Negative Bias In Weeks Following FOMC

In yesterday's report, we noted that there hasn't been any notable pattern surrounding trading around recent FOMC meetings, other than a mild drift higher before the announcement and then volatility (both ways) afterward. We're seeing that pattern again so far today with modest gains in stocks.

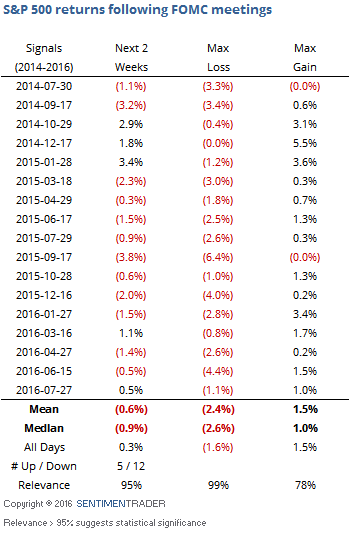

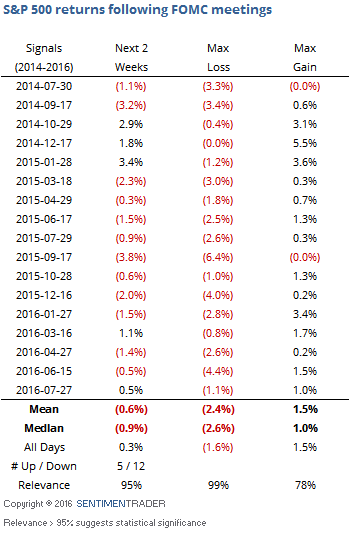

Looking at it further, one aspect that does stick out is the performance in the S&P 500 over the next couple of weeks. Over the past two years, there has been a distinct negative drift.

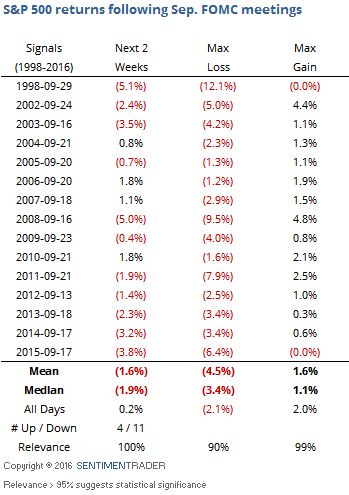

Since it's September, that would also coincide with what has traditionally been a weak point of the month. The latter half of September has not often been kind to stocks. So let's look at how the S&P performed in the two weeks following September meetings:

We get the same kind of negative bias, with a heavily skewed risk/reward to the downside. We don't place a ton of weight on seasonality and jawboning from Fed officials that seems to change on a daily basis, but we'd consider the consistent weakness in the two weeks following recent meetings - and September meetings in particular - to be a modest negative here.