Nasdaq Hits New High With Fewer Stocks Coming Along

This is an abridged version of our Daily Report.

Some tech stocks struggle to keep up

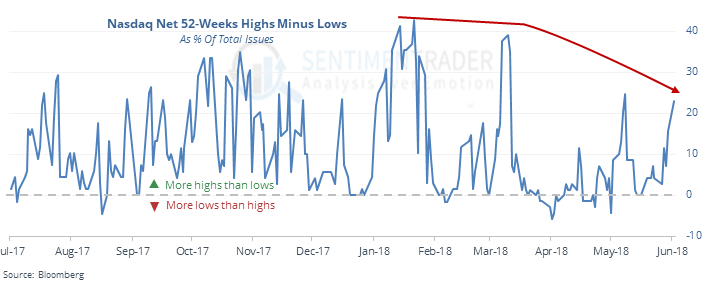

The S&P 500 Technology index has hit new highs the past two days, but fewer of its stocks are coming along. In January and March, more than 40% of its members hit 52-week highs, compared to only 15% on Friday.

This was an inconsistent warning sign, however, even as it’s considered a major negative divergence.

A good day (and sign) for the Nasdaq

The Nasdaq Composite scored a fresh 52-week high for the first time in months. The end of its streak of more than 50 days since its last high triggered in early summer, which isn’t typical. When the index sets a new high in early- to mid-summer, its risk during the summer is lessened.

Middle East heat

Among country ETFs, nothing is hotter than Saudi Arabia (haha). Its Optimism Index is now above 90, making it the reddest of the red on the Geo-Map. We only have a couple years of history for the fund, but optimism has been above 90 on 26 other days.

Not sweet on sugar

Sugar contracts have tumbled the last two days, losing nearly 7% just since Thursday. That’s the 2nd-largest two-day selloff in five years. It’s fairly common for the volatile commodity, however, with more than 200 such selloffs since the 1980s.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |