Monthly Anomalies You Are Probably Not Aware of (Part III)

This is Part III of a three-part series looking at unique seasonal anomalies in the stock market that most traders are not aware of.

In Part I, I looked at something of an odd "quirk" in the stock market calendar. In Part II, I highlighted a monthly 6 trading day period that has consistently witnessed poor market performance. Here in Part III, we will flip the script and highlight a monthly 4 trading day period that has consistently witnessed positive market performance.

Once again, the primary goal is simply to help investors find an edge in the markets by highlighting information that hides in plain sight.

Identifying "Trading Days"

As we did in Parts I and II, we start by counting back trading days from the end of the calendar month. As such:

- The last trading day of the month is designated as "TDM -1"

- The 2nd to last trading day of the month is designated as "TDM -2"

- And so on and so forth back to TDM -4

The Period Under Consideration

For Part III the period will look at is:

- The 4-day period each month comprised of the last 4 trading days of the month (i.e., TDM -4 through TDM -1)

- We will look at 90 years of history from 12/31/1930 through 12/31/2020

- The results that follow represent the hypothetical returns achieved by buying the S&P 500 Index at the close of TDM -5 every month and selling at the close on the last trading day of the month.

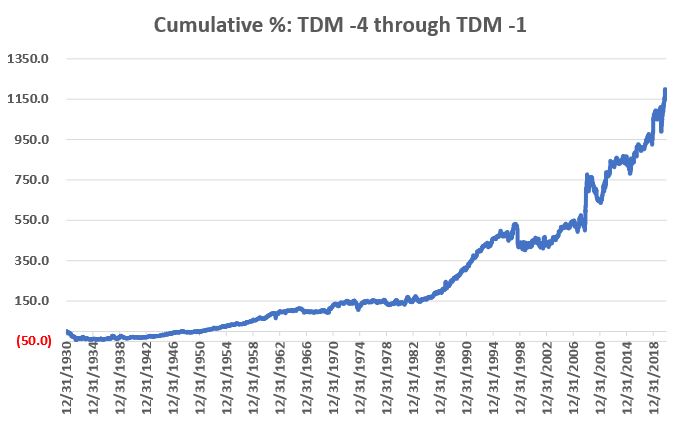

The figure below shows the cumulative % price gain for the S&P 500 Index held only during this 4-trading day period per month (i.e., the 4th to last trading day of each month through the last trading day of the month) over the full 90-year test period. The key things to note is the relatively persistent LLUR ("Lower left to upper right") nature of the equity curve.

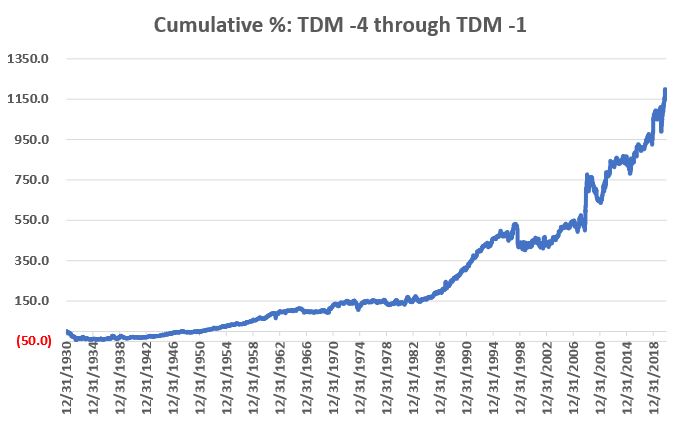

For comparison sake, let's look at the cumulative % price gain for All Other Trading Days (i.e., every day of every month NOT including the last 4 trading days of the month). In the chart below we see a higher overall gain than in the previous chart. This should not be surprising since the last 4 days of the month comprise only 18.3% of all trading days (All Other Trading Days depicted in the chart below comprise 81.7% of all trading days). But note the violent swings that mark the equity curve below.

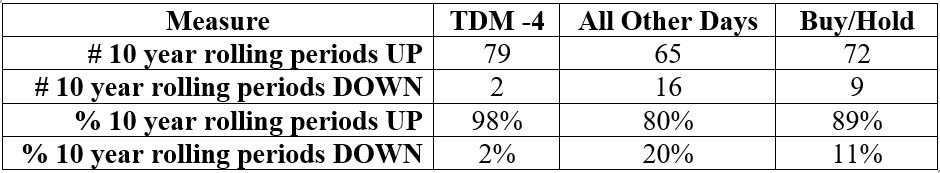

To compare consistency let's look at 10-year rolling returns for:

- Last 4 trading days of the month

- All Other Trading Days

- Buying-and-Holding the S&P 500 Index

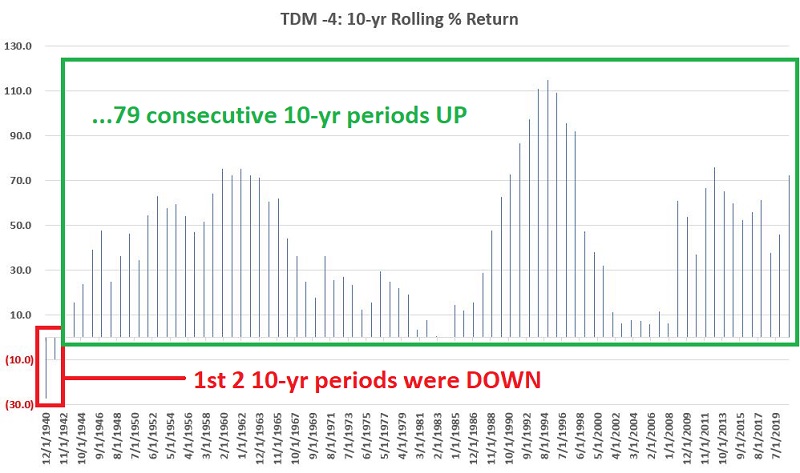

The key thing to note is that buying and holding only during TDM -4 to TDM -1 registered a 10-year rolling gain 98% of the time.

Interestingly - and as you can see in the chart below - the two losing 10-year rolling periods for TDM -4 were the first two measured (Dec-1930 to Dec-1940 and Dec-1931 to Dec-1941). Since then, the last 79 consecutive 10-year periods have witnessed an overall gain for the S&P 500 Index during TDM -4 to TDM -1.