Most Shorted Stocks Surge With Optimistic Momentum

This is an abridged version of our Daily Report.

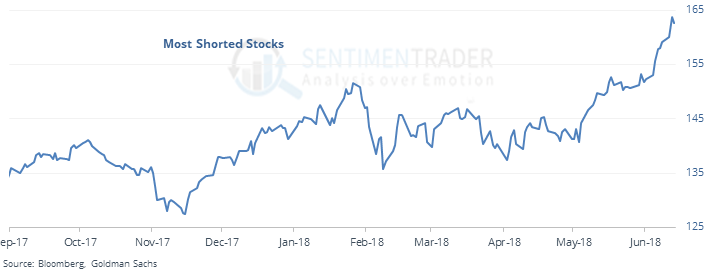

Short squeeze

The most shorted stocks in the market have outperformed the S&P by a wide amount in recent weeks. An index of heavily shorted stocks has jumped nearly 10% to a new high.

After similar short squeezes, the S&P outperformed heavily shorted stocks going forward.

Optimistic momentum

Heading into Wednesday, short-term optimism had been extreme for 8 out of the last 10 days. That’s a sign of buying momentum that isn’t seen very often. After other times it triggered, stocks struggled in the very short-term but not after that.

Fed prediction

Using markets’ knee-jerk reaction following a Federal Reserve meeting as a predictor for future returns is a questionable strategy. Since the 2009 low, the S&P 500’s reaction on a FOMC day predicted the next day’s return 58% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |