Monday Midday Color - Gapped, Slapped, And Beaned

Here's what's piquing my interest so far on this trying-to-recover day.

Gappy

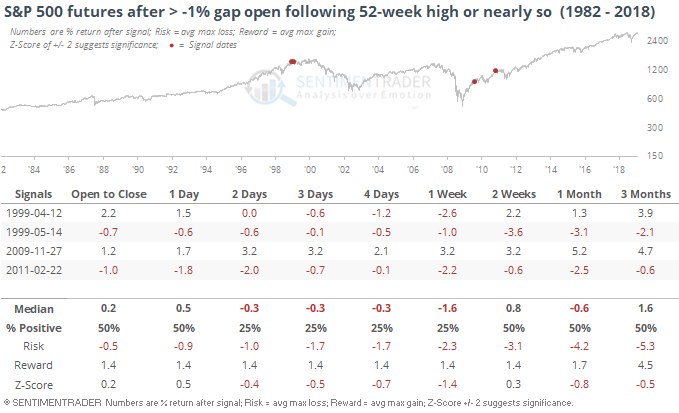

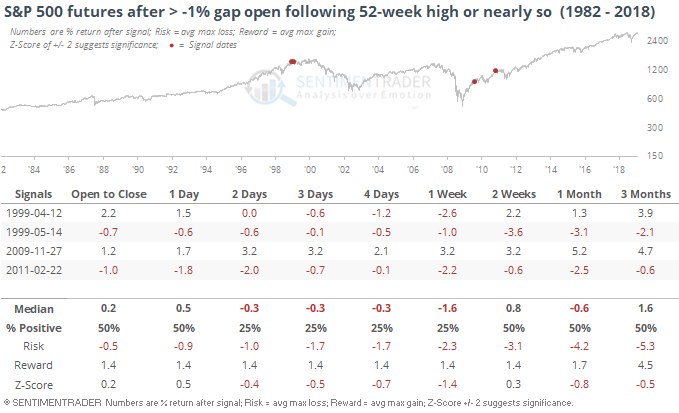

Stocks suffered a rough open, which is not something we often see after being at or very near a 52-week high at the close of the previous session. Using the S&P 500 futures over the past 33 years, it has happened only four other times.

But 1% during a low-volatility environment is more shocking than a 1% move at other times, so if we look for the largest gap down open in at least 3 months, the conclusion is still mostly the same.

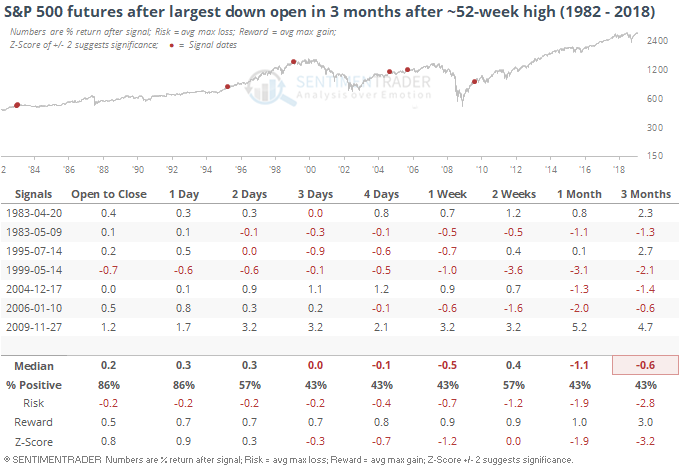

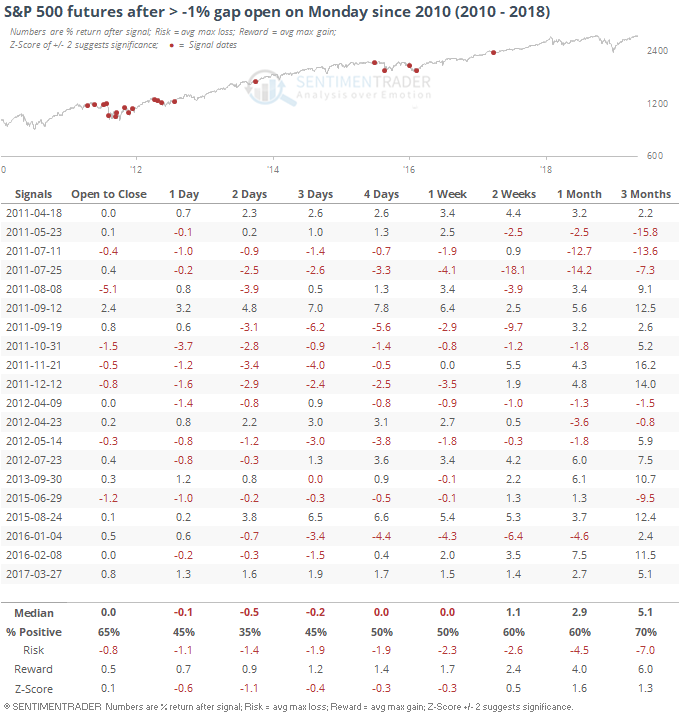

Regardless of how close the S&P was to a 52-week high, here's every large gap down on a Monday morning since the initial recovery from the financial crisis. Pretty much the same story. Tendency to rebound right away, chop around for the next week or so, then rebound over the next couple of weeks.

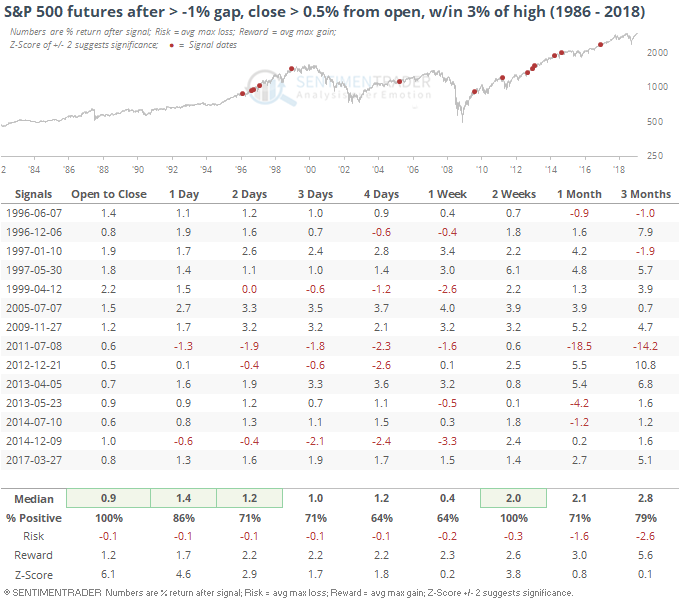

How about if we look for times when the S&P was relatively close to a 52-week high, gapped down 1% or more at the open, then recovered at least 0.5% during the day, as it's on track to do?

Note that these are returns from the *opening* price, so the open-to-close is always going to be positive. It's worth noting, at least, that returns were positive every time two weeks later.

Bully Bully

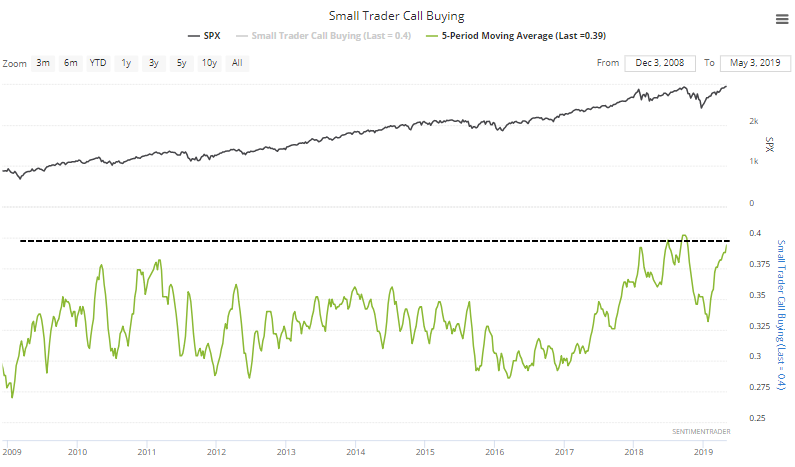

The smallest of options traders picked up the pace of their speculative call buying again last week. Over the past 5 weeks, they've now spent an average of 39% of their volume buying call options to open. Since the financial crisis, only the summer and fall of 2018 can match this pace of leveraged enthusiasm.

Slapped

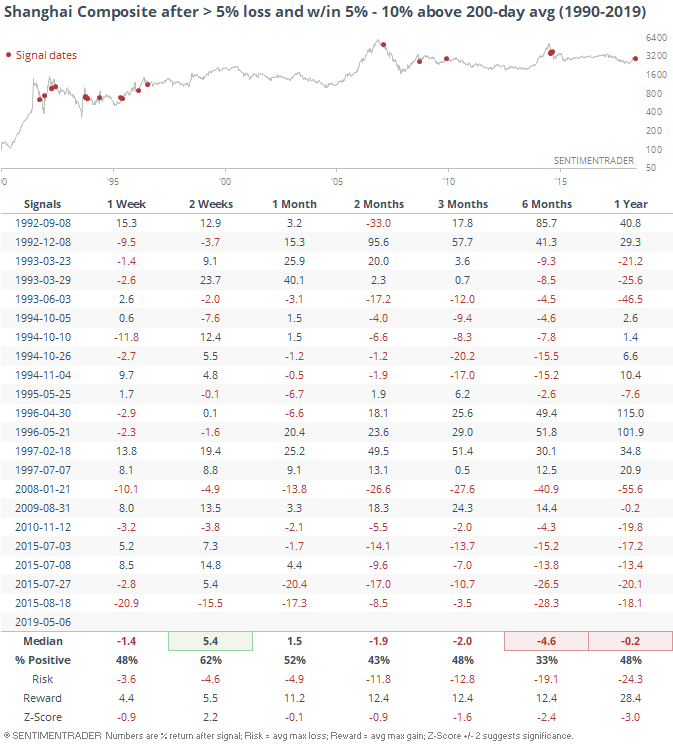

Renewed trade worries was a big negative for Chinese shares, which traded again for the first time in days. We saw some signs late in April that the kind of breadth deterioration going on in those shares has typically led to more weakness but few were likely expecting the left-field Tweet by the President.

This is the first time in years that the Shanghai lost more than 5% while trading a moderate amount above its long-term average.

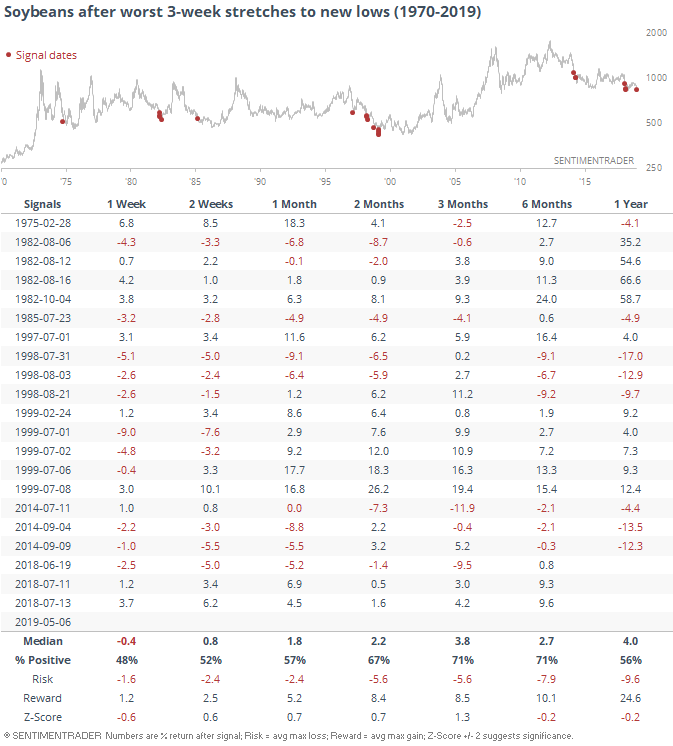

Beaned

Grains got hit yet again on Monday due to the trade tantrums. They cannot catch a break. Hedgers are about the most long they've ever been, typically good for multi-month rebounds, but there is no sign of that yet.

Soybean futures have rallied only 3 days out of the past 3 weeks, lost more than 1.5% on Monday and closed at a multi-year low. That has usually been among the last signs of a washout, but led to some pretty bad future losses in '98 and '14.