Nasdaq Stocks Lag While Emerging Market Nerves Hit High

This is an abridged version of our Daily Report.

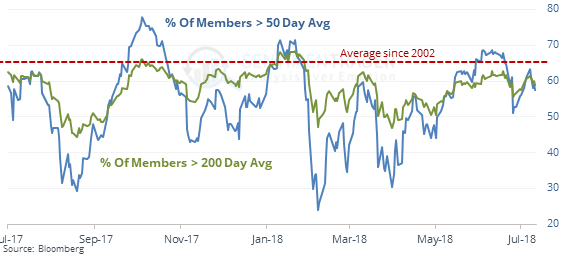

Some lag during latest leg

The Nasdaq Composite closed at a 52-week high on Friday but relatively few stocks have come along, with fewer than 60% of members trading above their 50- and 200-day averages.

The one-year return in the Nasdaq averaged -2.2% when so few stocks were above their averages versus +14.9% otherwise.

Emerging nerves

The “fear gauge” for emerging markets is extremely high versus U.S. stocks. It’s at a 52-week high while the VIX is near the bottom end of its own range. The two other times there was so much relative anxiety, emerging stocks did better.

Transports sending a signal

The Dow Transports closed just above its 200-day average. When it’s in a downtrend, it has served as a headwind for the Dow Industrials. When the Transports were above the 200-day, the Industrials advanced at an annualized +9.1%. When the Transports were below the 200-day, the Industrials only returned an annualized +3.9%.

More lag

A day after the S&P set a 100-day high, the McClellan Oscillator is already showing slowing breadth momentum by closing below zero.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |