New Highs Ahead? Leveraged Bets Are Counting On It

Funds buy in

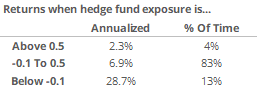

We saw last month that equity hedge funds apparently have a low exposure to stocks on a longer time frame. We also follow macro and commodity-trading funds, which tend to be more aggressive, leveraged, and trend-following with a shorter time frame. And they have suddenly seen the light, going from 25% short exposure in March to more than 50% long exposure by late last week.

This has tended to precede weak returns.

Leveraged bets on a rally

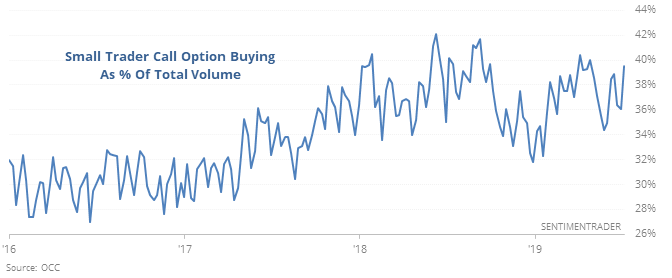

The smallest of options traders placed a record bet on a stock decline in late May and early June. Now that stocks have done the opposite, they’re moving to the other side of the boat.

Last week, they spent 40% of their volume on speculative call options, one of their most leveraged bets on a rally since 2000.

Earnings optimism

Regardless of Wall Street’s opinion, investors seem to be bullish about stocks’ prospects heading into earnings reporting season, with the S&P 500 closing at a new high 10 days after the end of a quarter. When this happened in July since 1950, the S&P added to its gains over the next two months only 3 times out of 9 attempts, with risk about twice as large as reward.

Bueller? Bueller?

SPY closed at a 52-week high but nobody seemed to care – it range and volume were the lowest in months. We’ve never seen this outside of holiday-influenced sessions. All others were in November or December.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.