More and more stocks in a downtrend

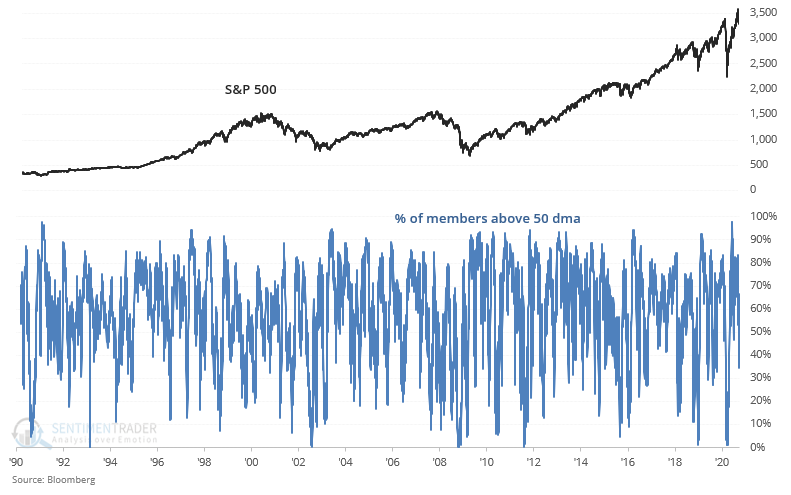

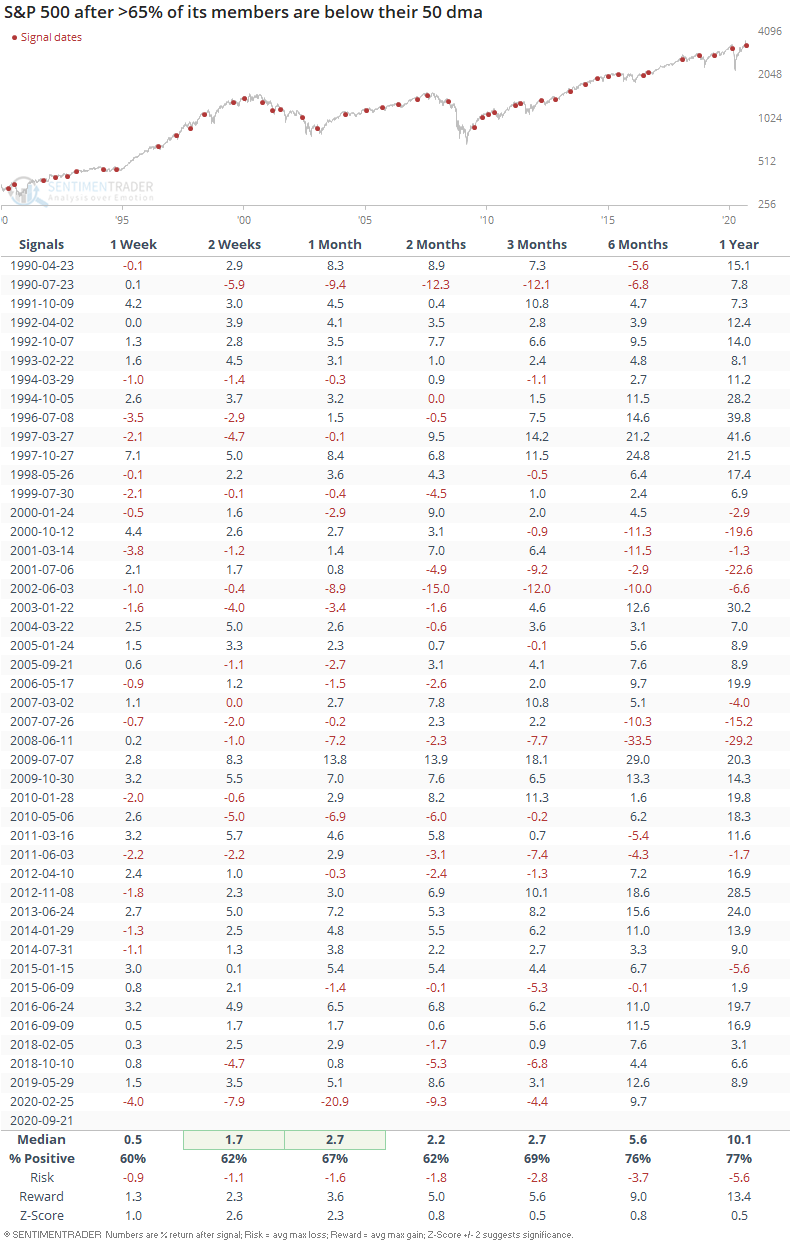

More and more of the broad indices' components are in a medium term downtrend, thereby dragging down the indices themselves. For example, nearly two-thirds of the S&P 500's members are now below their 50 dma:

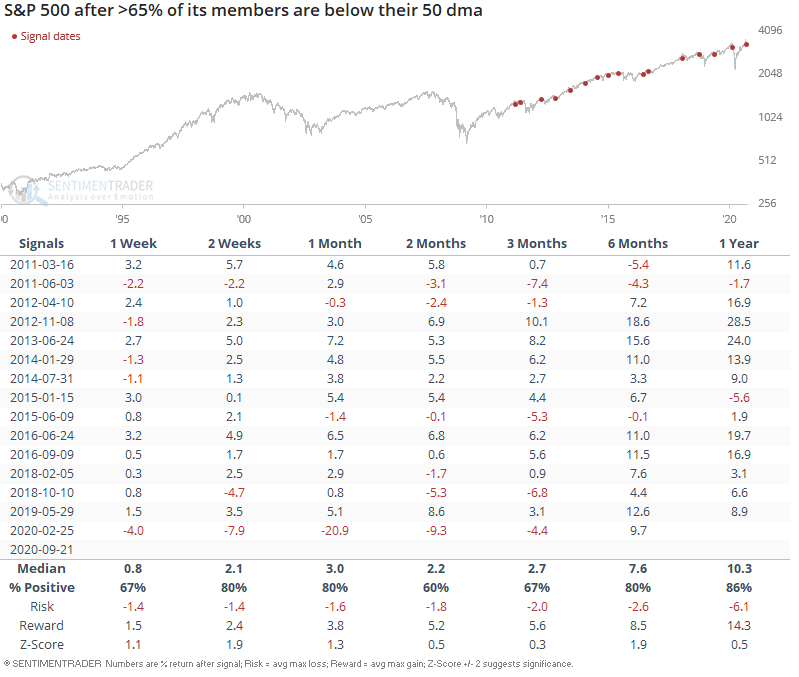

When this happened from 1990-present, the S&P 500's forward returns were not much more bullish than random:

However, this is also were many of the S&P 500's short term pullbacks stopped in the past 10 years:

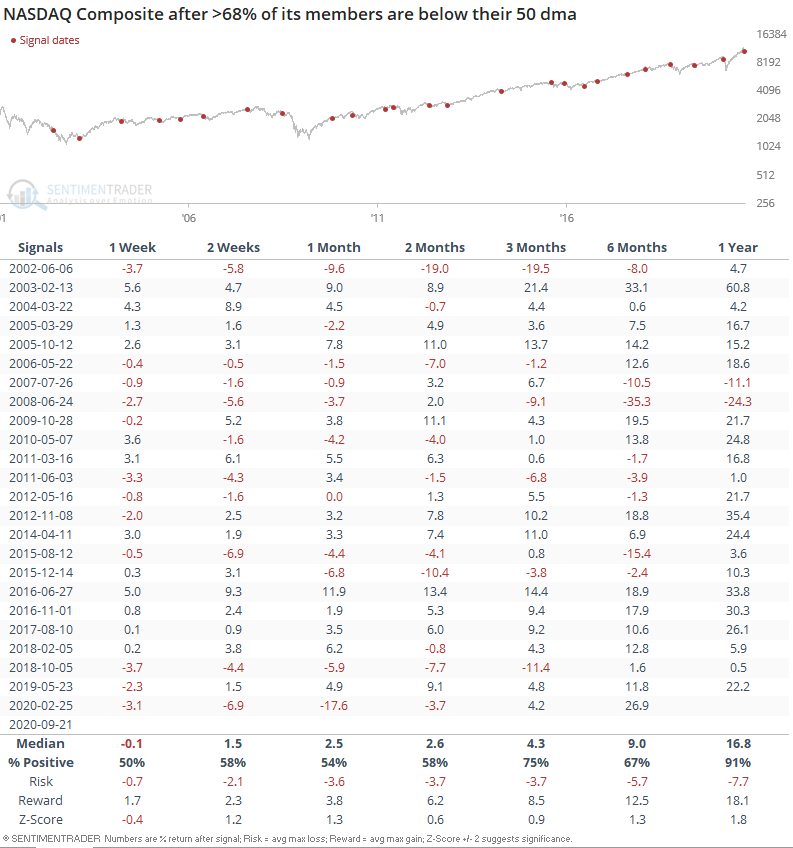

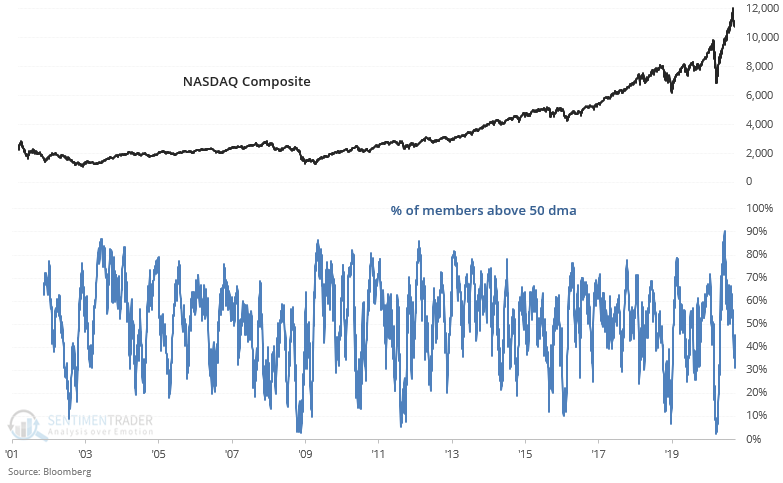

A similar story is going on in the NASDAQ. After a record % of its members were above their 50 dma, more than 68% of its members are now below this key moving average:

But for the NASDAQ, this did not lead to results that were more bullish or more bearish than random on any time frame: