Monday Midday Color

Here's what's piquing my interest so far today.

Reversal

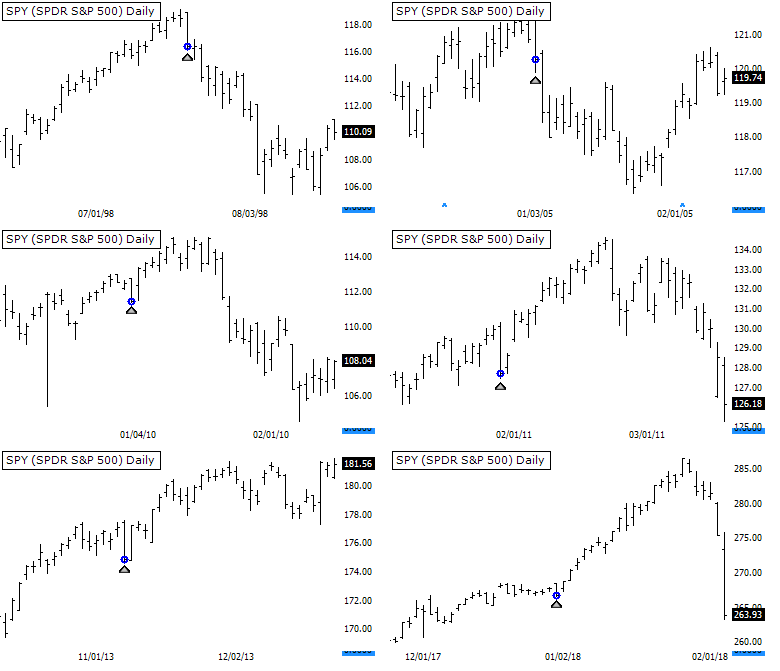

Pretty nasty-looking outside reversal in indexes and funds like SPY today. But...be careful. These have a terrible habit of not working like chartists insist they should. Following is every time SPY gapped up above the highest close in the past 50 days and then reversed to close at the lowest point in at least the past week. Two of them, in 1998 and 2005, did lead to more sustained downside. But the four since then preceded immediate upside reversals.

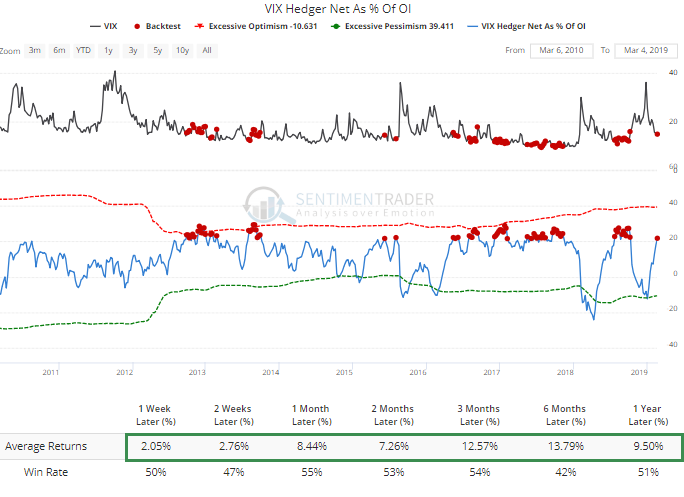

Volatility

Hedgers have been stepping up their purchases of VIX futures. As of mid-February, they were holding more than 20% of the open interest in those contracts net long. When hedgers held this much of the open interest, the VIX's tendency to rise was middling, but its returns were skewed to the upside. That's not all that surprising given volatility's behavior, but is a minor suggestion that the rapid drop in the VIX may start to slow.

Buying Exhaustion

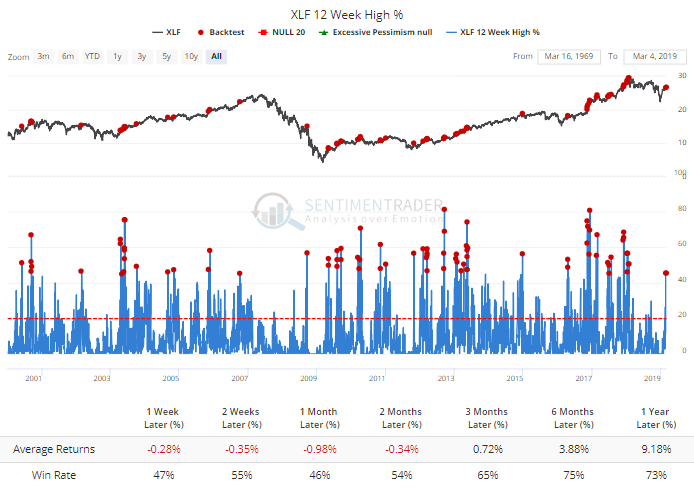

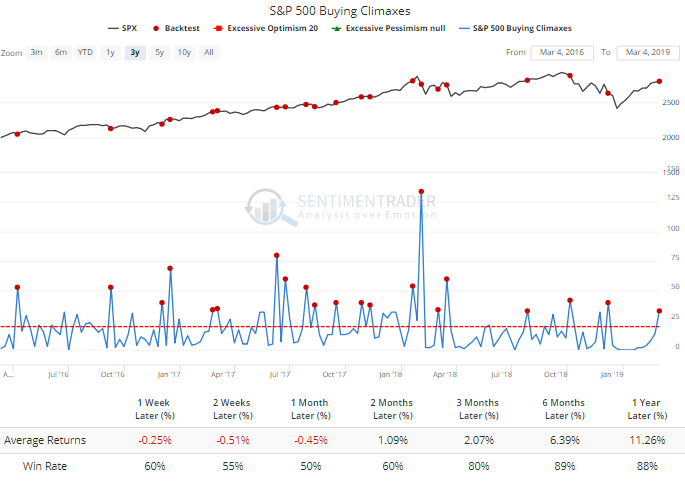

After the record-setting number of selling climaxes in December, we haven't seen any weeks with a large number of either buying or selling climaxes. Last week, buying climaxes finally increased to the highest level since early December. Out of the 505 stocks in the S&P 500, 33 of them set a 52-wee high during the week, then reversed to close below the prior week's close.

This is not at all extreme, and buying climaxes are less reliable than selling climaxes. The only caution is that over the past few years, buying climaxes this numerous led to below-average returns over the shorter-term.

Bullish Traders

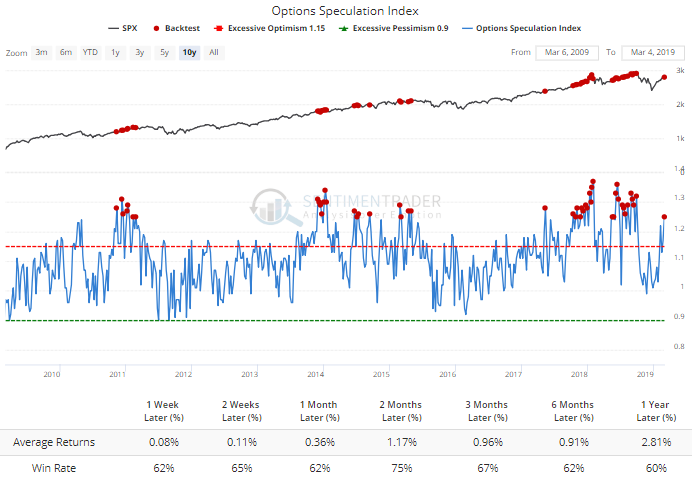

Options traders have become significantly more aggressive in recent weeks. Last week, the volume of bullish options strategies was 25% heavier than bearish ones, the most since last September. Again, this has not led to particularly negative returns in stocks, but those returns were definitely "meh." Even three months later, the S&P's average return was less than 1%, during one of the most impressive bull markets in history.

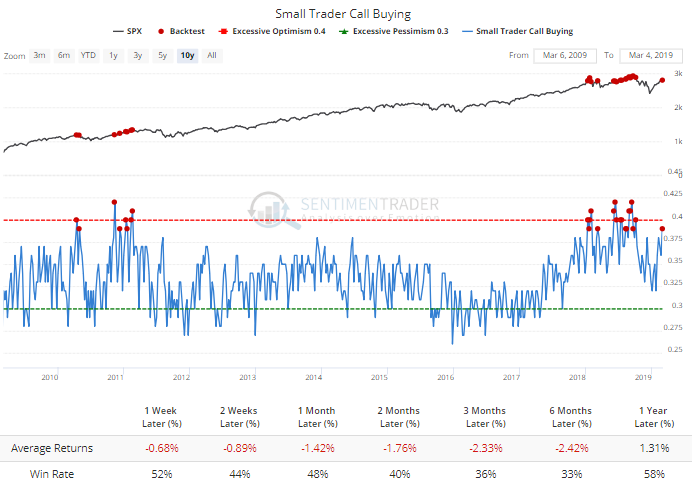

A large part of the jump in speculative options activity was due to the smallest of traders. Those folks spent 39% of their volume on purchasing call options. While their put activity is still higher than normal, when they've focused so much of their activity on calls, stocks have struggled.

Breadth Extremes

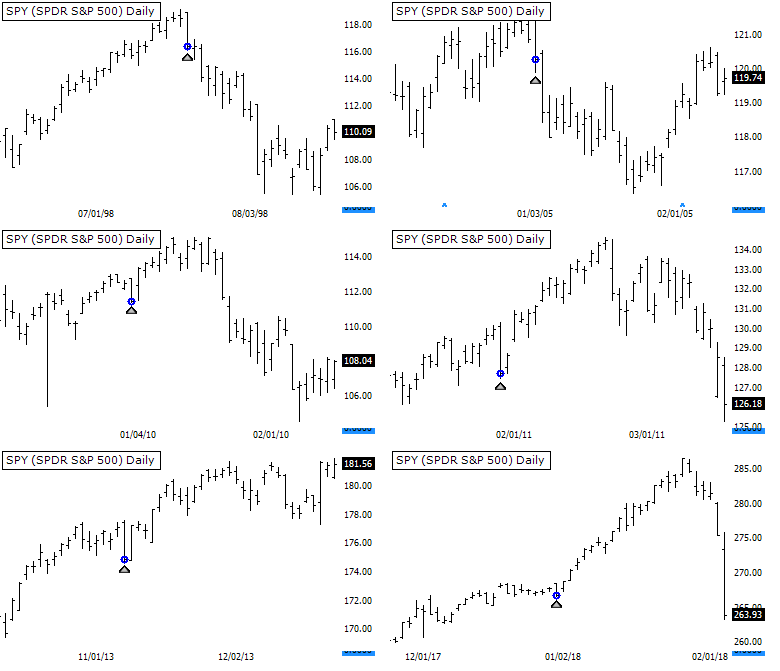

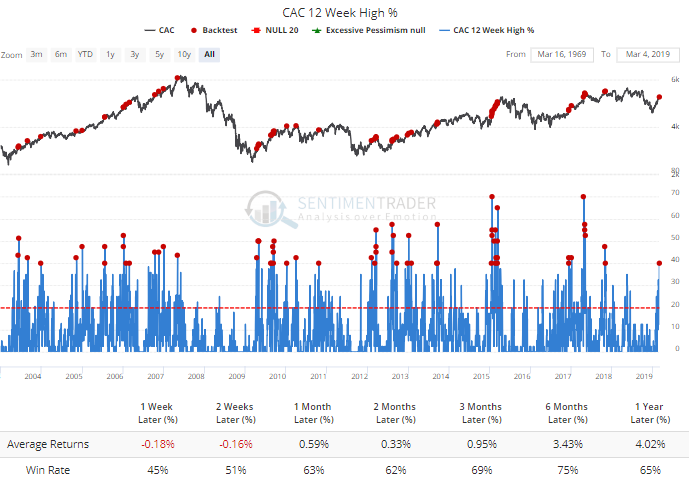

The moves on Friday triggered a couple more extremes in sector breadth. Most notably, a jump in French stocks hitting multi-month highs. This has led to modest under-performance short-term.

Same for financials.