New Lows Among The S&P

In the Report on Thursday, we took a look at the oddly low amount of volume flowing into securities on the NYSE for a day the S&P 500 rallied to a new high.

One of the issues with using NYSE breadth is that it's impacted by issues that have nothing to do with the S&P 500 itself.

But even within the component stocks that make up the S&P, there is a disturbing lack of participation. An unusually low number of stocks are trading above their short-, medium-, and long-term moving averages given how well the S&P index itself has been performing. The reason, of course, is because a few large stocks are driving the index higher.

But what's being masked is that an unusually large number of stocks within the S&P are not only lacking upside, they're acting heavy.

According to Bloomberg data, 18.2% of stocks in the S&P made a 52-week high on Thursday, which is fine. But a remarkable 2.4% of them hit a 52-week low. That's not fine.

Going back to 1990, there have been only three other days when more than 15% of stocks on the S&P reached a 52-week high on the same day that at least 2% of them also reached a 52-week low.

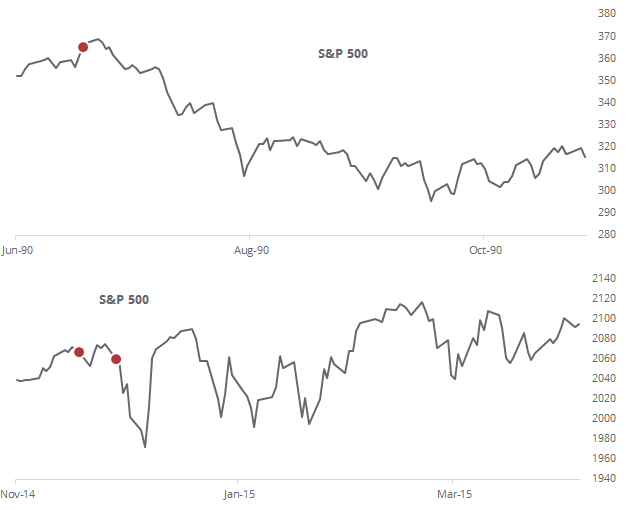

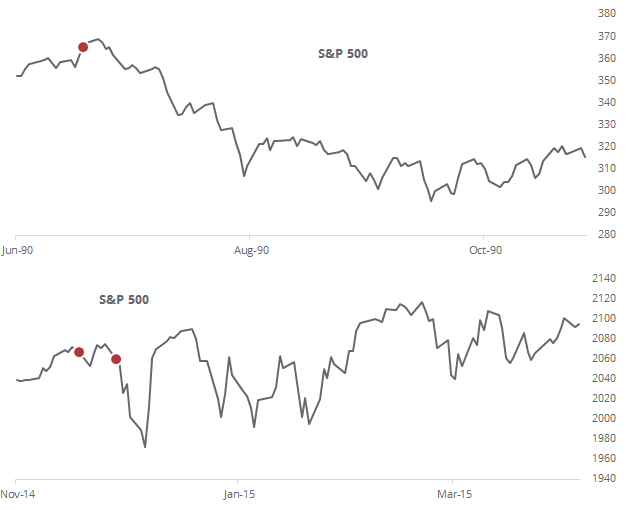

The dates were 1990-07-12, 2014-11-28, and 2014-12-08. The S&P's reaction are shown in the charts below.

In 1990, it dropped more than 10% over the next month, while in 2014, it lost more than 4%. Its upside was not more than 1.5% in any of the cases. Yes, it's only 3 precedents, but combined with the other breadth oddities, it's a negative.