Most energy shares trade for less than $5 (even $2)

Thanks to free commissions and an increasingly democratized investing landscape, more and more trading activity has occurred in low-priced stocks.

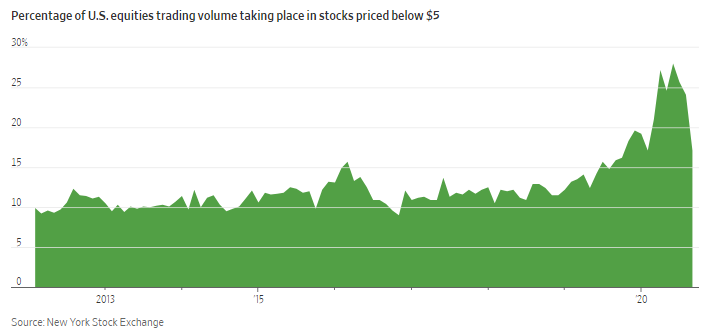

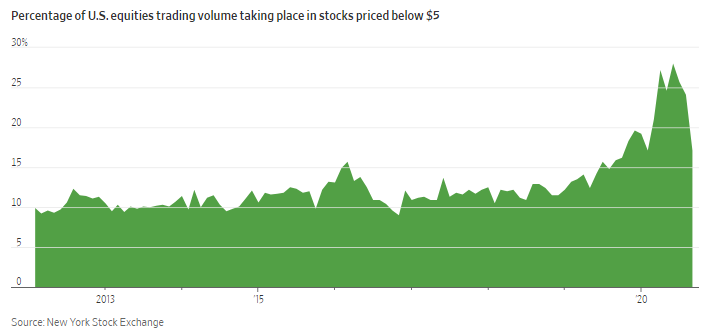

As the Wall Street Journal notes, earlier this summer the volume in stocks priced below $5 more than doubled:

"Trading in speculative stocks with low share prices has surged this year, fueled by a huge influx of individuals using zero-commission investing apps and online brokerages. During several months this spring and summer, more than 25% of the shares traded in the U.S. stock market were in companies with a share price below $5, according to data from the New York Stock Exchange. From 2012 to 2019, that percentage mostly hovered between 10% and 15%, the NYSE data show."

We can see just how extreme this volume jumped in 2020.

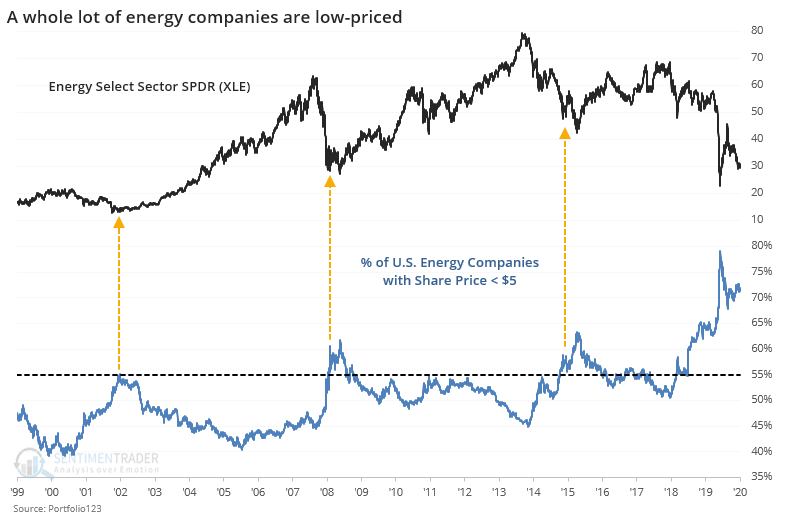

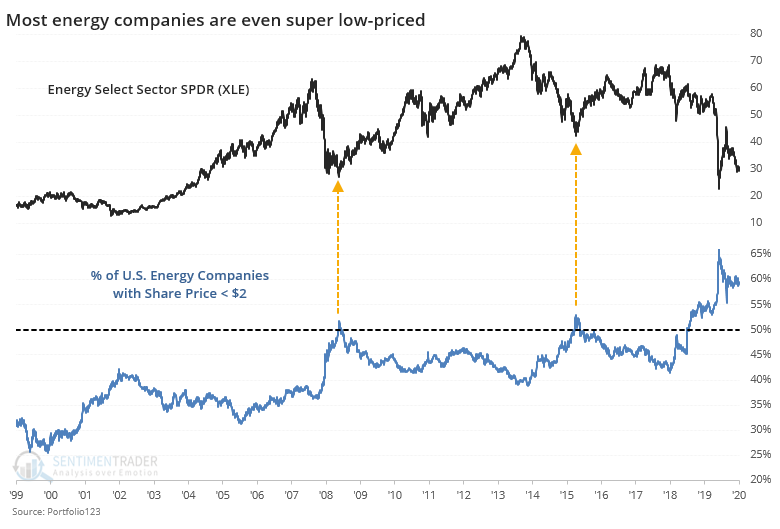

One sector that has seen this increased volume flow is energy. Not because investors are in love with it, quite the contrary. Rather, it's because stocks in the sector have fallen so much that many of them have become cheap by default. Cheap in price, not necessarily valuation.

According to data compiled by Portfolio123, out of 663 U.S. listed stocks in the energy sector, 470 of them have a share price under $5.

This is kind of insane. And it's down from a peak of nearly 80% of these companies in March. No other energy bust in the past 20+ years saw more than 65% of these firms with a share price under 5 bucks.

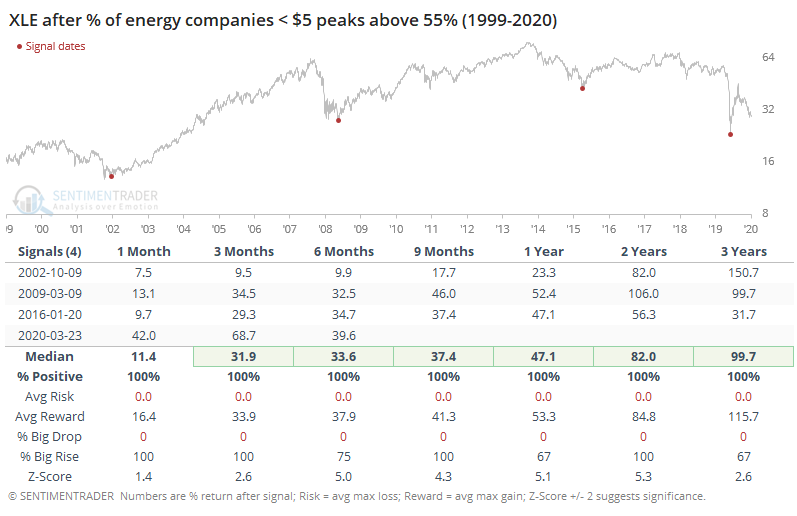

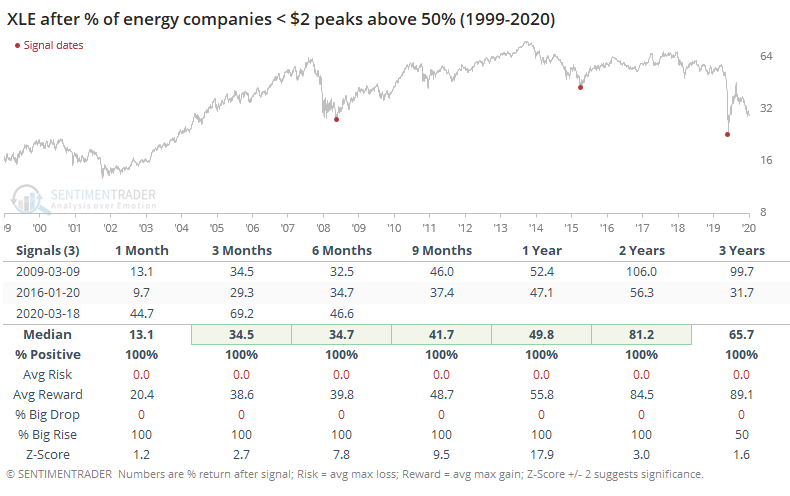

The only other times when there was a peak with more than 55% of energy companies below $5, the long-term returns in XLE were abnormally positive.

It gets even more extreme. More than 390 of them have shares that you could buy with a 2 dollar bill.

It gets even more extreme. More than 390 of them have shares that you could buy with a 2 dollar bill.

Again, forward returns were heavily skewed to the positive after peaks above 50%.

This appears absurdly positive for long-term returns in many of these shares.

The biggest caveats are that the 2020 readings are so extreme that there's simply no real precedent over the available data history. And even though these shares became low-priced to an extreme degree in the summer of 2019, the sector continued to suffer tremendous selling pressure, unlike the last two times when it marked the ends of the bear markets.