NASDAQ's death cross

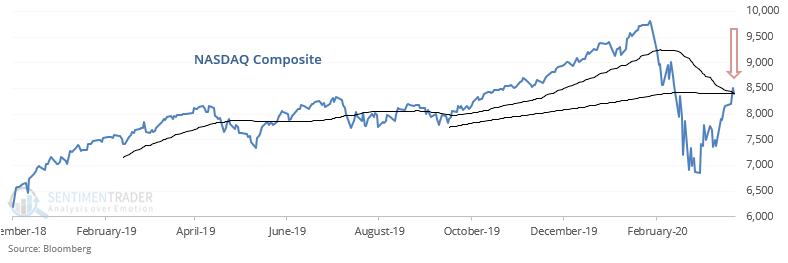

The NASDAQ Composite is about to form a death cross. It is the last major U.S. index to do so since others have already formed one over the past 2 weeks:

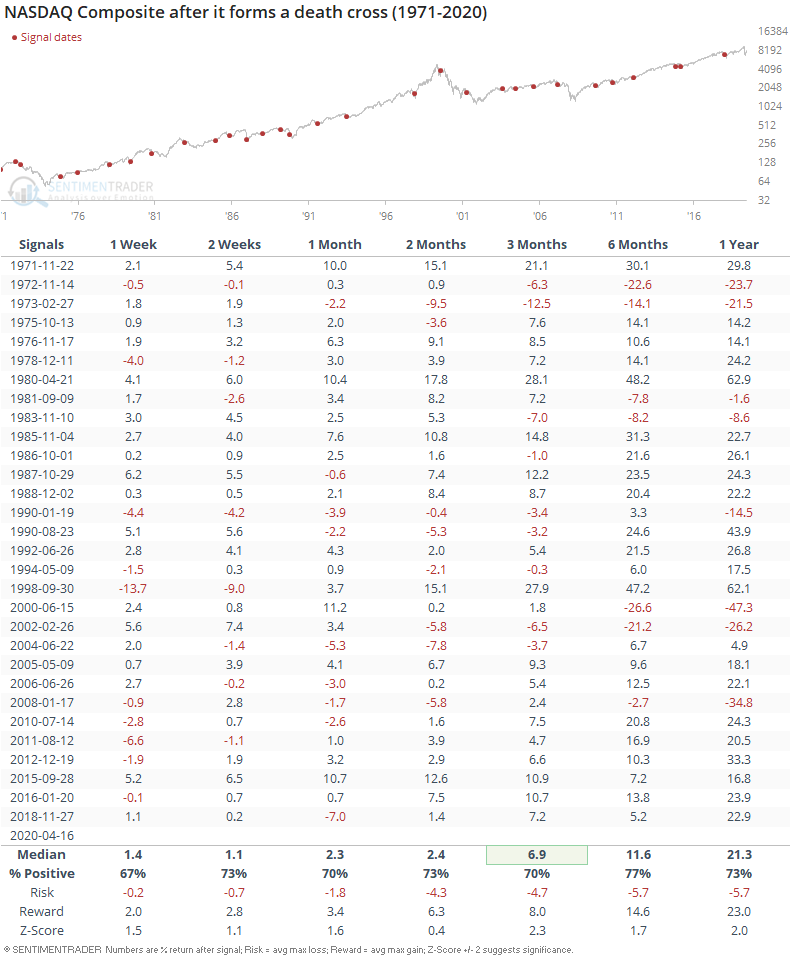

Death crosses (50 dma cross below 200 dma) always sounds scary, but historically haven't always led to losses for the NASDAQ Composite. In fact, more often than not the NASDAQ rallied over the next 1-3 months:

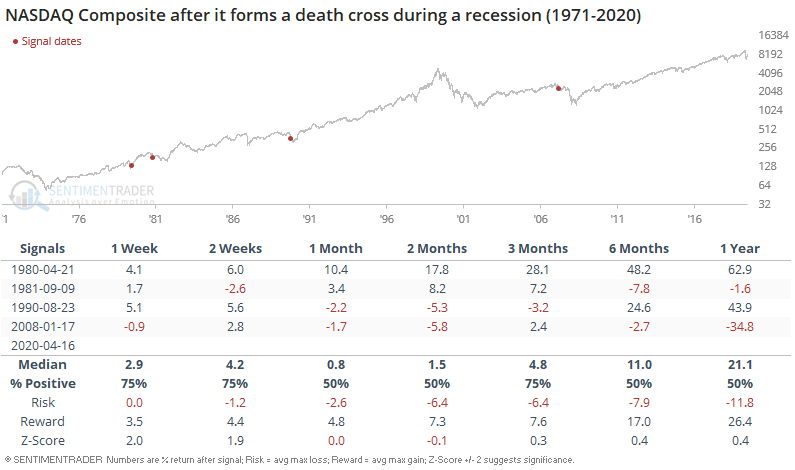

Granted, the current death cross could be seen as worse than many other death crosses which did not occur during recessions. If we only look at death crosses which occurred during a recession (not before or after a recession):

The NASDAQ Composite's forward returns were worse. Only the April 1980 case did not see further losses in the coming months, whereas the 3 other cases all saw further losses (1981, 1990, 2008).