Nasdaq 100 McClellan summation index suggests higher prices

Key points:

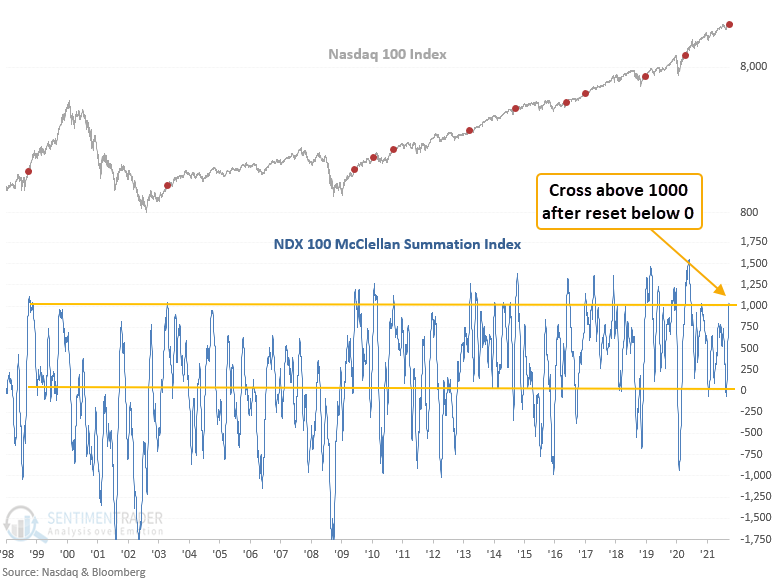

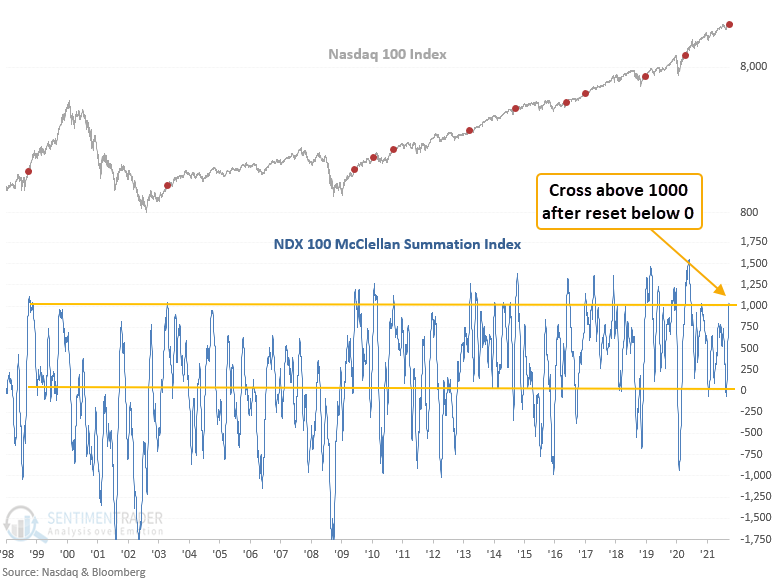

- The Nasdaq 100 McClellan Summation index crossed above 1000

- The index has rallied 100% of the time over the next 12 months after other signals

The new signal provides more evidence of broad-based participation

In a note last week, I shared a study that utilized the percentage of Nasdaq 100 members in a correction to show a reversal in selling pressure with a 100% win rate.

With a reversal in the McClellan summation index, we now have an additional signal that suggests stocks can go higher.

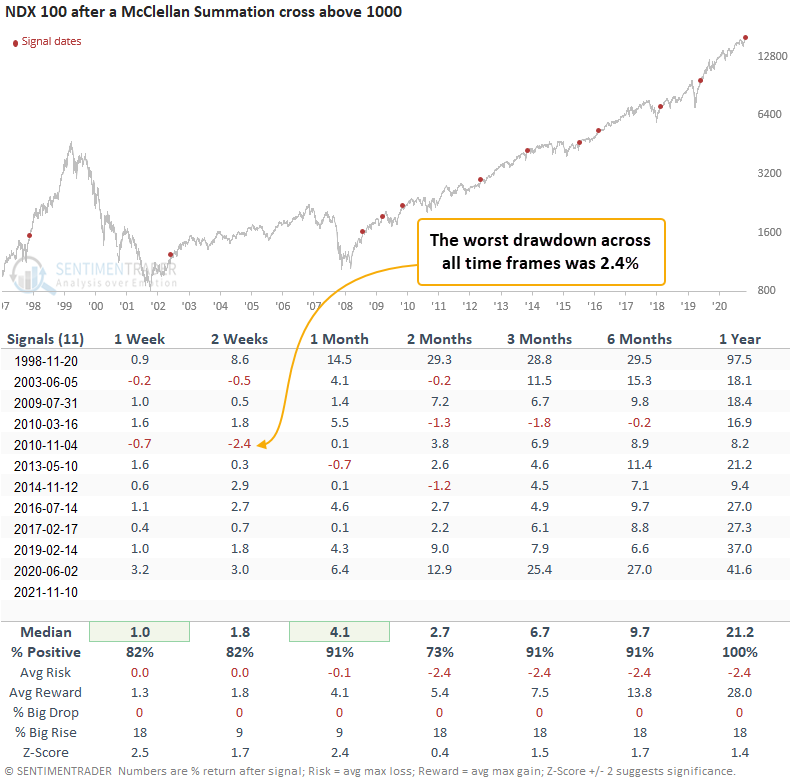

Similar signals preceded gains every time 1-year later

When the McClellan summation index crosses above 1000, after a reset below 0 to screen out repeats, Nasdaq 100 performance is excellent.

This signal has triggered 11 other times over the past 24 years. After the others, future returns and win rates were excellent across all time frames. A year later, the NDX was higher each time, and drawdowns were nonexistent, with a worst-case scenario of -2.4% in the 2-week time frame.

What the research tells us...

Nasdaq 100 stock participation is strong when the McClellan summation index cycles from less than 0 to greater than 1000. Similar setups to what we're seeing now have preceded rising prices for the index across all time frames, with a 100% win rate a year later.