More Evidence Of Recession-Era Sentiment

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Recession sentiment

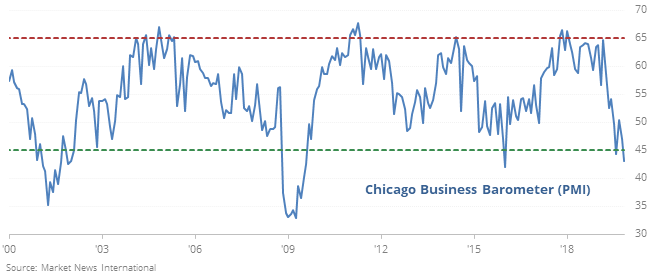

Another survey of insiders at companies in the Midwest shows the kind of sentiment normally seen during and in the latter stages of a recession.

The Chicago Business Barometer has plunged to the 2nd lowest level since the financial crisis, and one of the lower readings in the past 50 years, the kind of reading that has typically led to positive long-term returns for stocks.

Most of the readings this low triggered during the middle or latter stages of a recession, not the beginning.

Risk Appetite Index

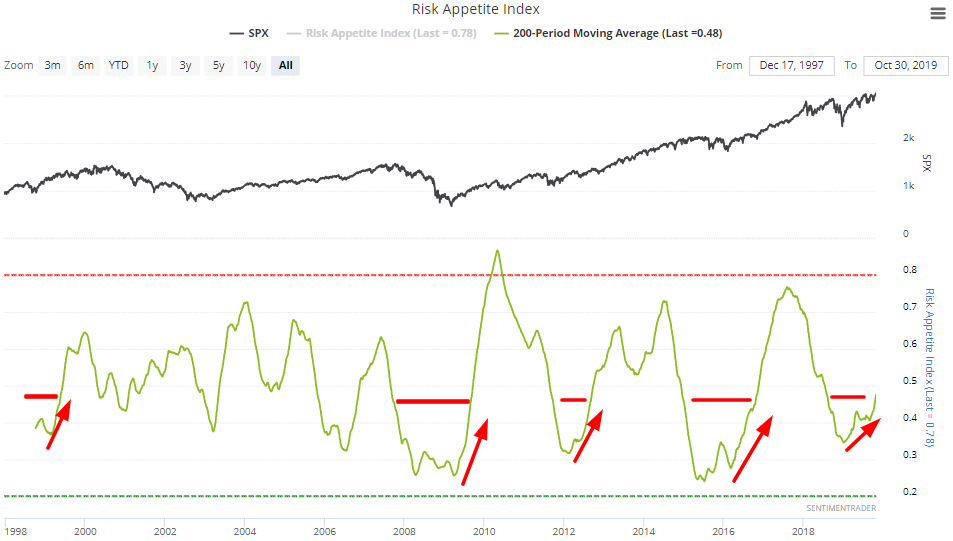

2018's stock market crash and various fears this year (e.g. trade war, global slowdown) have put a dent on sentiment. As a result, our Risk Appetite Index was consistently low. But now that various fears are subsiding, our Risk Appetite Index's 200 dma is trending higher.

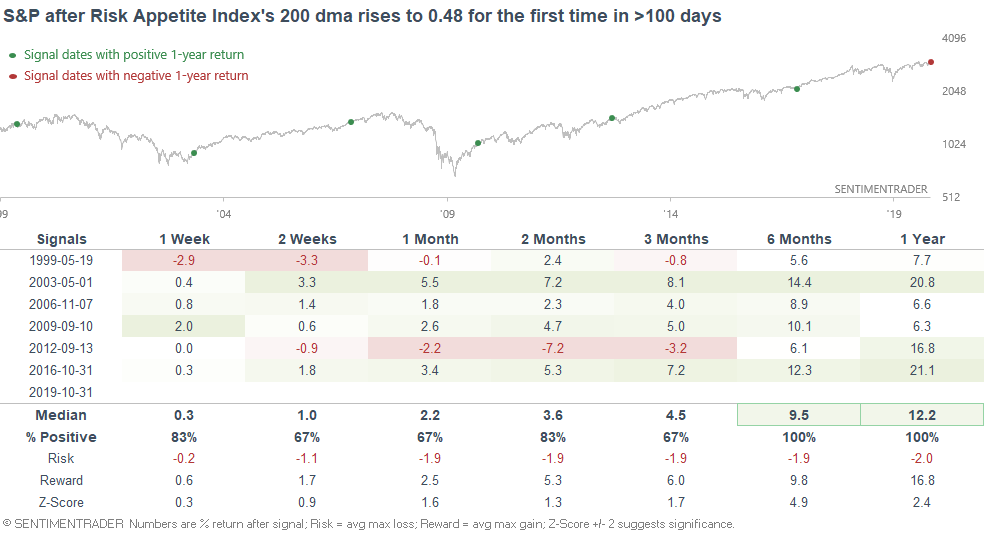

Our Risk Appetite Index's 200 dma has risen above 0.48 for the first time in 330 days. When this happened in the past (typically after major market crashes within the past year), the S&P surged over the next 6-12 months: