Most Stocks Are Rallying; Put Open Interest Is Rising

This is an abridged version of our Daily Report.

Stocks are rallying

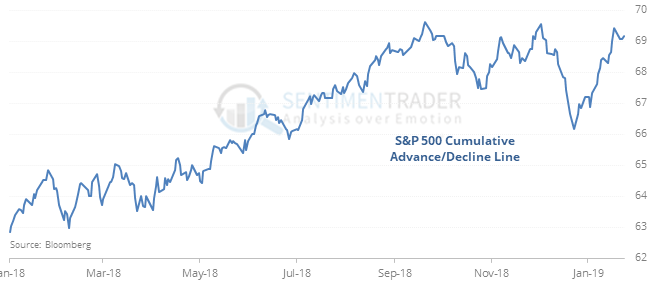

Even though the S&P 500 is nearly 10% below its high, its Cumulative Advance/Decline Line has rebounded so much it’s almost at a new high.

That’s a positive divergence, but historically there hasn’t been much positive about it, with several false signals. Every time it triggered, the S&P showed a negative return one or two weeks later, which isn’t a big deal for most investors. But it generated terrible false signals during 2001 and 2002, as well as (so far) last December.

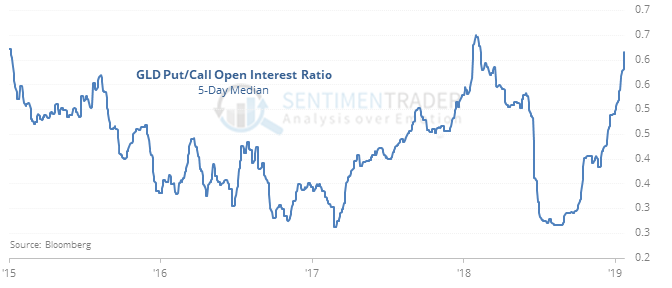

Rising interest

Late last year, options traders closed out a historic number of puts relative to calls, which is usually a good sign of excessive pessimism. It has since rebounded strongly. In the GLD gold fund, put open interest has been rising so much that it’s nearing a four-year high.

Intel assault

A bad reaction to earnings is sending Intel down more than 5% after hours. It’s the largest weight in the SMH fund which is showing a 10-day Optimism Index above 60, which is high. Seems like a bad combination, but there was one other time this happened, when optimism on SMH was high then Intel gapped down more than 5% after earnings, which was January 18, 2013. After that one, SMH fell modestly for the next four days then quickly regained its losses. There were 5 times Intel gapped down 2% the next day...