New bull market?

First, some headlines from Bloomberg:

Investors often define a "bull market" as a 20%+ rally from lows. Even though this definition (20%) is artificial, let's just assume that this is indeed what defines a "bull market".

Many stock indices around the world are close to rallying 20% from lows in late-March. While some have already done so (e.g. Canada, South Korea, etc), others are very close. For example, the S&P is currently at +19% and seems poised to cross the +20% threshold on Tuesday, provided that the S&P doesn't give up gains during regular trading hours.

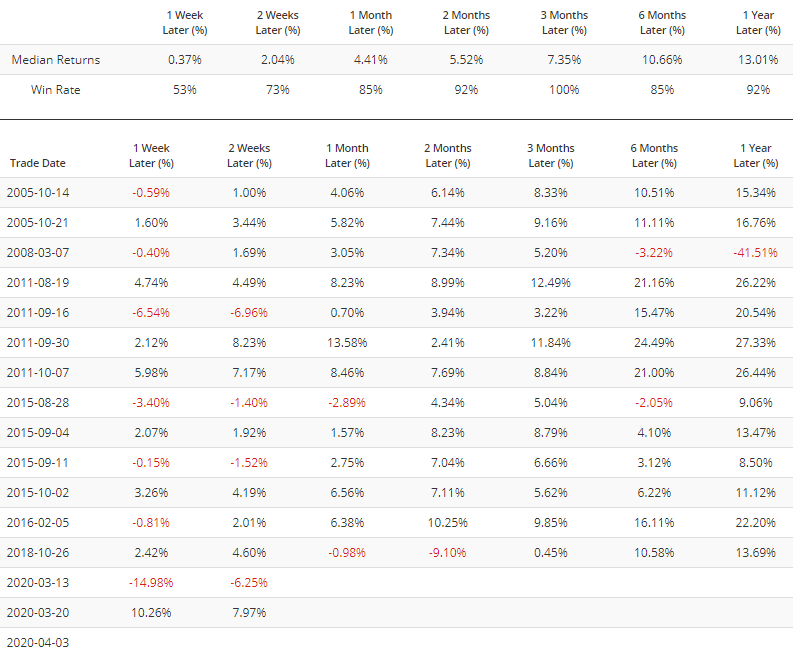

The following chart demonstrates that out of 20 countries, 4 have seen their stock indices more than 20% higher than lows over the past 2 weeks.

*Countries = U.S, Japan, Hong Kong, UK, Canada, India, Germany, South Korea, Switzerland, Sweden, Australia, Taiwan, Brazil, Singapore, Indonesia, Russia, China, Italy, Spain, France

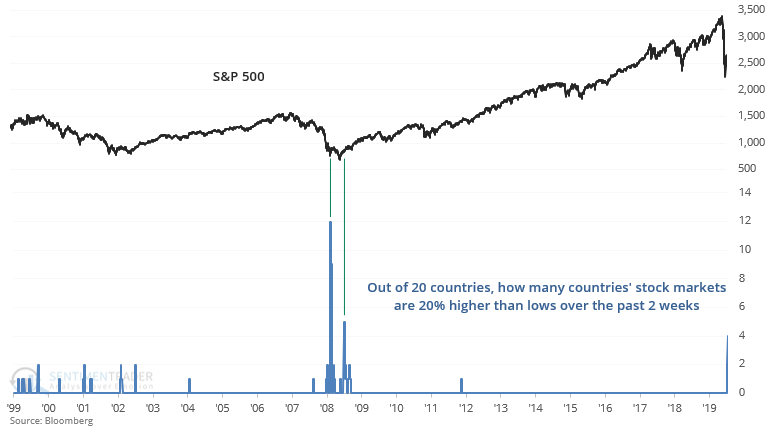

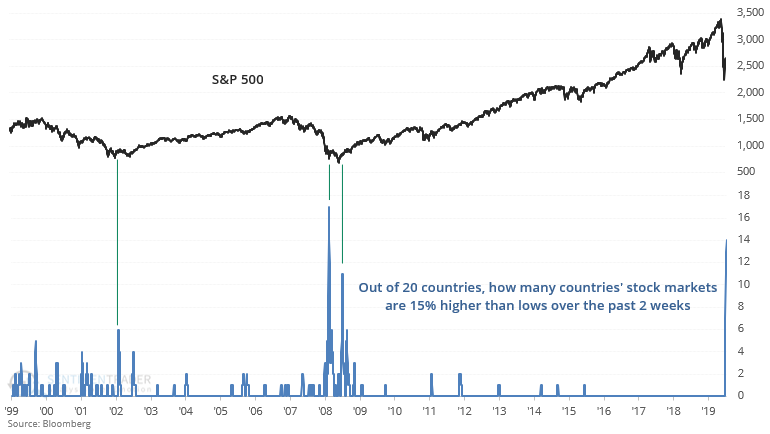

This figure will probably jump as of Tuesday's close. But even if it doesn't, we can see the # of countries whose stock markets are 15%+ higher than lows over the past 2 weeks:

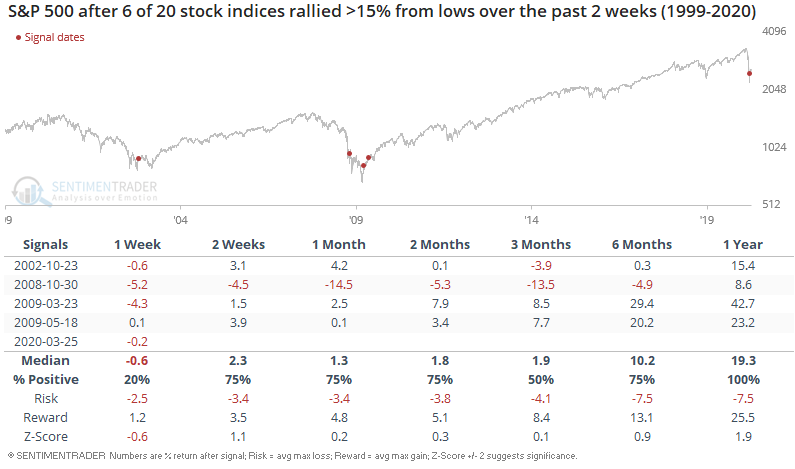

When so many countries' stock indices came close to entering a bull market (+15% from lows) at the same time, the S&P 500's returns over the next few weeks and months were mixed. October 2002 and October 2008 saw more short term losses ahead. But the S&P always rallied over the next year.

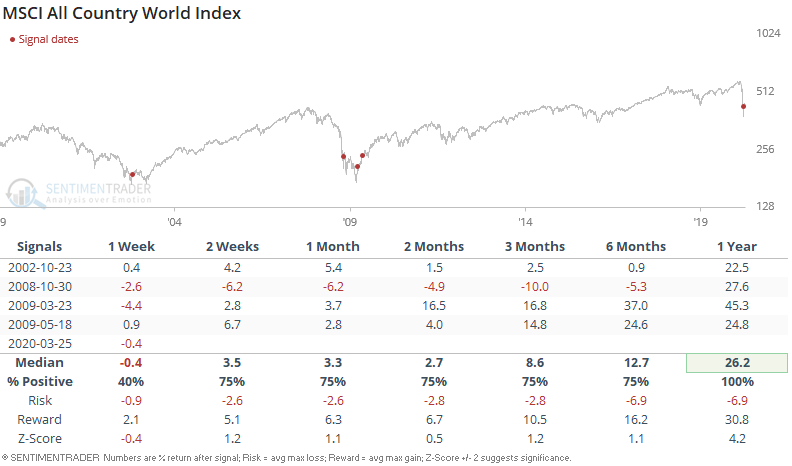

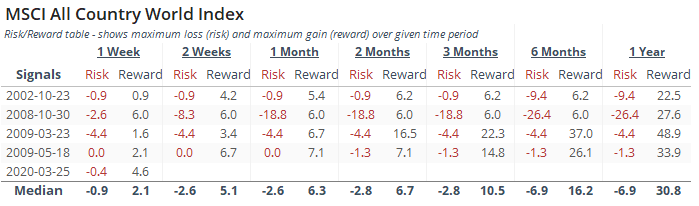

Similarly, the MSCI All Country World Index also rallied over the next year by a median of +26.2%

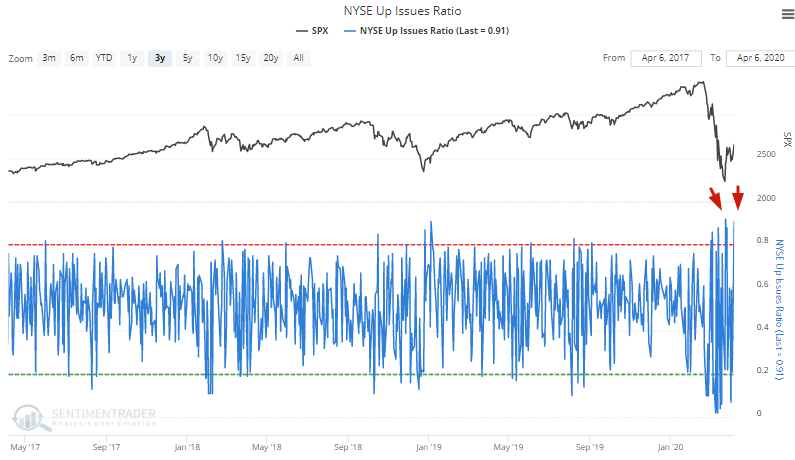

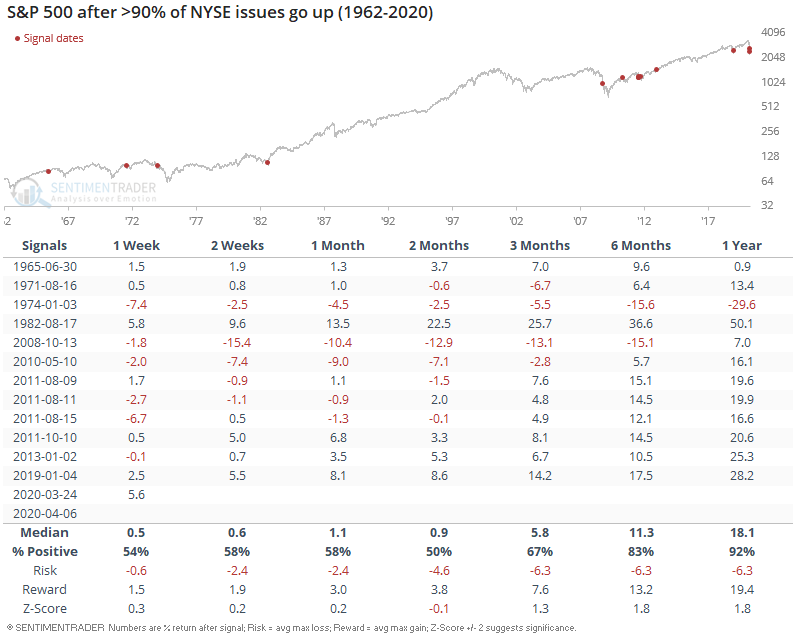

NYSE breadth is constructive for the rally. 2 of the past 10 days have seen more than 90% of NYSE issues go up.

Any single day with >90% of NYSE issues going up is typically bullish for stocks over the next 6-12 months. The single exception came in January 1974 as the worst of the 1973-1974 bear market and recession began.

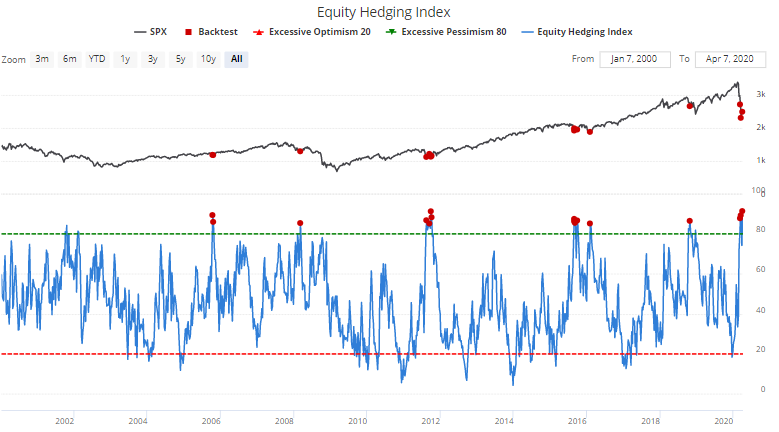

Meanwhile, our Equity Hedging Index is at an all-time high. Investors and traders are still extremely wary of risk right now. Such high readings always led to a S&P 500 rally over the next 3 months. The sole long term bearish case came in March 2008, but even that led to a big multi-month rally before the market rolled over.