Monday Midday Color - Smart Money, Biotech, Options Optimism

Here's what's piquing my interest so far on a quiet Easter Monday session.

Smart Money

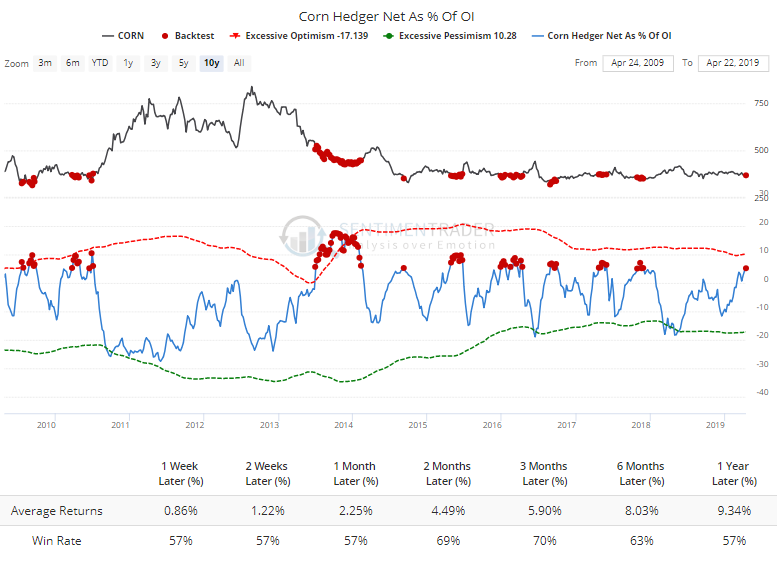

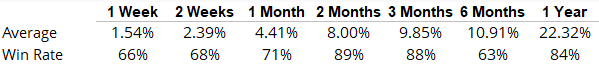

Last week, hedgers continued to build up their positions in some of the agricultural contracts. In corn, they went net long by more than 94,000 contracts, the most since 2017. That's more than 5% of open interest. According to the Backtest Engine, over the past decade - which has been dominated by a severe downtrend - future returns were mostly positive when they were this long.

Most of the negative returns were due to 2013. If we eliminate only that year from the results, they improve markedly.

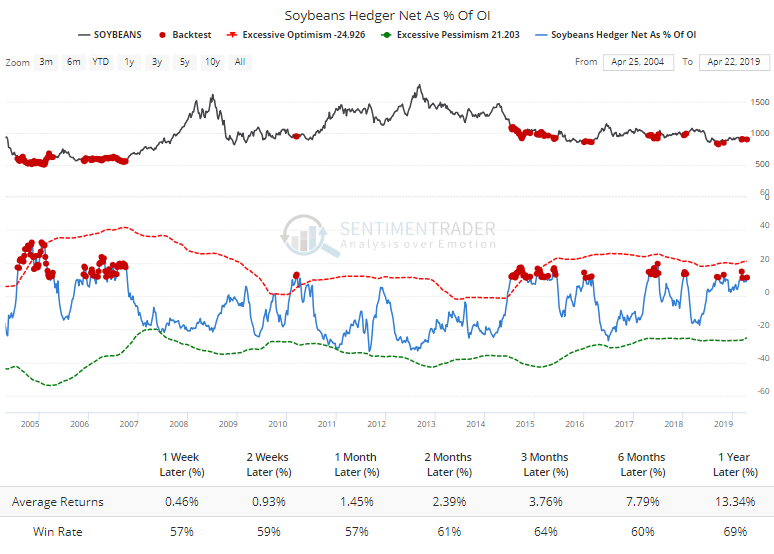

They're also holding more than 11% of soybean contracts net long, which has led to mostly positive returns as well.

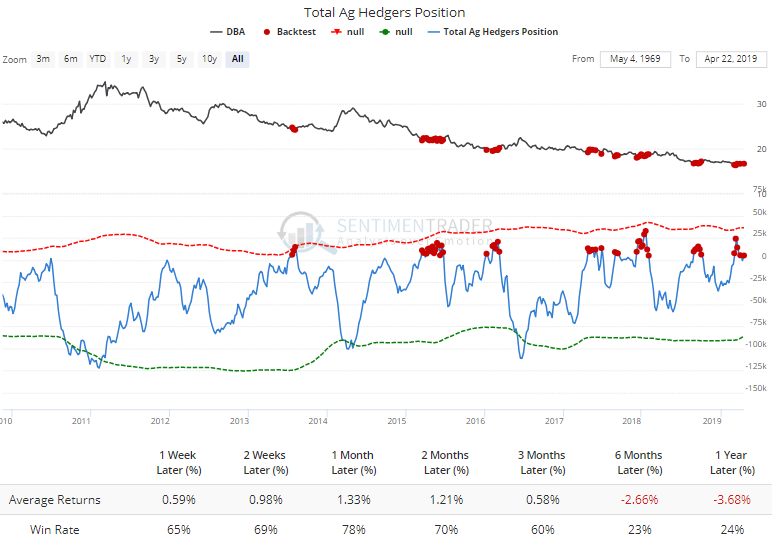

Hedgers are holding more than 5,000 contracts net long in the commodities that make up the DBA exchange-traded fund. "One of these days" the fund is going to form a major bottom, but trying to bet on it has been akin to slamming one's knee with a hammer. On a shorter-term basis, even a horrid trend like that for DBA has been interrupted when hedgers were this long in recent years.

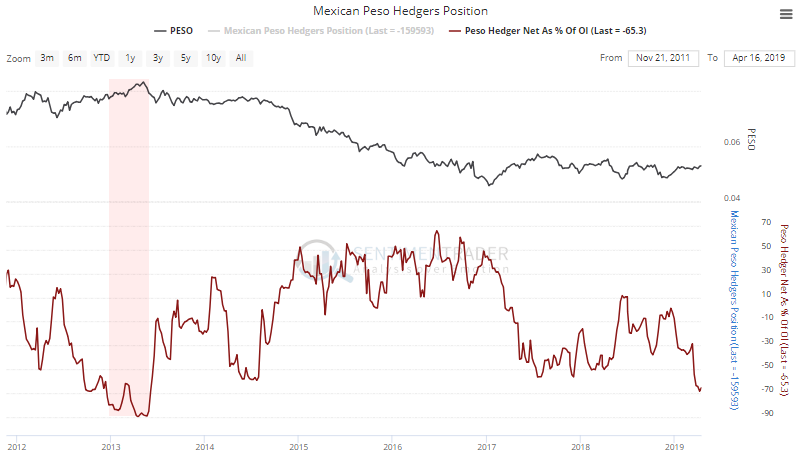

They're not so hot on the peso, where they're short more than 65% of the open interest, the most since 2013.

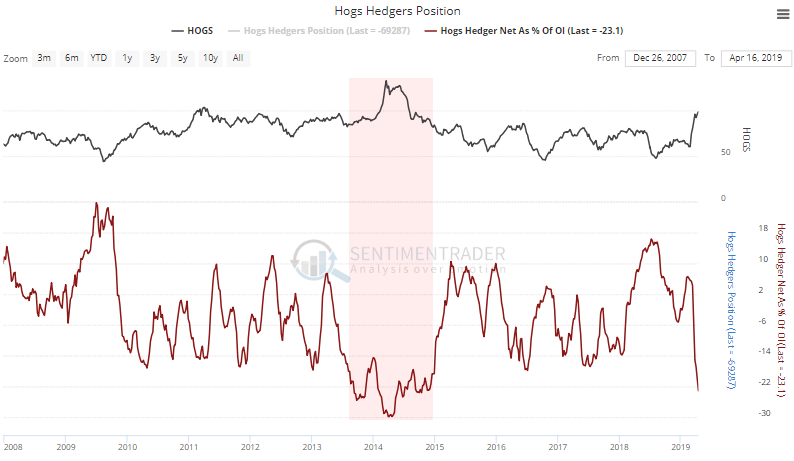

And hogs, where they've been selling aggressively in recent weeks.

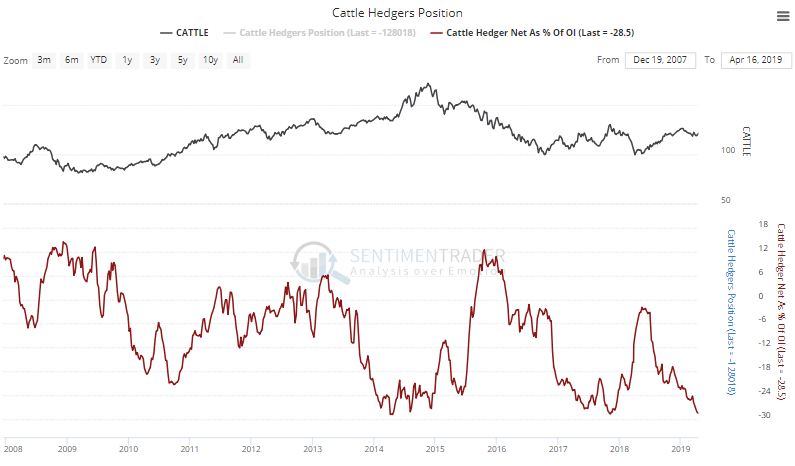

Same with cattle, but the market doesn't respond as well to these extremes in meats as it does in other contracts, especially agricultural ones like the grains.

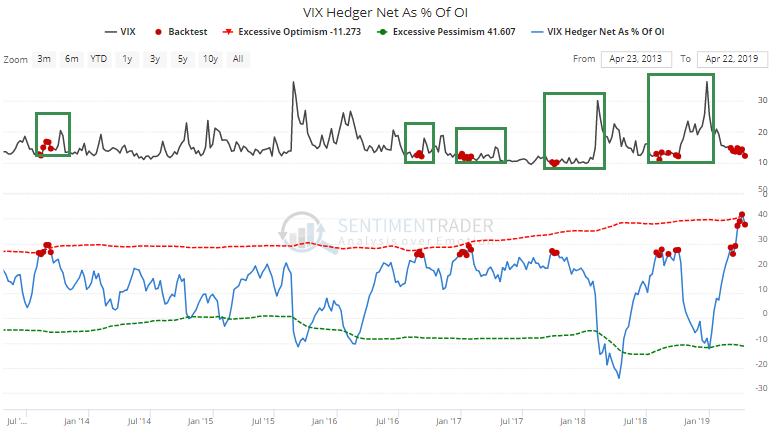

In equities, they've continued to hold a near-record position in VIX futures, receding a bit from 40% of the open interest. In recent years, that has preceded a "volatility event."

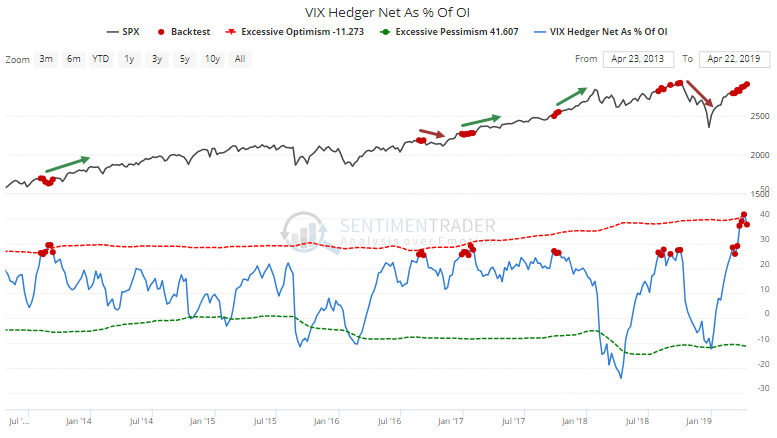

But that hasn't necessarily (or even consistently) been a bad thing for stocks.

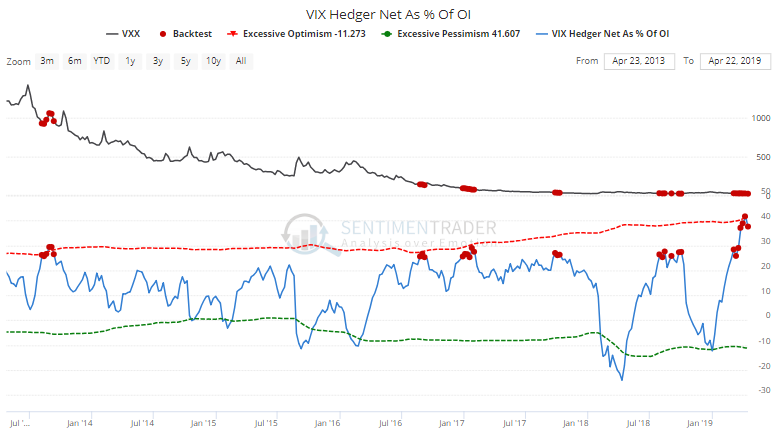

And trying to trade it by using a disaster like VXX (or VXXB now) has been futile.

Biotech Blues

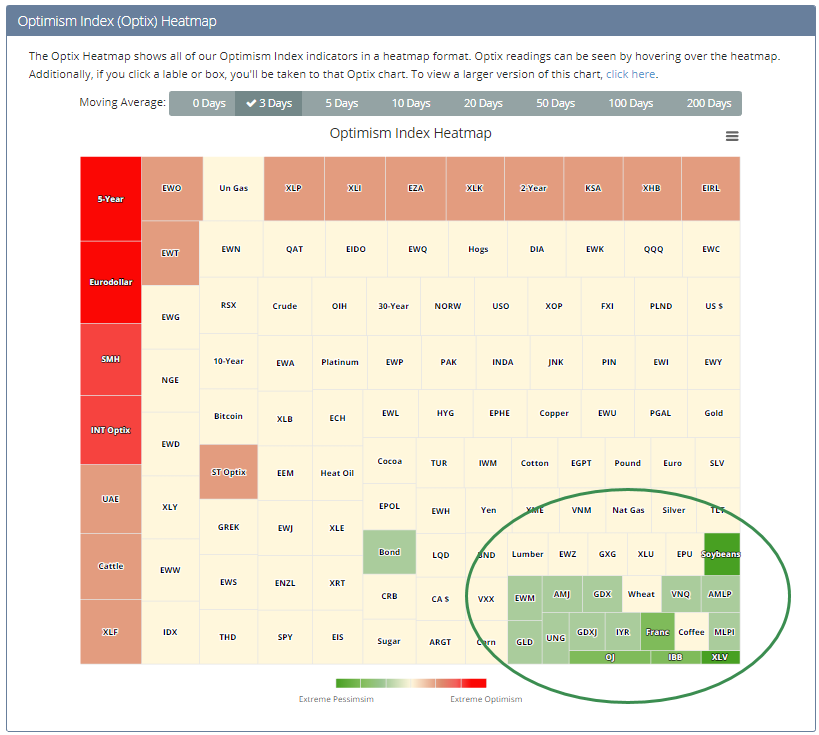

The Heatmap shows where investors are currently the most/least optimistic. If we look over the past few sessions, it's not surprise that IBB and XLV rank among the most pessimistic.

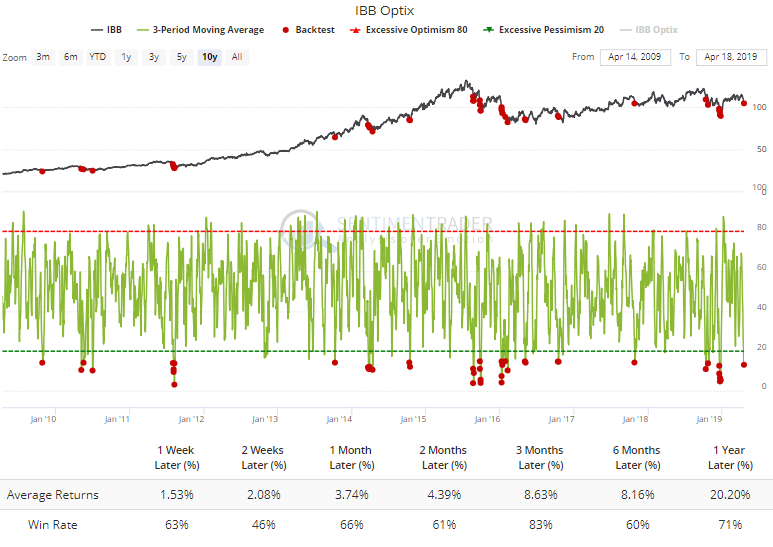

Biotech got hit along with the broader health care sector last week. The 3-day average Optimism Index for the IBB fund is now below 15. That has mostly led to rebounds over the next few months.

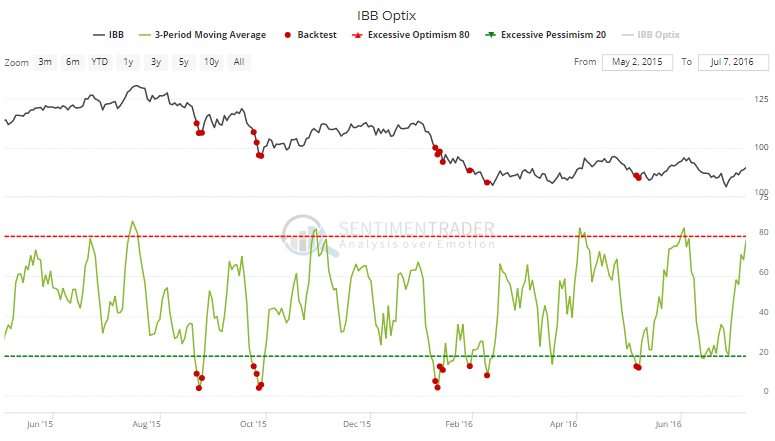

The only real exception was in 2015-16 when the fund went into mini-meltdown mode for a few more days.

Options Optimism

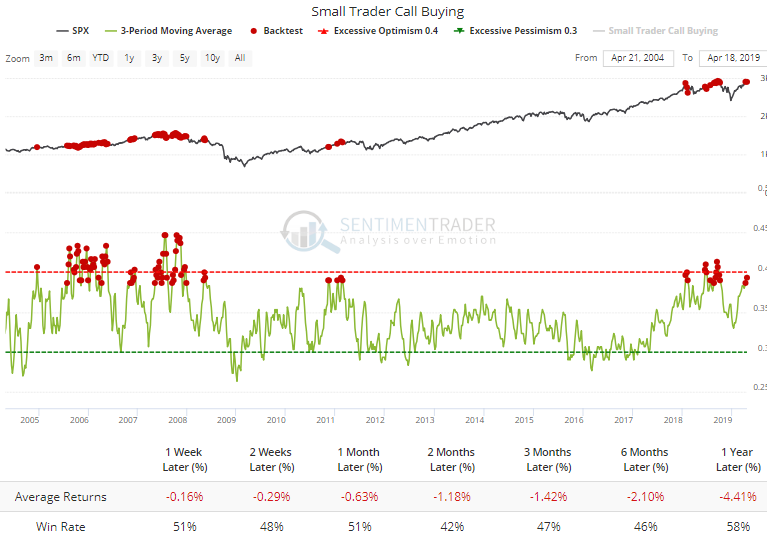

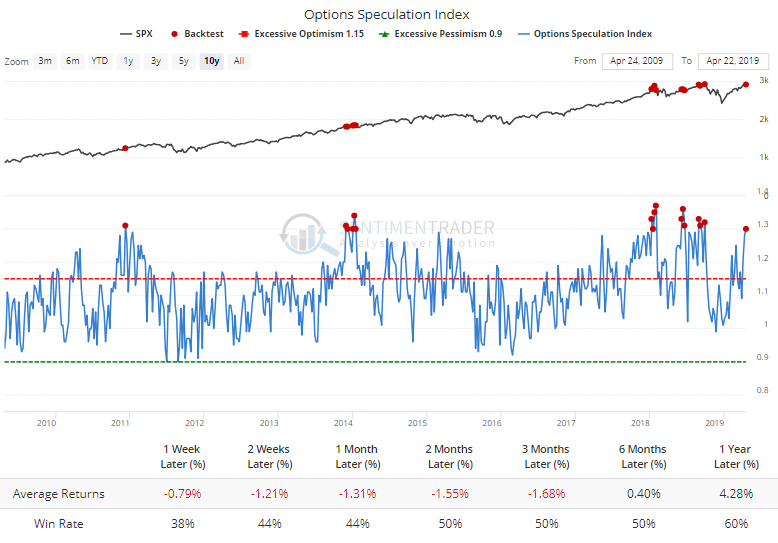

The smallest of options traders continue to press their bets. Over the past three weeks, they've spent an average of 39% of their volume on buying speculation call options across all U.S. exchanges. That hasn't been a great recipe for high returns in stocks going forward.

It's not just the little guys, either. Among all options trades, there was 30% more volume in bullish strategies than bearish ones. Not a great sign for stocks.

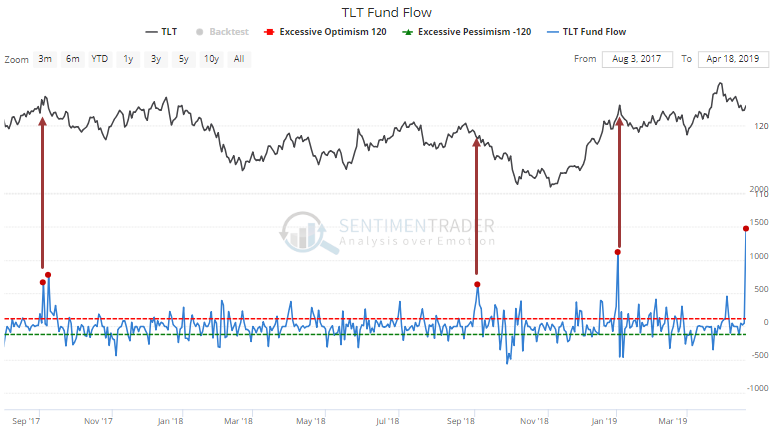

Bond Flows

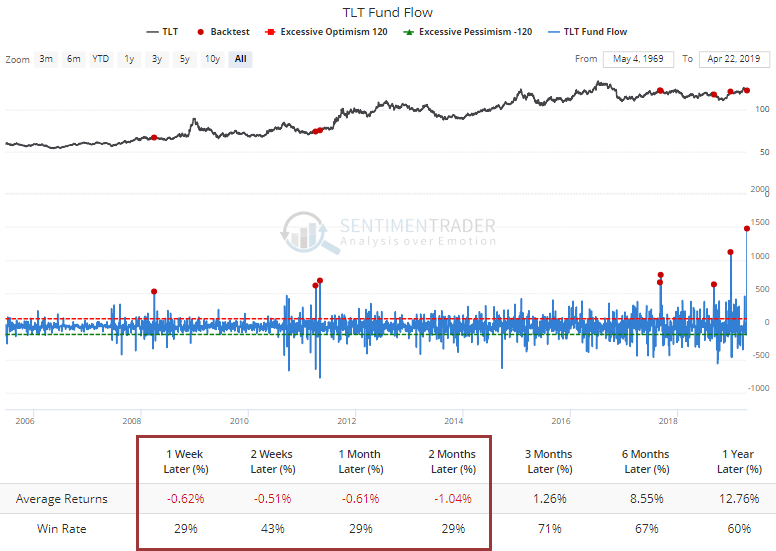

Investors poured more than $1.4 billion into the TLT bond fund to end last week. Fund flows are an iffy sentiment measure, but for this fund anyway, big inflows (> $500 mln) have led to some weakness.

The last few times marked peaks.