New Features - Social Sentiment, Index Moving Average

Over the weekend, we added the following features to the site:

- Added new Social Sentiment indicators. The new indicators are "Bearish Percent" and "Bullish Percent" for each of the active ETF's that we track.

- Changed Social Sentiment indicators to allow different indexes and secondary indicators to be drawn.

- Added the Russell 2000 Index to the Index Seasonality Chart.

- Users now have the ability to add a moving average for the Index on charts. To add an Index Moving Average, select any moving average from the "Index Moving Average" drop-down menu on the chart page. These moving averages can be saved into your favorite configurations just like any other selection.

As always, you can find out about new additions / changes by visiting the "What's New" page.

Social Sentiment Changes

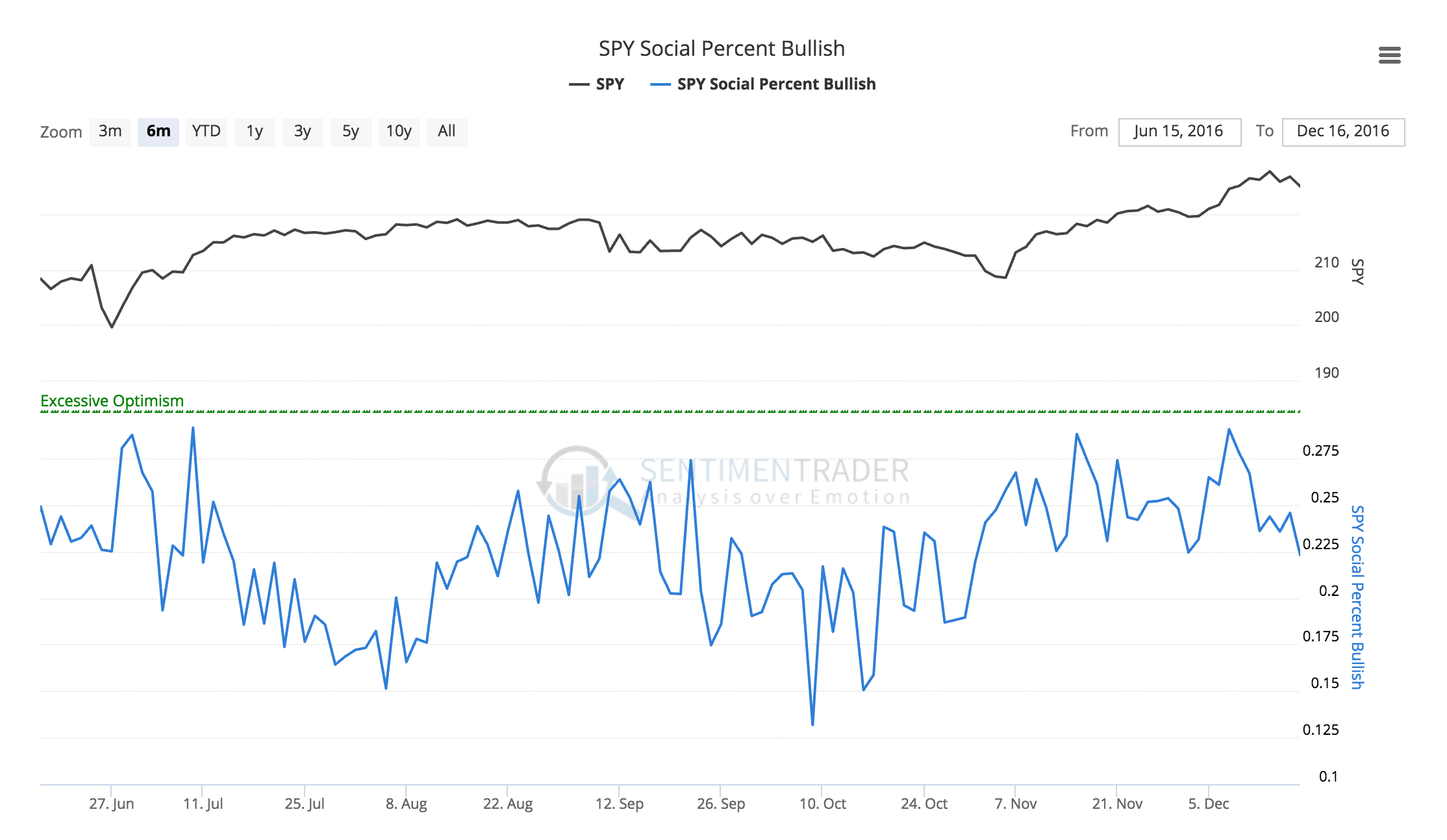

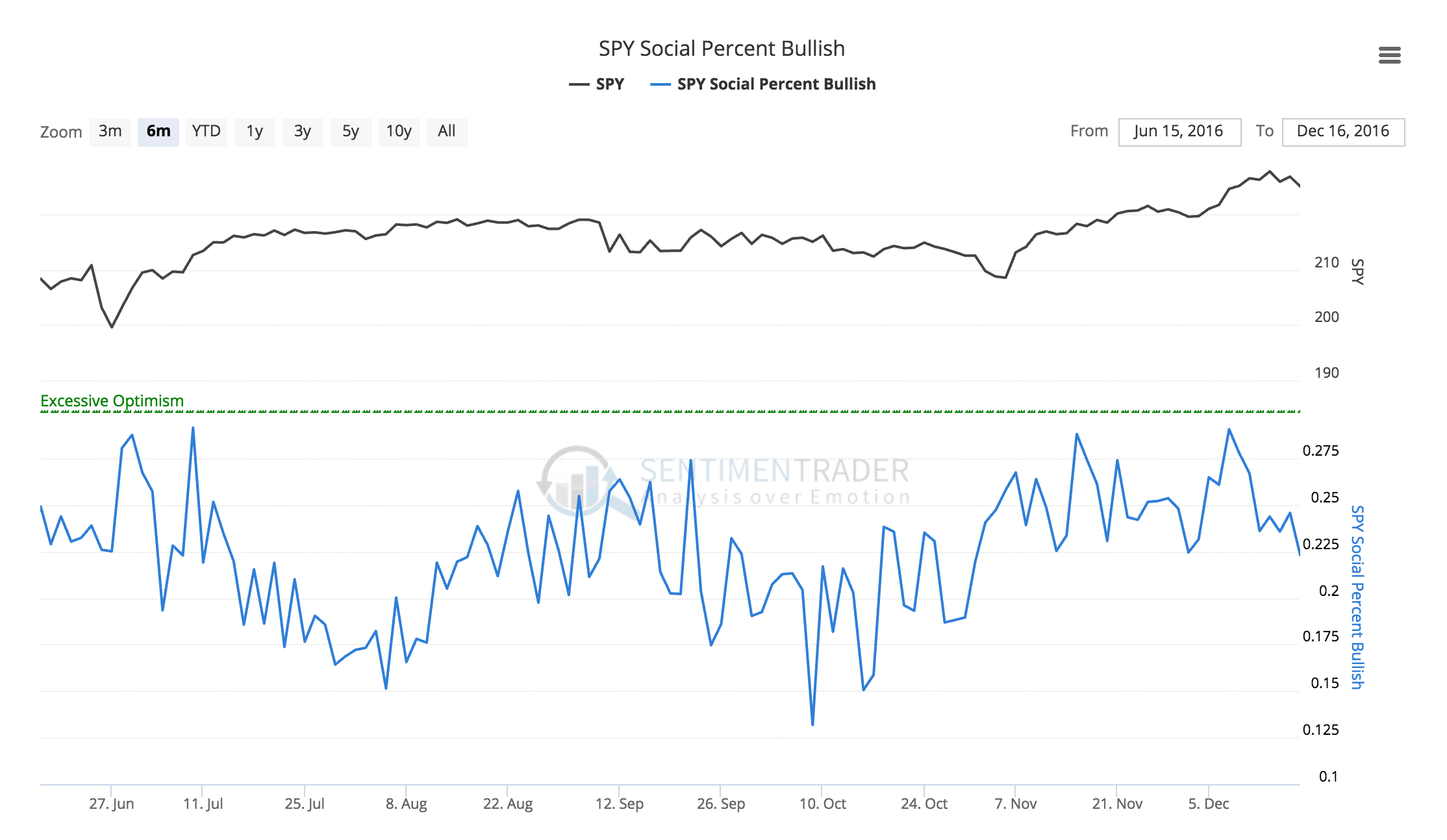

Social Sentiment is sentiment derived from performing automated natural language processing on messages collected from Twitter. Messages that mention a symbol (SPY for example) are collected and analyzed and given a rating of 'bullish', 'bearish' or 'neutral' (some messages are also categorized as 'spam'). From these messages, the percentage of bullish messages and bearish messages are then calculated (based on the total number of messages).

For each of the active ETF's on social media that we track, Social Percent Bearish and Social Percent Bullish are provided on the Social Sentiment listing page. A sample of the SPY Social Percent Bullish is below.

[caption id="attachment_1071" align="aligncenter" width="650"] Figure 1: SPY Social Percent Bullish[/caption]

Figure 1: SPY Social Percent Bullish[/caption]

Social Sentiment Listing & Chart Changes

We made it easier to 'filter' the social sentiment listing by setting up the appropriate filters and categories. Like all other listing tables you can now filter the table by "Index", "Commodity", "Bond", "Country" and "Sector".

Additionally, we added the ability to view secondary indicators and different indexes to Social Sentiment indicators.

Russell 2000 added to Index Seasonality

Due to an oversight on our part, the Russell 2000 was not included in the Index Seasonality Chart. It has been added now. Along with SPX, DJIA and COMP, you can select "RUT" in the index dropdown to view the monthly seasonality by day of month.

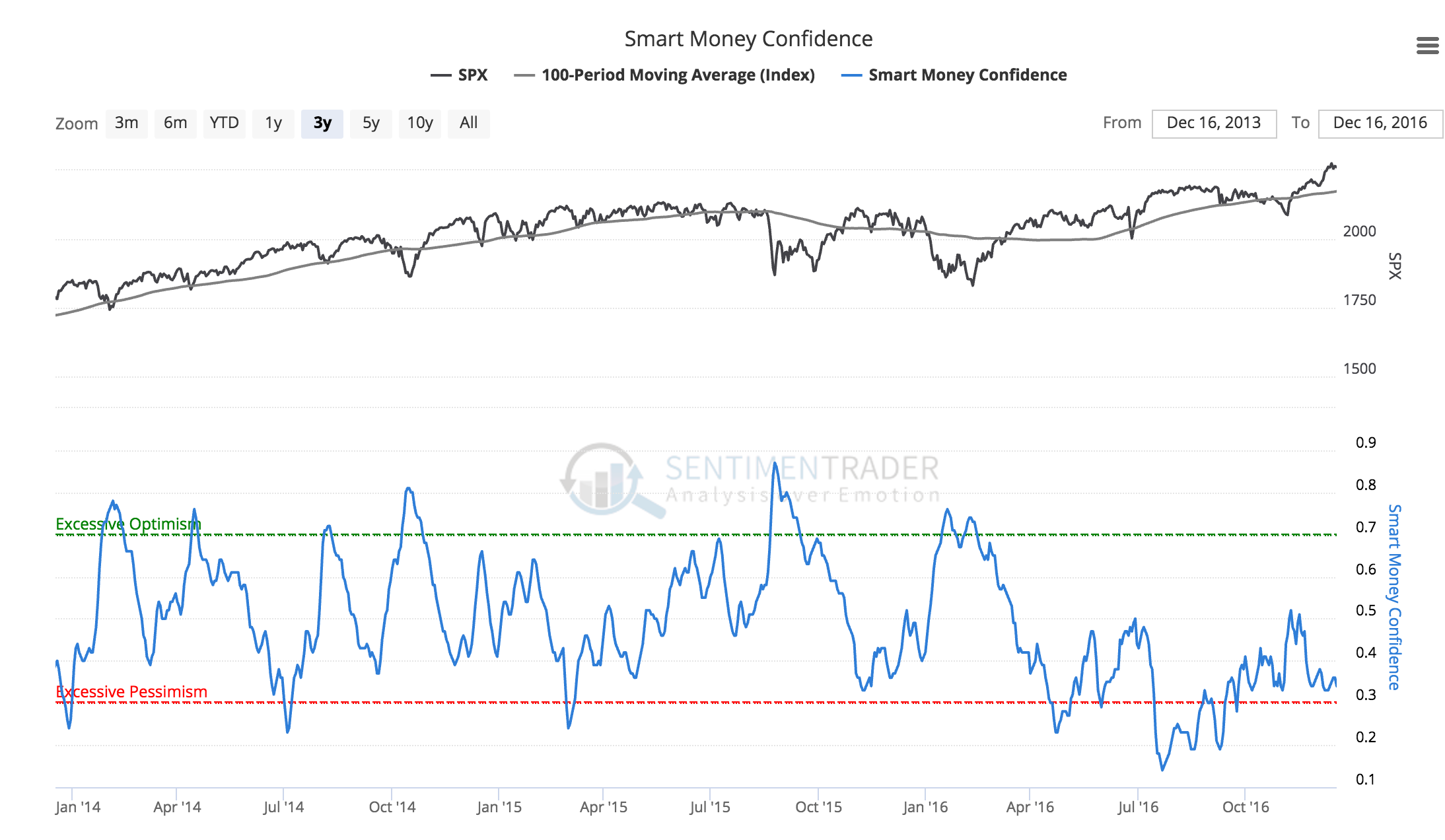

Index Moving Averages

[caption id="attachment_1069" align="aligncenter" width="650"] Figure 2: Moving Averages on Indexes[/caption]

Figure 2: Moving Averages on Indexes[/caption]

One of the requested features for the site has been the ability to add a moving average to the Index panel of charts. This has now been added as a feature to our charts.

To add a moving average to an Index, use the 'Index Moving Average' dropdown menu located next to the "Indicator Moving Average" menu below the charts.