New Lows In Financials; Buy-The-Rally Is Dead, Too

This is an abridged version of our Daily Report.

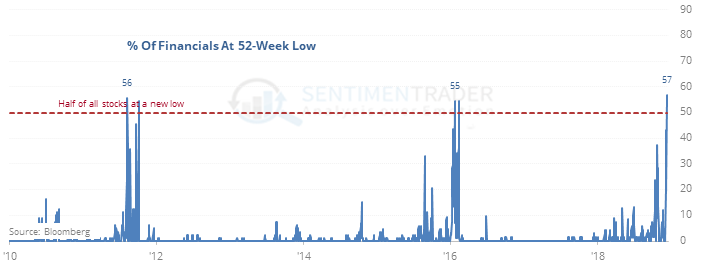

Financial troubles

More than half of the stocks in the S&P 500 Financials sector have declined to a 52-week low, the most in more than two years.

After investors have sold so many in a single sector to this low of a level, it has tended to bounce. After 26 of the days, the sector bounced back over the next week 23 times, and two of the three losses were minimal. It was less consistent over the medium-term thanks to 1990 and 2008. It’s worse overseas, where nearly 90% of Euro Stoxx Bank Index stocks hit a low in October, and there was another big drop this week.

Buy-the-rally is dead, too

We saw on Monday that the tendency for investors to step in after weakness has dropped dramatically in the past few months. So has the tendency to chase rallies. Over the past two months, there have been four days when the S&P 500 rallied at least 1% intraday only to give it all back by the close.

It’s not just Financials

Energy stocks have been faltering, too, with more than 40% at a new low. And fewer than 5% of them are above their 10-, 50-, and 200-day averages. There have been 23 days since 1990 when selling was this widespread, with a rally in the S&P 500 Energy sector over the next two weeks after 18 of them. Every one of the 5 losses was in 2008.

Overbought bonds

The BND fund is the only one in “Phase 3” meaning it’s overbought. This doesn’t happen often. It’s the first time the 10-day average of its Optimism Index was above 70 since January 2017.