Nasdaq's Record Reversal As Black Swans Go On Sale And Yields Rise

This is an abridged version of our Daily Report.

A record reversal

The Nasdaq 100 fund has never enjoyed as large a recovery as it had on Tuesday. The QQQ fund opened Tuesday’s trading down more than 1%, then reversed to close at a 52-week high, something it’s never done before. The underlying index has had several large recoveries, leading to minor short-term dips.

Black Swans might be on sale

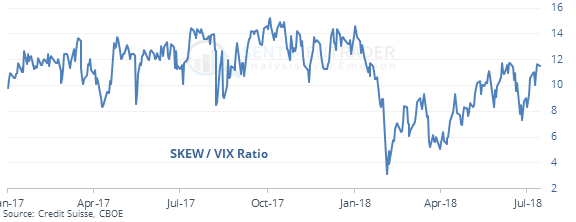

The SKEW index is showing that options traders expect a high chance of a big move, pricing in a near-record probability of a 2 standard deviation move in stocks during the next 30 days.

Longer-term options are not showing any kind of similar concern, leading to an extreme in the ratio of the SKEW to the VIX and the CS Fear Barometer.

Risk-free competition

The yield on 3-month Treasuries is now higher than the dividend yield on the S&P. That’s the first time since 2008, leading some to worry about stocks. But since 1971, stocks have rarely yielded more, and on average the 3-month has offered investors 2% or more than the S&P’s dividend.

Steady Staples

Since Staples had become so out of favor in May, they’ve been on a slow but steady rise. The XLP fund on Tuesday closed above its 200-day average for the first time in 102 sessions, tied for the 3rd-longest downtrend since its inception in 1999.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |