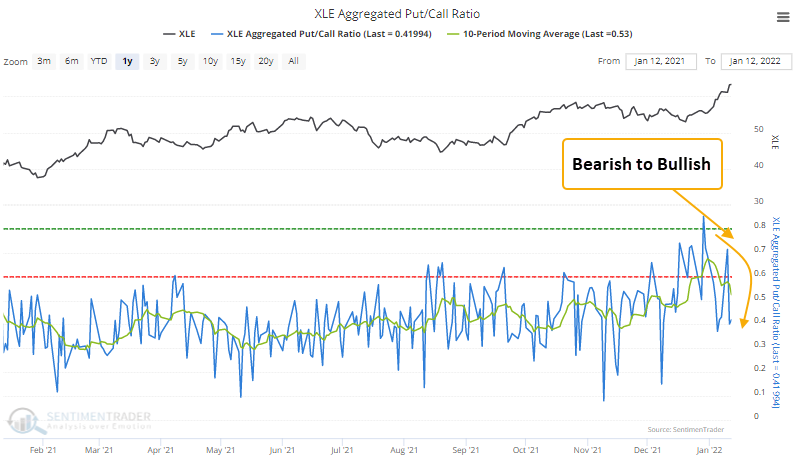

Negative bets on the energy rally are reversing

A reversal in negative energy bets

When investors are bullish on stocks, they buy call options to bet on rising prices. Conversely, when they are bearish on stocks, they purchase put options to bet on declining stocks. The put/call ratio can be used as a contrary indicator to identify an environment where sentiment has become too pessimistic on the future direction of stocks. When opinions become too bearish, stocks tend to rally.

The aggregated put/call ratio indicator measures the summed options data for constituents of the index/ETF. For Energy stocks, this put/call ratio is reversing from a relatively high level.

A similar reversal signal has triggered 10 other times over the past 8 years. After the others, XLE future returns, win rates, and z-scores were excellent across all time frames, especially the 2-month window when there were no losses.

| Stat box Traders pulled more than $1.3 billion from the HYG high-yield bond fund on Tuesday. That's the 3rd-largest single-day outflow in the fund's history, next to two days in January and February 2020. |

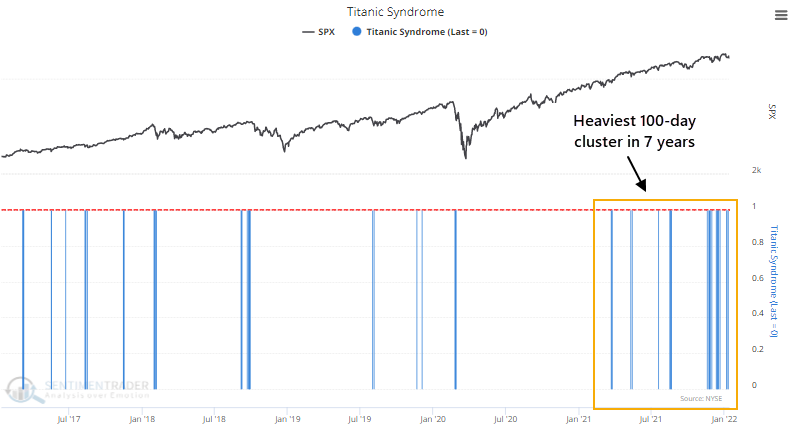

Technical warnings have piled up

Near the end of December, there was a surge in buying pressure in many stocks. That led to positive breadth thrusts in the S&P 500 and even among broader securities traded on the NYSE. Markets have not reacted well since, which is a worry.

From a longer-term point of view, there are other concerns. Over the past six months, there have been many days when indexes like the S&P 500 or Nasdaq Composite have reached a 52-week high. However, within mere days, more stocks and other securities were trading at 52-week lows than 52-week highs.

That type of behavior has triggered a cluster of Titanic Syndrome warnings for securities on the NYSE.

Those haven't just been firing on the NYSE. While fewer lately, there have also been a bunch of signals among securities traded on the Nasdaq.

When we combine the signals on both exchanges and tally them up over the past 6 months, there have been 34 signals. In other words, nearly 30% of all days since July have seen a Titanic Syndrome warning on either the NYSE or Nasdaq exchanges. This is the 3rd-highest reading in almost 40 years.