New Low Spike; Heavy Selling Cluster

As we head into the close on yet another dreadful day for stocks, along with almost everything else, there are a few things that are worth noting.

Most importantly, there is clear evidence of wholesale selling on a level we rarely see. Since 1984, as far back as we can go, there have been only 8 other days that showed more 52-week lows as a percentage of total issues combined on the NYSE and Nasdaq exchanges. All of those 8 sessions were either in October 1987 or October/November 2008. So in that sense, what we're seeing here is on a par with the two greatest crashes in the past 40 years.

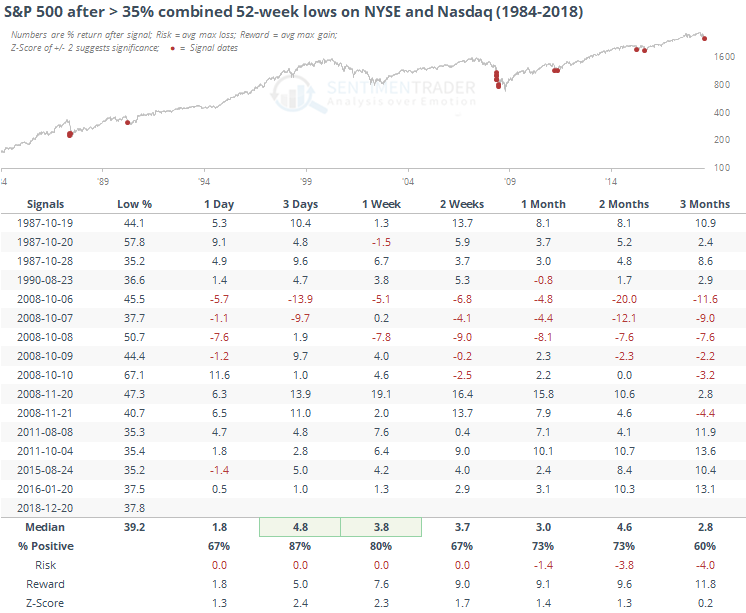

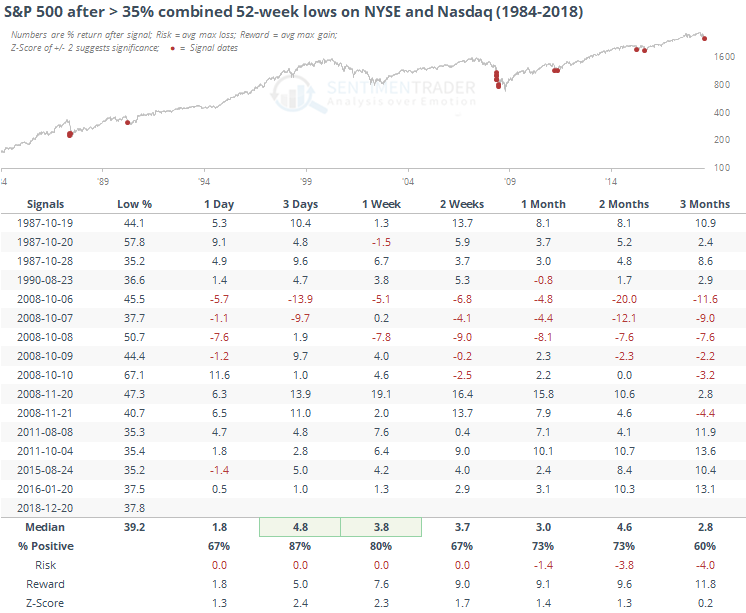

Here are all days when the combined new low percentage was at least 35% of all issues.

Except for the meltdown in early October 2008, the led to quick rebounds in the S&P.

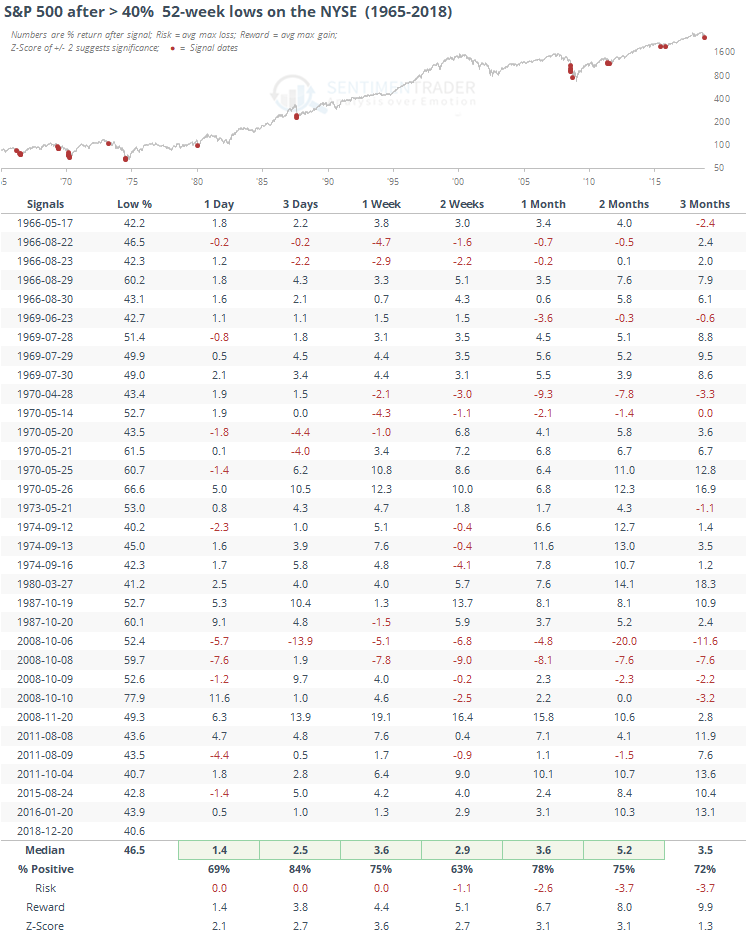

If we just look at the NYSE, then we can go back to 1965. And using just that exchange, today's figure is even more extreme, at more than 40% of all securities traded. This will not get better before the close, it can only get worse, so it's safe to say that we've hit this extreme today.

With a larger sample size, there is still a distinct tendency to rebound in the days and weeks ahead.

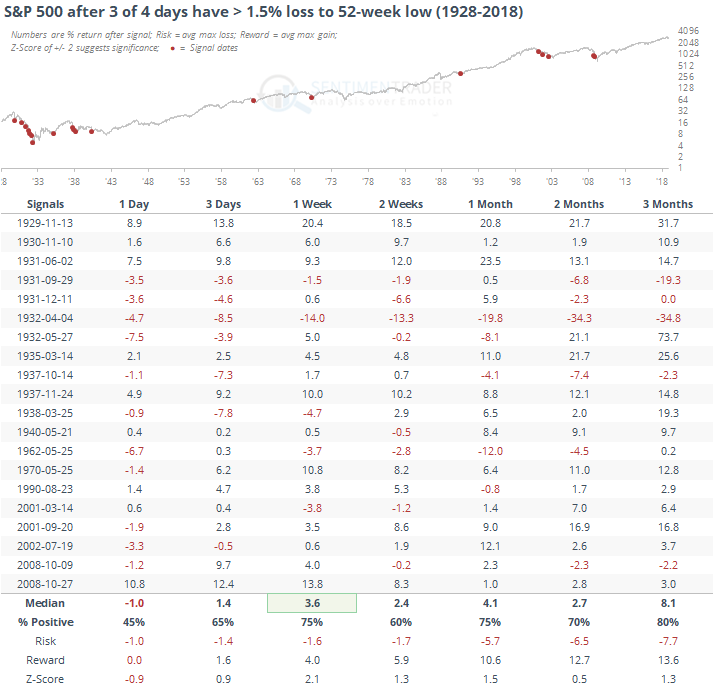

The S&P is on track for one of the worst multi-day stretches of selling in its history. This is the first time since 2008 that 3 out of the past 4 sessions suffered a loss of 1.5% or more to a 52-week low. Most of the others were in the 1930s.

During more modern markets, there was still some very short-term selling pressure, but rebounds the majority of the time in the days and weeks ahead, even during the worst bear markets in the past 20 years.

We should be nearing the final puke phase of this decline, especially when looking at some of the preliminary discounts that are being forced on some funds. There are more than hints of panic in the air today.