Most financials lose their medium-term uptrends

Financial stocks have been among the laggards and still haven't been able to get out of their own way.

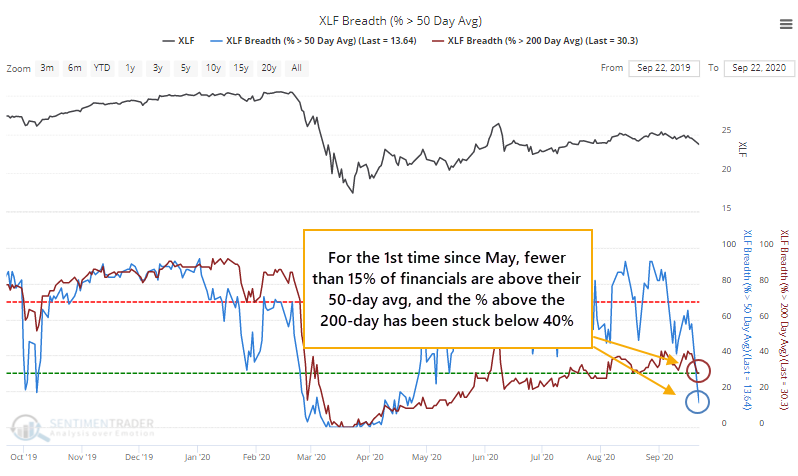

When they fell on Tuesday, they really fell, and it dragged most of them below their medium-term averages. For the first time since May, fewer than 15% of financials were able to hold above their 50-day averages. That comes during an environment where fewer than 40% of them even made it above their 200-day averages.

This ended a streak of more than 100 days with more than 15% of financials above their 50-day averages. In the broader market, when a long streak of positive momentum (or at least "not negative" momentum) ends, it often precedes positive returns, as those who missed the rally see their first real opportunity to get in.

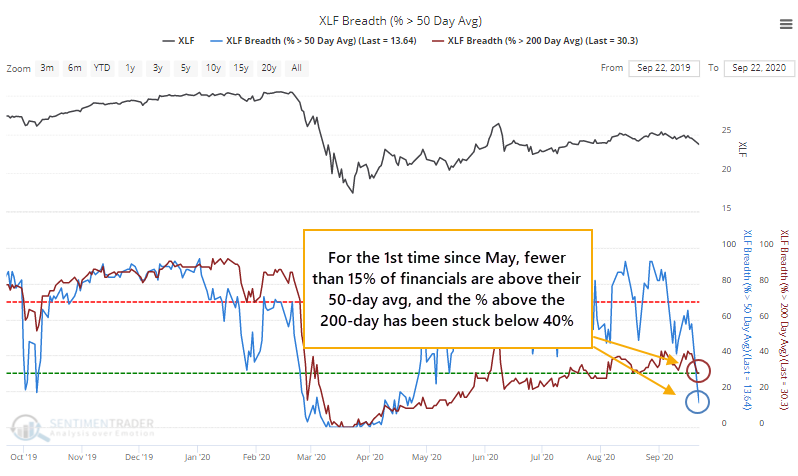

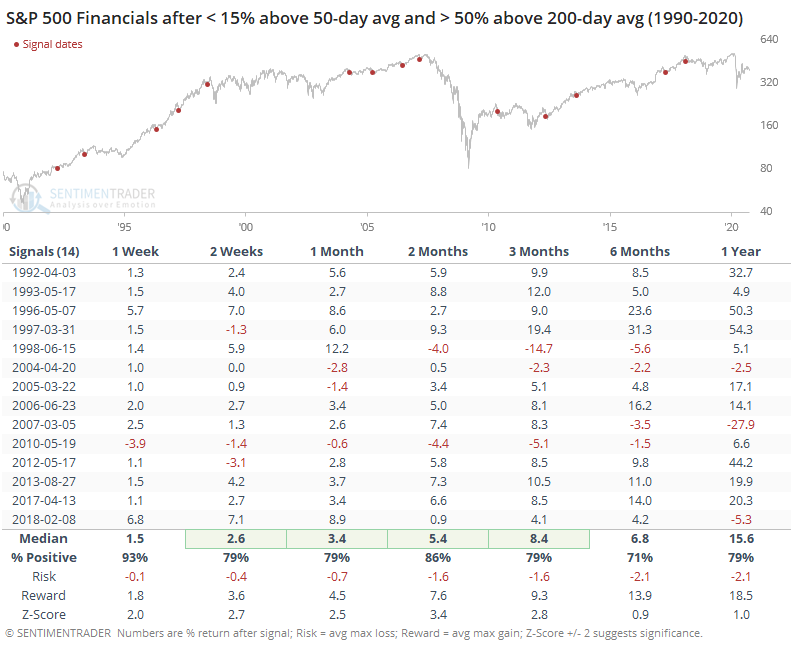

With financials, these opportunities seemed heavily dependent on the larger market environment. Below, we can see future returns in the S&P 500 Financial sector when fewer than 15% of stocks held above their 50-day averages for the first time in at least 100 days, while fewer than 50% of them were also above their 200-day averages.

Forward returns weren't great, especially over the medium-term of 1-6 months. Average returns were poor, and the risk/reward was horrid. There were a few temporary successes in there - financials quickly turned and soared for a while in 2017 and 2019 - but most fizzled out.

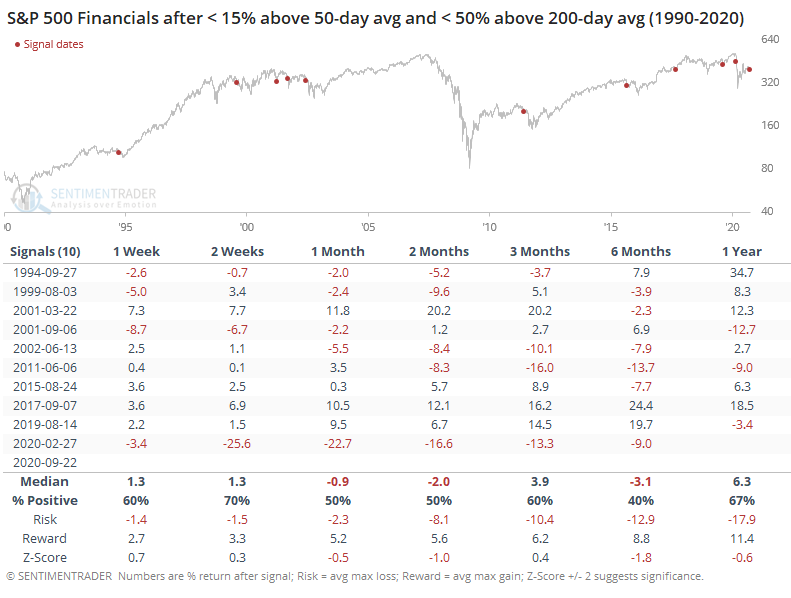

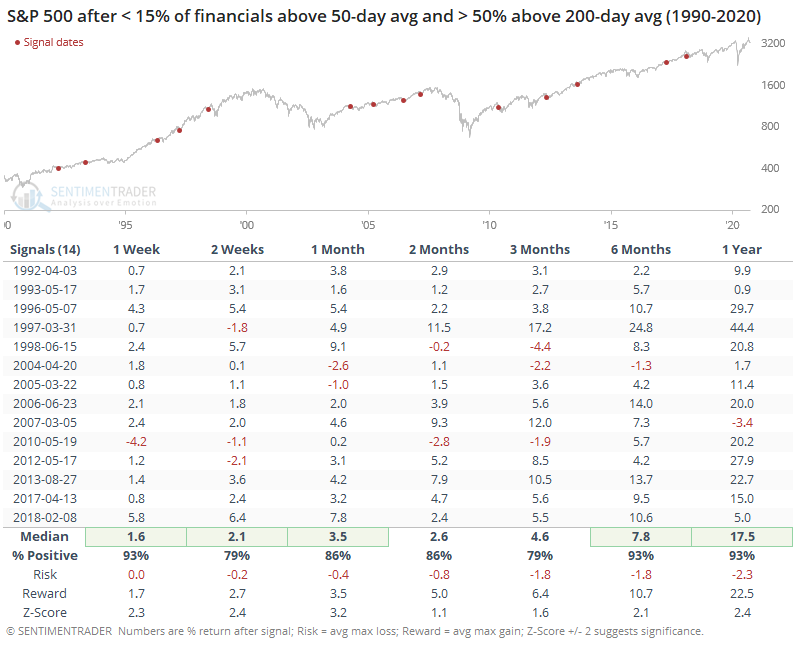

While not as bad, returns for the broader S&P 500 index were also tepid over the next 2 months, though already by 3 months later, there were only 2 (large) losses.

Contrast that to times when these streaks ended, but more than 50% of financials were above their 200-day averages.

This was quite a change. These tended to be excellent buying opportunities, with only a few failures over the medium- to long-term.

For the broader S&P, these were excellent signals, with only one small loss over the next 6 months.

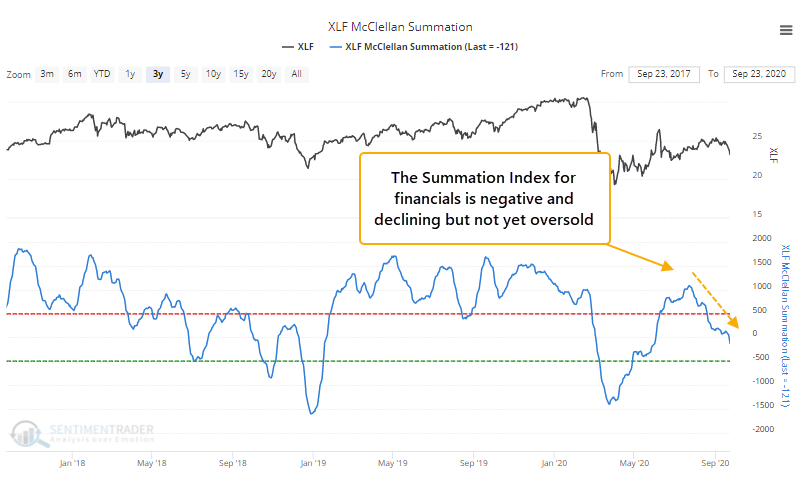

We can also monitor the longer-term environment for financials by watching the McClellan Summation Index for the sector. Currently, that's showing the worst possible combination - below zero, declining, and not yet oversold.

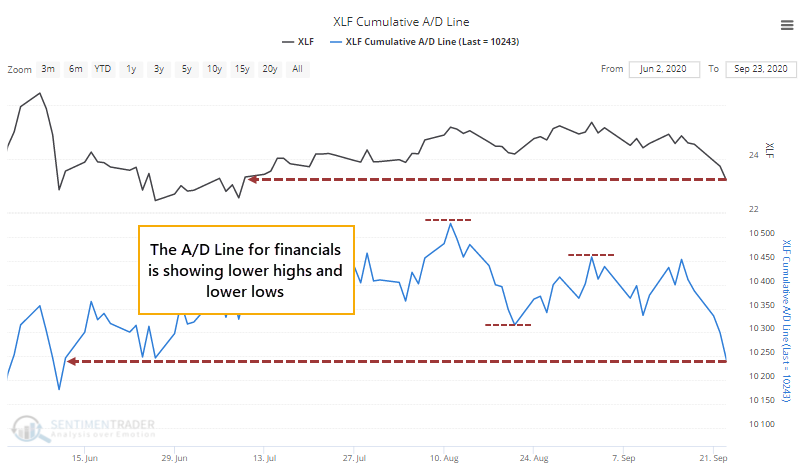

While a more minor consideration, the Cumulative Advance/Decline Line for financials is leading the index itself lower and showing a clear pattern of lower highs and lower lows.

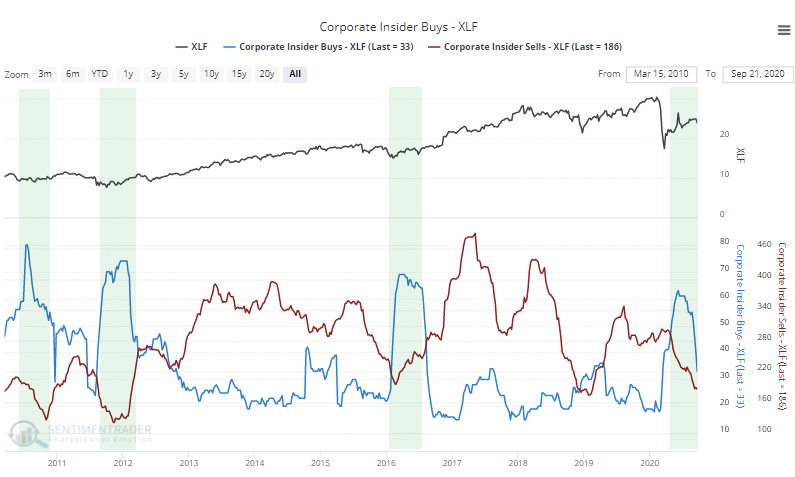

The biggest positive for the group is the spike in buying among corporate insiders during much of the spring. That has tapered off, but so has selling. This tends to be longer-term, and the poor market environment is a more immediate concern.

Market environment matters when judging overbought/oversold and optimism/pessimism, and right now that environment is very poor in financials. When there is a poor market environment, the concept of "oversold" takes on a new meaning, and it requires truly extreme bouts of heavy selling and pessimism to create low risk / high reward setups for buyers. We don't have that yet in this sector, at least based on historical reactions to similar behavior.