Nasdaq Breadth Is (Too) Good As Buyers Finally Persist Intraday

This is an abridged version of our Daily Report.

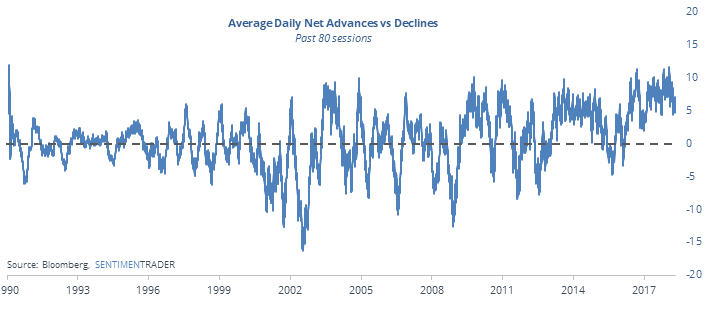

Tech breadth remains impressive

A few major Tech stocks get all the attention, throwing a shadow over all the other members. So far this year, the sector is showing some of the best breadth readings since 1990, with broad participation.

Even if there was a negative divergence with breadth, it would not be a good reason to sell.

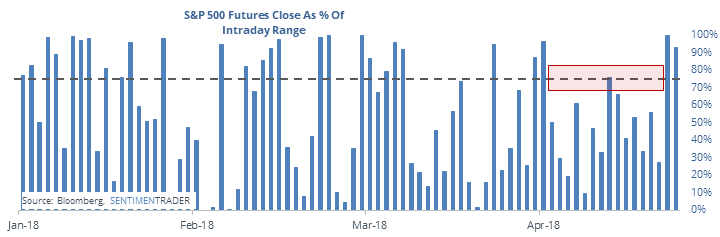

Buyers finally close

For the first time in weeks, buyers have persisted in closing the regular trading session near the intraday high. Prior to Wednesday, the S&P 500 futures closed in the bottom 76% of their range for 14 straight days.

When a streak of poor closes was ended by a close near the top of the range, it led to further gains.

Nasdaq gap

The Nasdaq 100 fund, QQQ, enjoyed a 2% rally on Thursday and thanks to a good reception to after hours earnings, is on track to gap up more than 1% on Friday morning. In its history, it has gapped up 1% the morning after a 2% rise 73 times, with its most consistent performance being a week later, when it added to the gains 26 times (a 35% win rate).

Intraday bubbly

Our shortest-term STEM.MR Model closed above 90% on Thursday, suggesting an abnormally large surge in ultra short-term optimism.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |