Nearly a third of small-caps are losing money

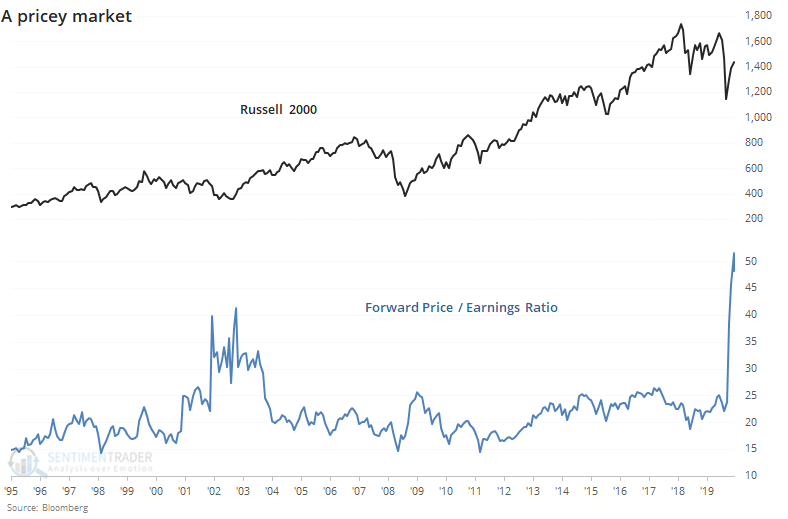

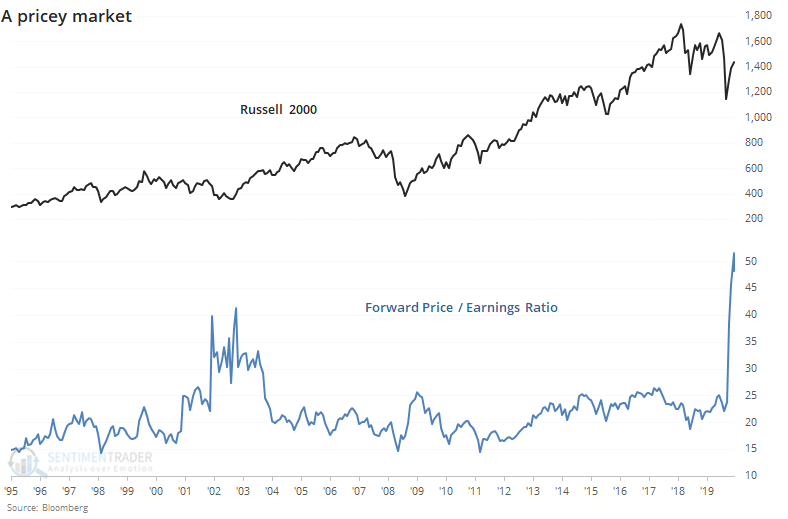

By some measures, stocks have never been so expensive, especially smaller ones.

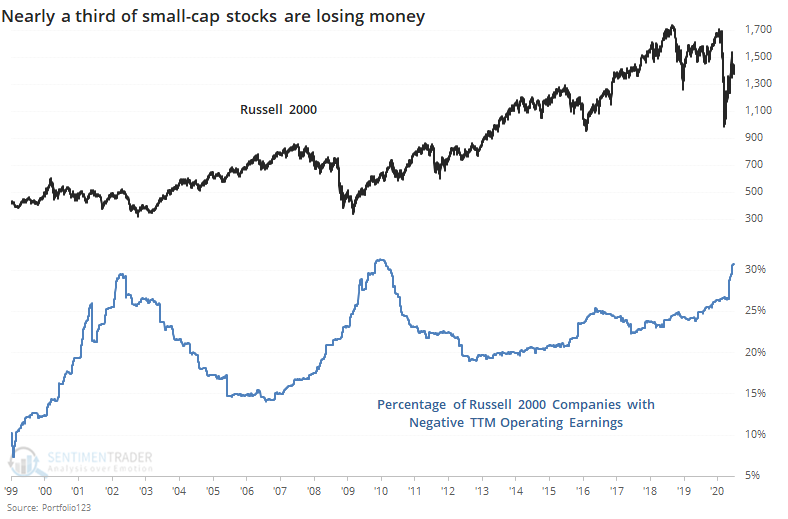

The problems with most valuation measures are well-documented, and Marketwatch highlighted one of them that is particularly prominent with small-cap stocks. A lot of small companies lose money, and those are often not included when firms calculate metrics like price/earnings ratios.

If we use forward earnings estimates from Bloomberg, then we can alleviate some of those issues. Even so, small stocks haven't been this pricey in 25 years.

Granted, estimated earnings bring their own set of issues, especially now with uncertainty so high. The last time the forward P/E ratio for Russell 2000 stocks spiked above 40 was the bottom of the 2002 bear market, so this is not necessarily a reason to think stocks are expensive, just that uncertainty about profits is high.

If we focus on the other issue, the fact that many of these companies are losing money, then it seems like a major negative. Below, we can see the percentage of firms in the Russell 2000 that have negative operating earnings over the trailing 12 months. It just moved above 30%, the most in over a decade.

Only twice before in 20 years have such a high proportion of these small companies lost money - April 2002 and December 2009 through February 2010.

Investors are anticipatory creatures, so by the time so many companies experienced negative earnings, stocks had already suffered major losses. By the time it got to this point, investors were already anticipating the turn, and the Russell was close to bottoming (in 2002) or already had (in 2009).

It's common to see hyperbolic headlines about high valuations and a preponderance of money-losing companies. It's less common to see an objective look at what it might mean. There isn't much history here, but from what we can see from the rare precedents, these fundamental worries are overblown.