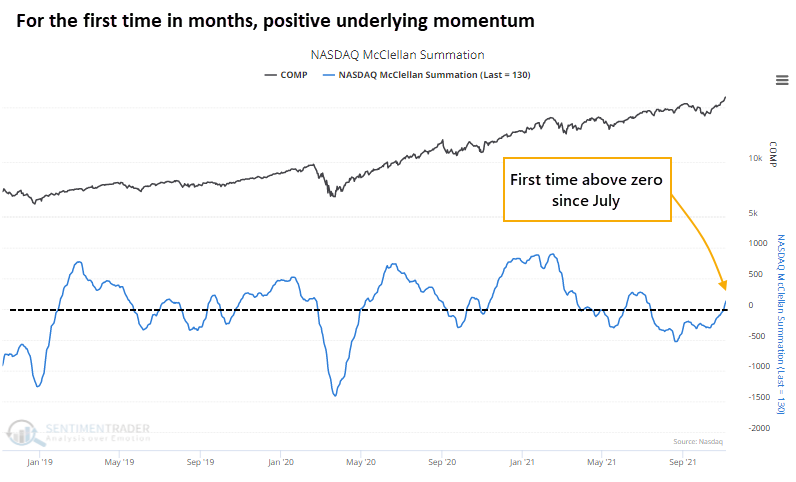

Nasdaq stocks haven't done this for 3 months

For the first time in months, the momentum in securities traded on the Nasdaq exchange has turned positive.

After a furious rally to start the year, so many stocks were churning that breadth on the Nasdaq couldn't surpass its highs at the start of the year. By mid-summer, it turned outright negative and stayed there until last week.

This has ended a streak of 77 days in negative territory for the Nasdaq McClellan Summation Index, among the longest streaks since the end of the Global Financial Crisis.

Only 6 other periods saw the Nasdaq's Summation Index stay in negative territory for longer. After those streaks ended, the Nasdaq Composite gained an average of nearly 19% at some point within the next year.

What's especially notable about the current flip to positive momentum is that it triggered as the Nasdaq Composite was on a run to new highs. Since 1986, there have been 8 similar signals.

What else we're looking at

- How the Nasdaq performed after other times the Summation Index turned positive

- Why context matters when momentum turns positive

- Using the 17 level in the VIX as a line in the sand

- What relative performance in the Russell 2000 is signaling about future returns

| Stat box More than 1/3 of Technology stocks are now overbought, according to their Relative Strength Index (RSI) readings. After the 58 other days that showed such a broad level of overbought stocks, the XLK fund showed a flat average return over the next month. |

Etcetera

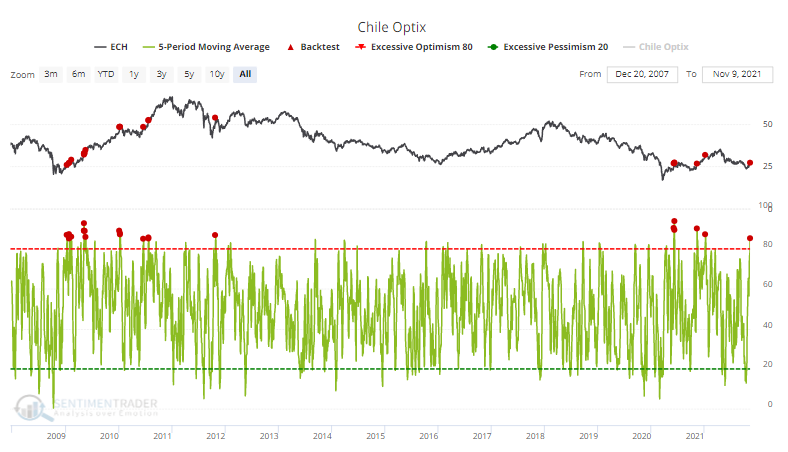

Chile is hot. Over the past week, the Optimism Index on the ECH fund has soared to 85%. Other bouts of extreme short-term optimism have tended to occur after protracted downtrends, ultimately leading to higher prices over the next 6-12 months.

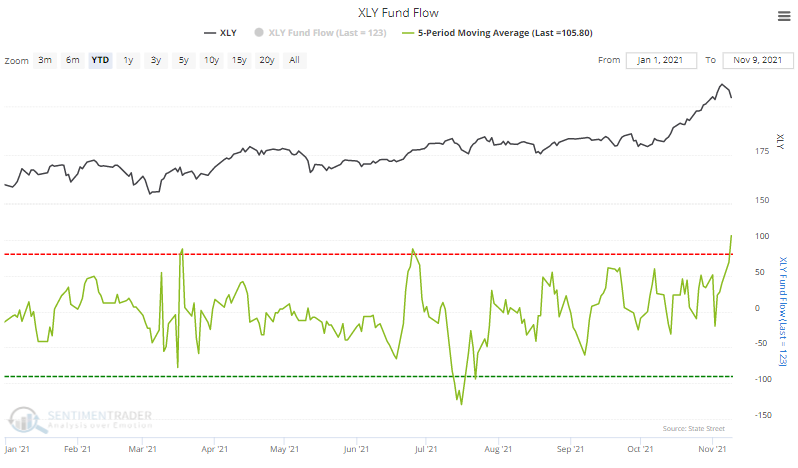

BTFD in Discretionary stocks. The XLY Consumer Discretionary fund has enjoyed an average inflow of more than $100 million per day over the past week, despite the price pulling back in recent days. This is the largest 5-day inflow of 2021.

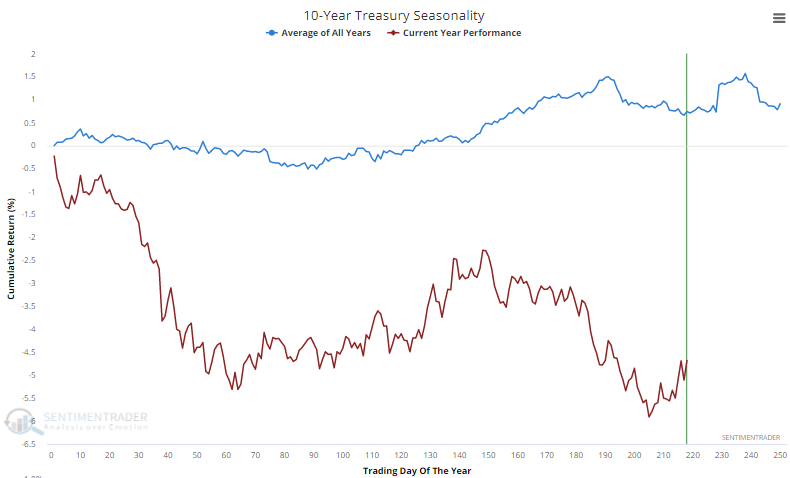

Time for Treasuries. The price of 10-year Treasury note futures has mostly followed its typical seasonal pattern (the path, not the magnitude). If it continues, prices should continue to rise into December.