More NASDAQ momentum

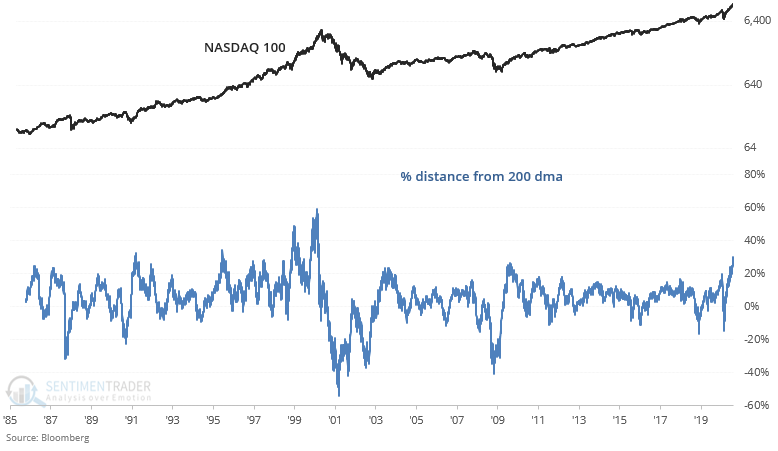

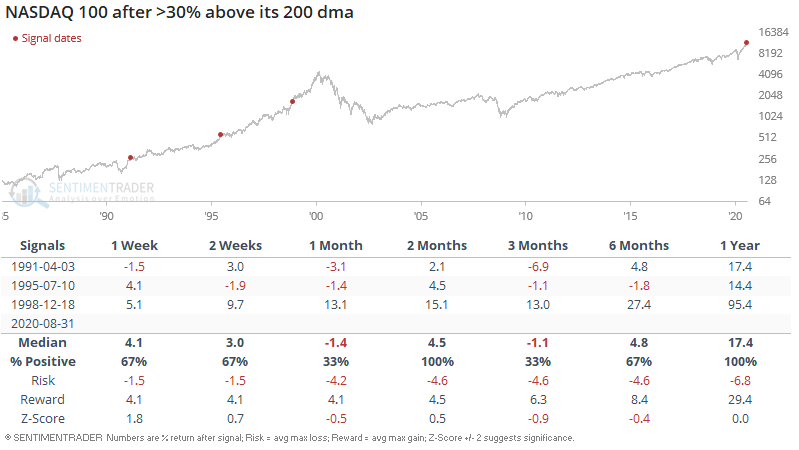

The NASDAQ 100's seemingly endless rally has caused its distance from its 200-day moving average to exceed 30%.

When this happened in the past, the 6 months - 1-year returns were bullish. But take this with a pinch of salt as this has only happened 3 other times in the past.

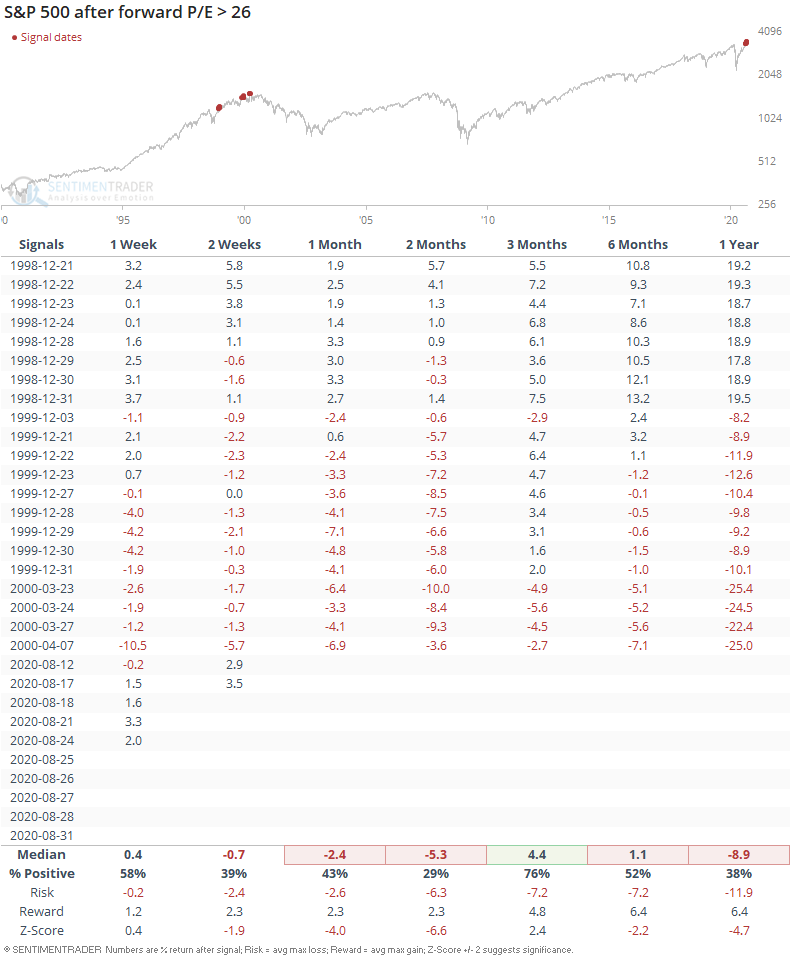

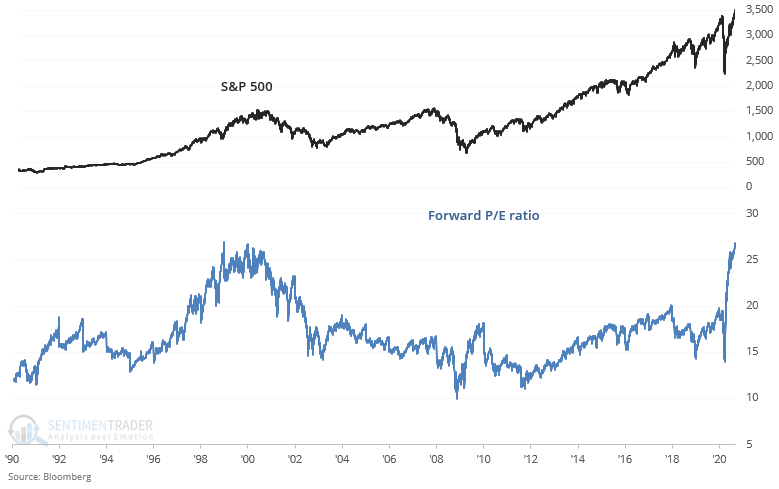

The S&P 500's forward P/E ratio has skyrocketed recently and reached levels similar to the dot com bubble.

When the S&P 500's forward P/E ratio exceeded 26 in the past, this was slightly more bearish than random for the S&P 500.