Monday Midday Color

Here's what's piquing my interest so far today.

This Little Piggy Goes To Market

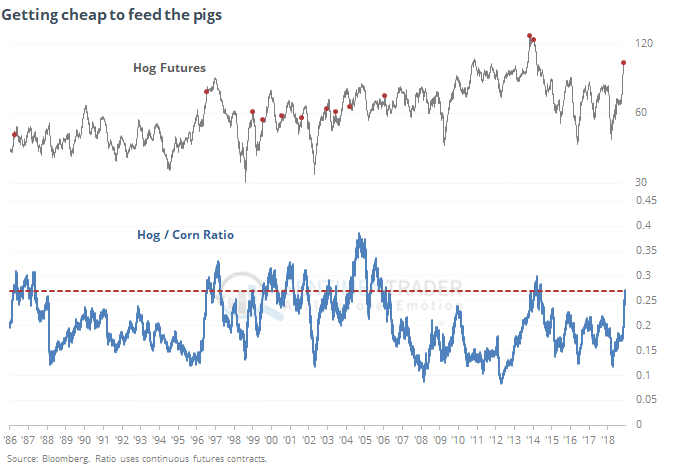

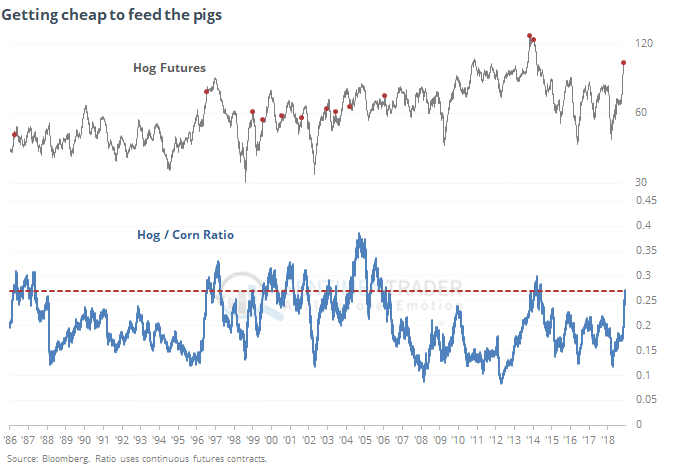

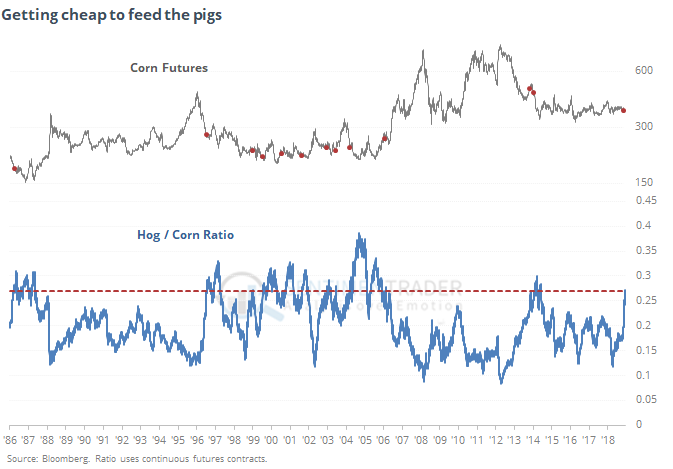

Hog futures have soared. Corn has not. The ratio between the two is now at an extreme.

There are a large number of factors that go into the price gyrations of both markets, but historically there has been a loose relationship between the two. Basically, pigs love corn.

Prior to the increase in specialized farming, diversified farms often viewed hogs as an alternative strategy for marketing corn. If corn prices were low the farmers would “walk the corn off the farm” by feeding hogs. If corn was more expensive or livestock too cheap farmers would sell corn and reduce livestock numbers.

Due to the vagaries of international trade, and secular changes in ag practices, there's no telling if the relationship between the two makes sense any more. Whatever the reason, there has been a general tendency for the prices of hogs to decline, and corn to rise, in the months following an extreme in the ratio between the two.

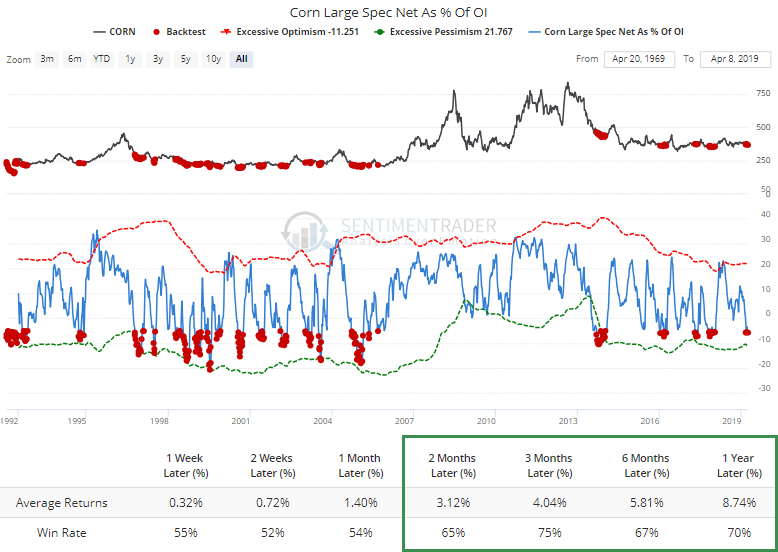

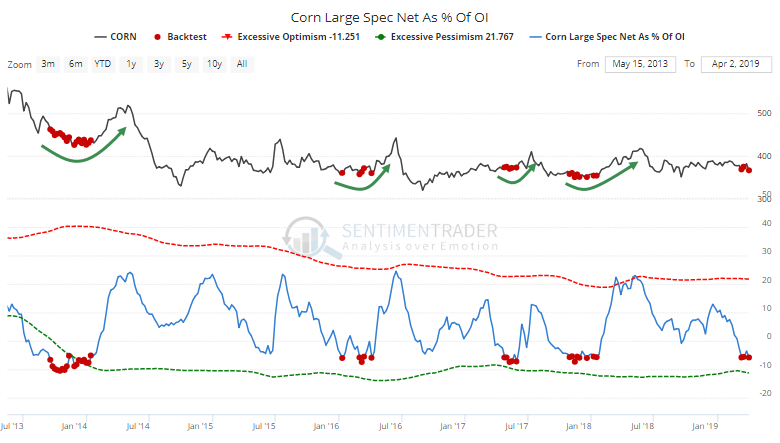

This is notable now because speculators keep selling corn futures and now hold more than 5% of the open interest net short. That has been a positive for future returns.

That's been the case even over the past few years of a steady downtrend, where every spike in prices has been sold aggressively.

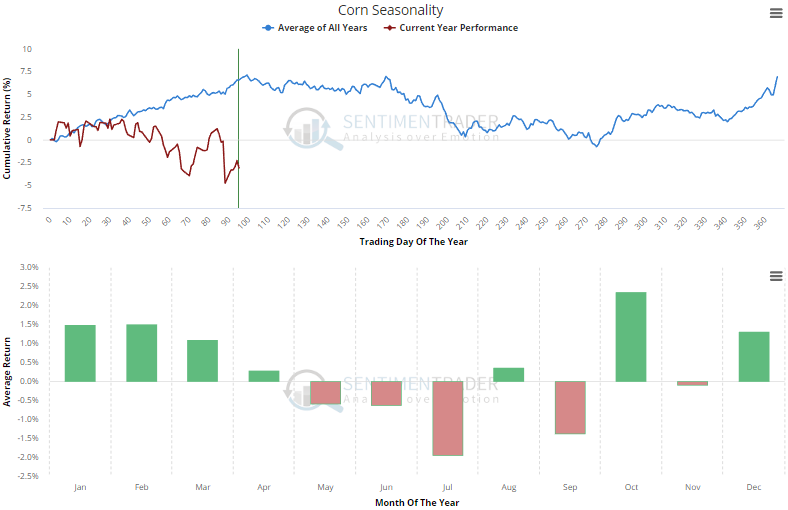

On the downside, corn traditionally peaks right about now, but the seasonal pattern has not held up much at all in 2019, with a highly inverse correlation to its usual path over the past 30 years.

Earnings

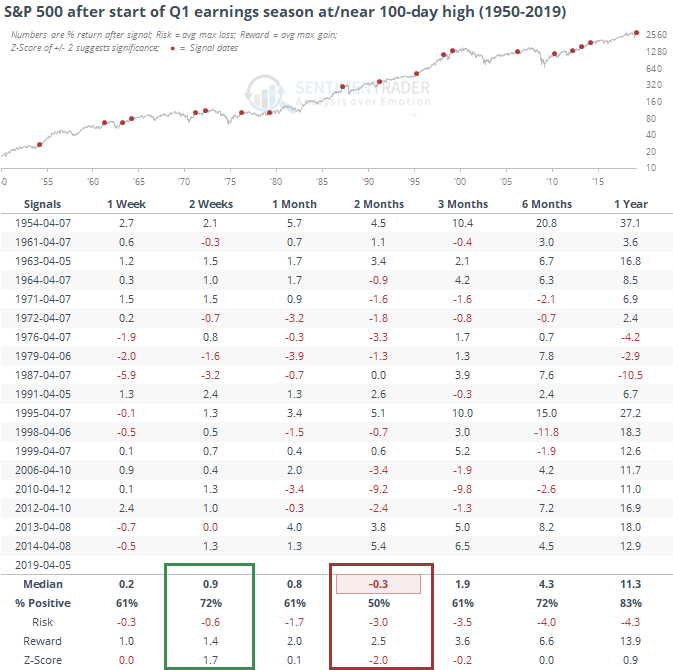

U.S. companies will start reporting their Q1 results in earnest this week. A concern is always that investors have already baked in potential better-than-expected results, since stocks are trading at near 100-day highs, even as earnings may take a hit from year-ago levels.

Generally, when the S&P 500 has been hitting 100-day highs in the week leading up to Q1 earnings, it has been good for the first couple weeks of reporting season, but the next two months showed more risk than reward.

Options Traders

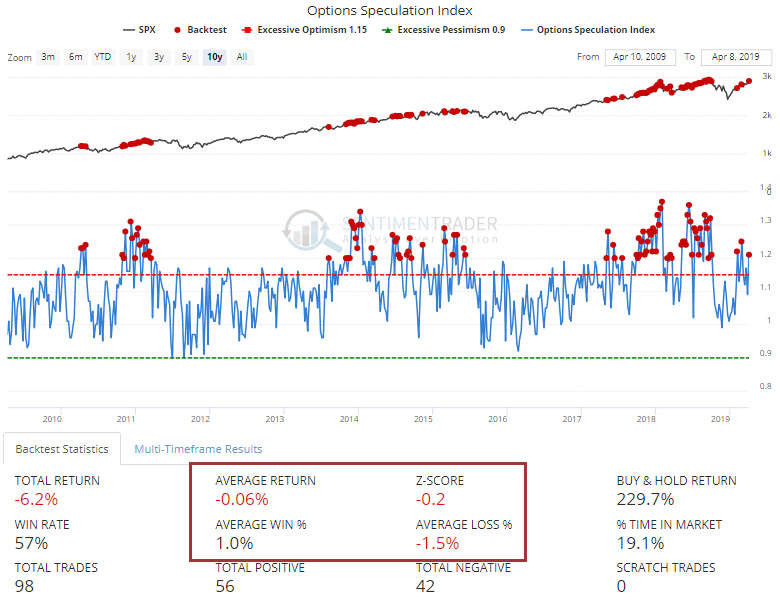

There was a modest rebound in speculative activity from options traders last week. The Options Speculation Index rose to 1.2, meaning there were 20% more bullish options strategies than bearish ones. While not a rally-killer by any means, the next-week returns in the S&P 500 were subpar after other similarly high readings.

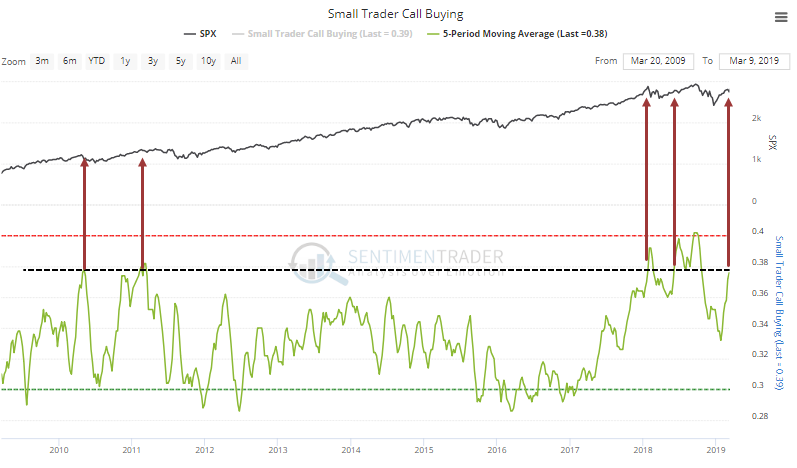

It's also a little troubling that over the past 5 weeks, the smallest of options traders have spent 38% of their volume on buying speculative call options.

Knee-Jerk Contrarianism

This week's Barron's cover story is generating a lot of heat among bears, hoping that *this time* it's going to nail the top. Some magazine covers are useful for that kind of thing. Barron's is not (see the Saturday blog post for a little more detail).

The chart below shows every egregiously bullish cover story in Barron's since the financial crisis. None of them were contrary indicators.