NASDAQ almost at all-time highs

Crises tend to accelerate existing trends by accentuating the existing advantages/disadvantages that various industries have. This time around, the pandemic-driven recession has been a boon to many tech companies. Noting this fundamental advantage, investors have pushed the NASDAQ closer and closer to all-time highs even though other indices are still some ways from all-time highs.

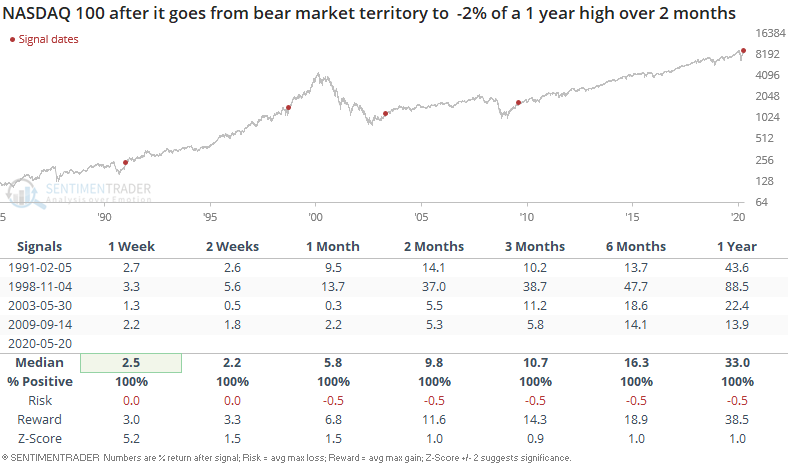

The NASDAQ 100 is within 2% of an all-time high after climbing out of bear market territory over the past 2 months:

When this happened in the past, the NASDAQ 100's returns were bullish on every single time frame.

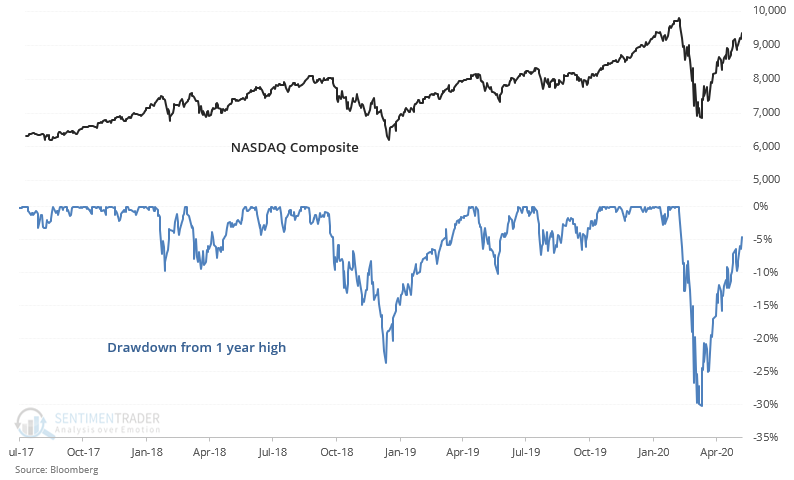

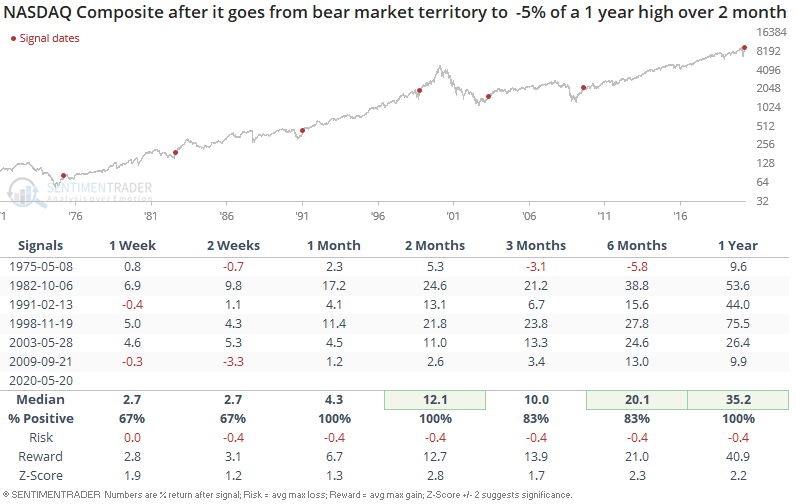

Similarly, the NASDAQ Composite is within -5% of an all-time high:

When the NASDAQ Composite cycled from bear market territory (-20% below a 1 year high) to within -5% of a 1 year high, the NASDAQ's returns over the next year were consistently bullish:

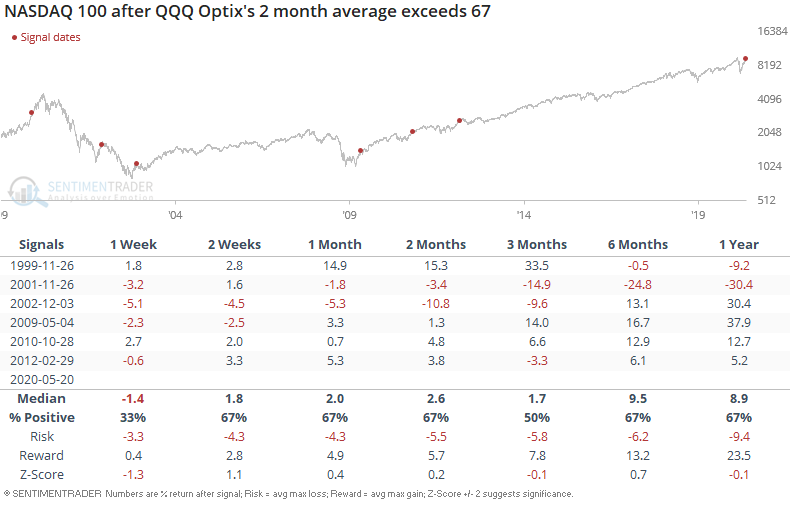

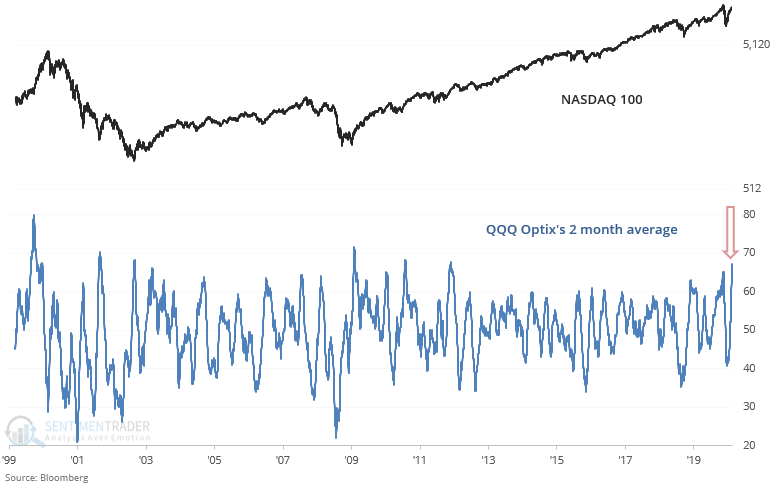

This doesn't mean that tech stocks can't pullback in the short term. Our QQQ Optix's 2 month average is at the highest level in 8 years:

Such excessive optimism could lead to a short term pullback: