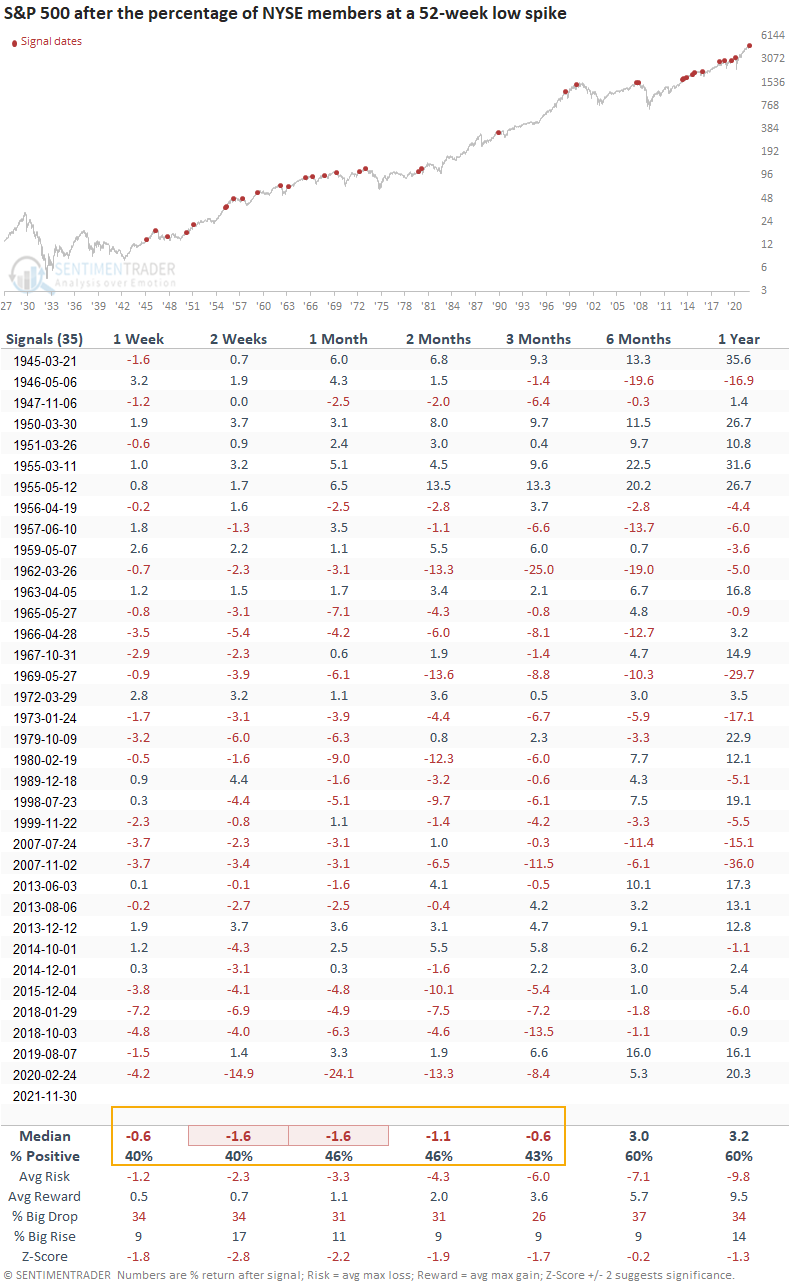

Applying the same concept to New York stock exchange members, the model also triggered a signal on Tuesday. However, the NYSE version uses a threshold of 6% for new lows.

Similar signals preceded weak returns across all short and medium time frames

This signal triggered 35 other times over the past 77 years. After the others, future returns and win rates were weak on a short and medium time frame with several unfavorable risk/reward profiles. The 2-week time frame shows 12 out of 14 losses since 1998.

What the research tells us...

When new lows expand and the market is near a high, something is amiss with market participation, suggesting rising risks. Similar setups to what we're seeing now have preceded weak returns and win rates on a short and medium-term basis.