Monday Color - Cycle Peak, De-Risking, Silver, Breadth Extremes

Here's what's piquing my interest on another day failing to hold a rally.

Mixed Messages

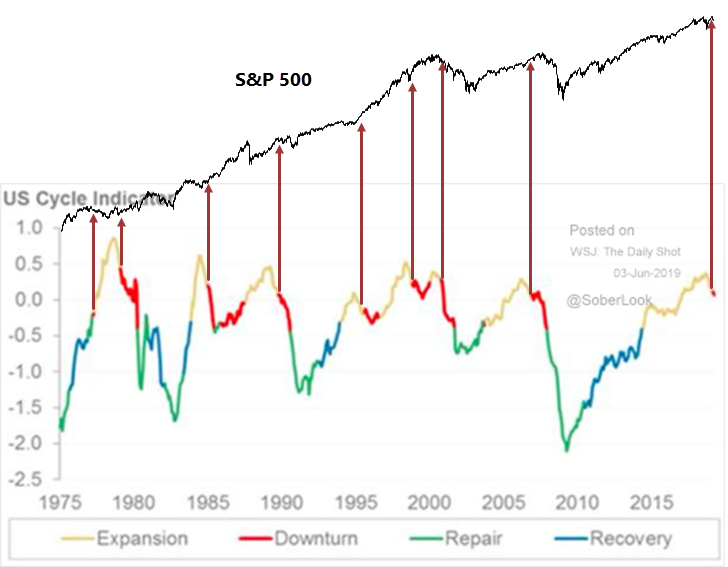

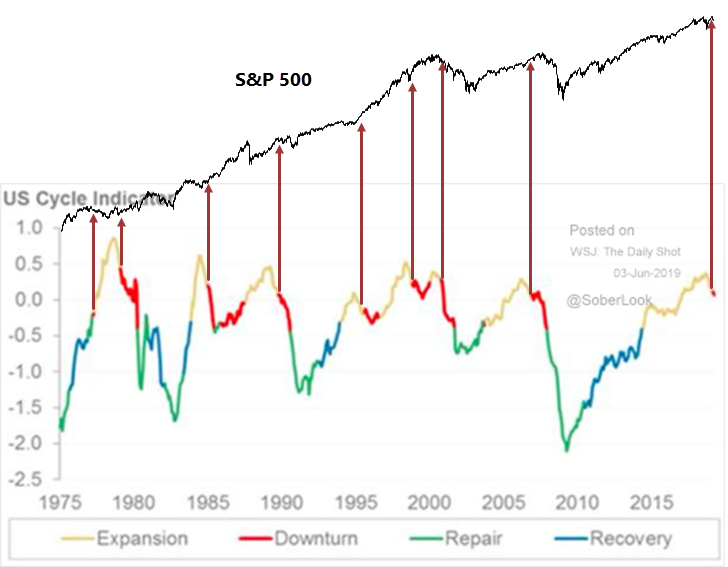

Depending on the data set, or even on the day, the fundamental picture for markets looks just as muddled as the technical one. One of the biggest worries is that the economy may be tipping into recession, based on part on a potential trade war. That's helping some long-term data roll over, showing a higher risk that we've reached a peak for the business cycle.

Morgan Stanley, via the WSJ notes that the cycle for the U.S. has already tipped and we're currently in the "downtrend" phase, which typically lasts for roughly a year.

When the cycle turned in 2000 and 2007, upside for stocks was limited and downside was massive. But the economy does not equal the stock market, and previous turns did not mark good selling points.

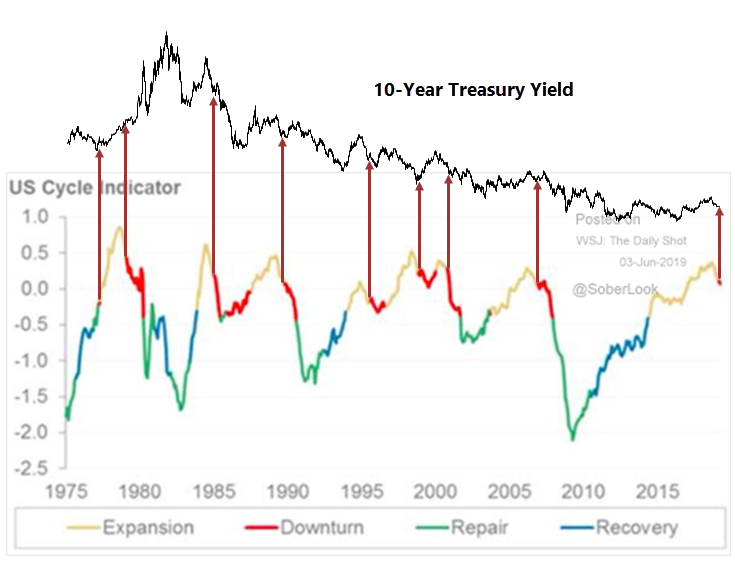

The impact on bond yields was similarly mixed, but generally yields rose in the months following a turn in the cycle.

De-Risking

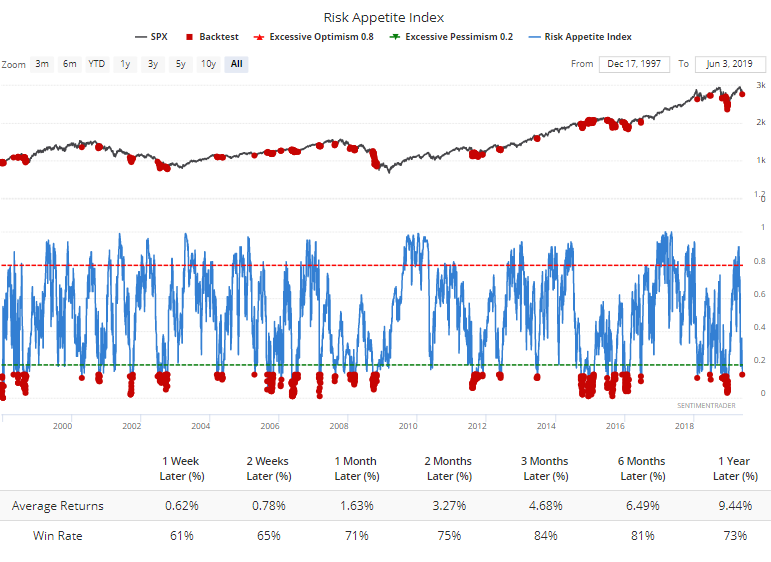

Signs of anxiety are getting common, which we saw in the reports and notes last week. More signs have popped up including a big drop in Risk Appetite.

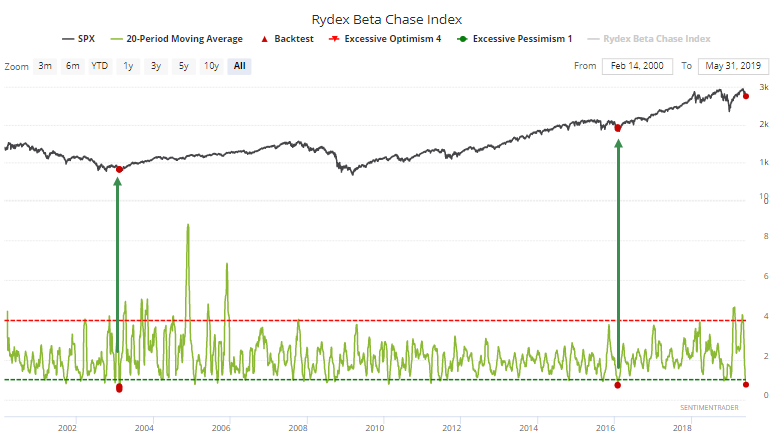

There has been a near-record level of Rydex mutual fund traders fleeing into "safe" funds versus "risky" ones over the past month.

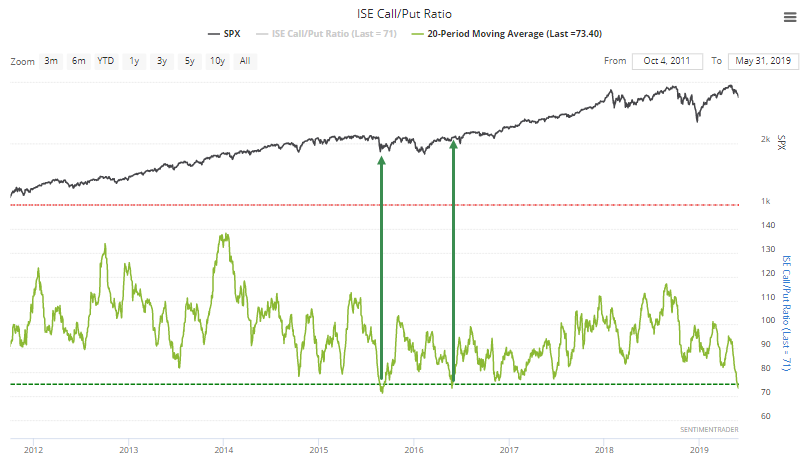

And a near-record lack of call buying on the ISE exchange.

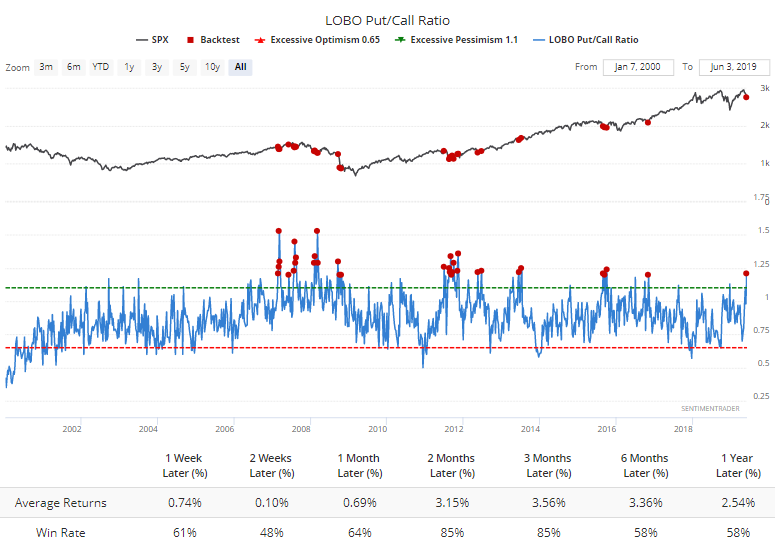

This is helping push the skew of put vs call options. This is kind of a wonky indicator and we would definitely not rely heavily on it.

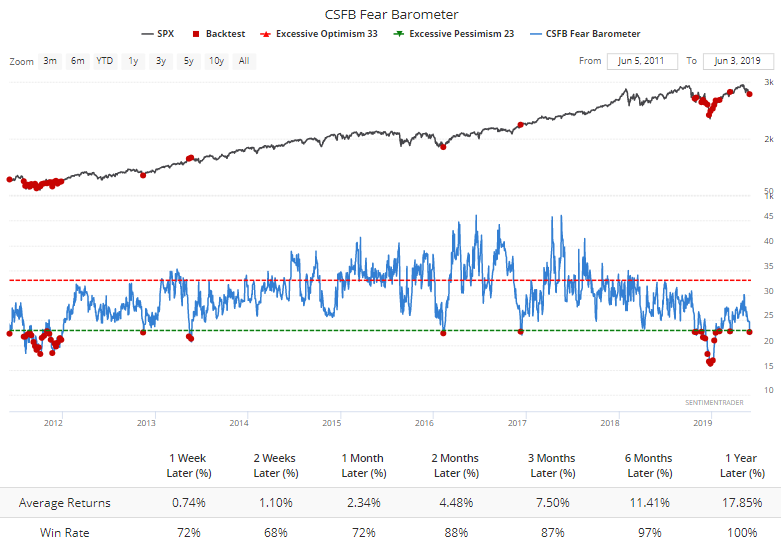

Even the largest of traders are scrambling to buy protective put options.

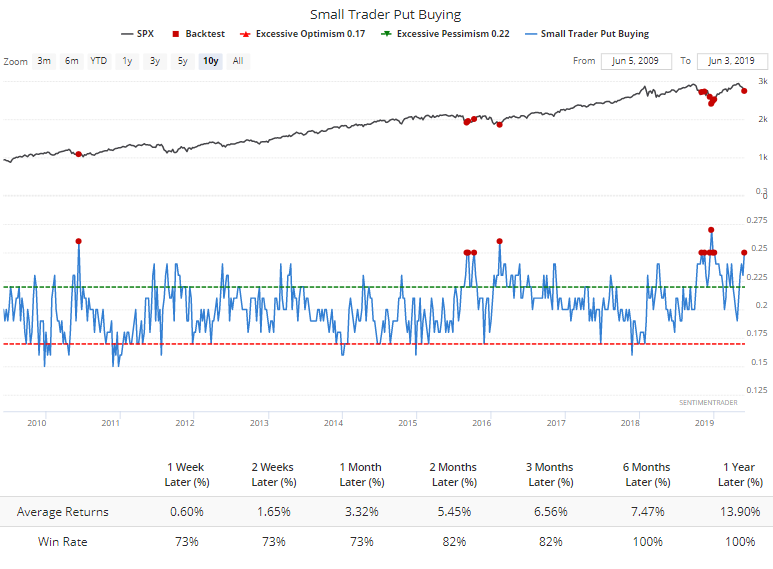

Small traders started buying a bunch of puts, too.

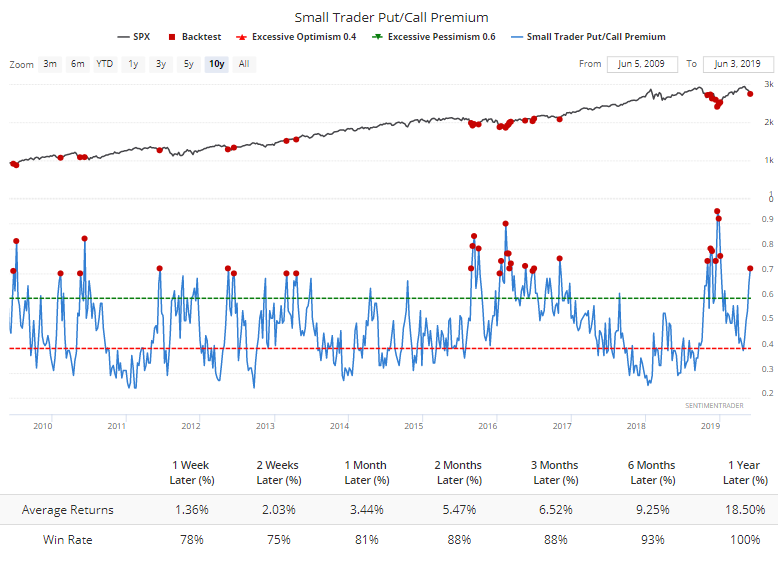

And they're paying up for the privilege.

Sinking Silver

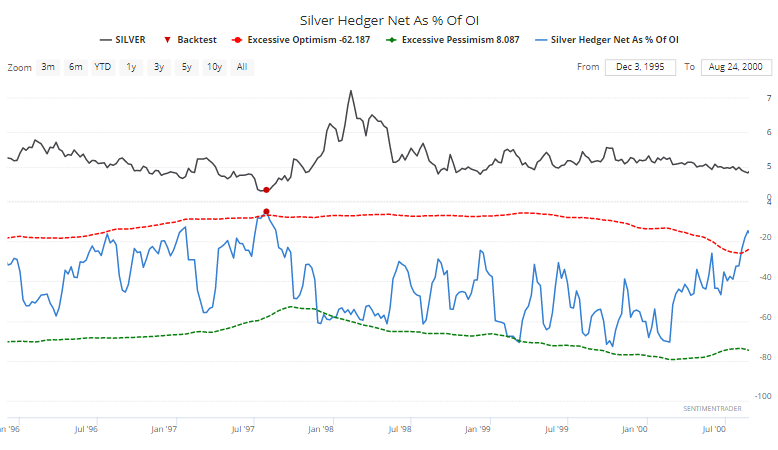

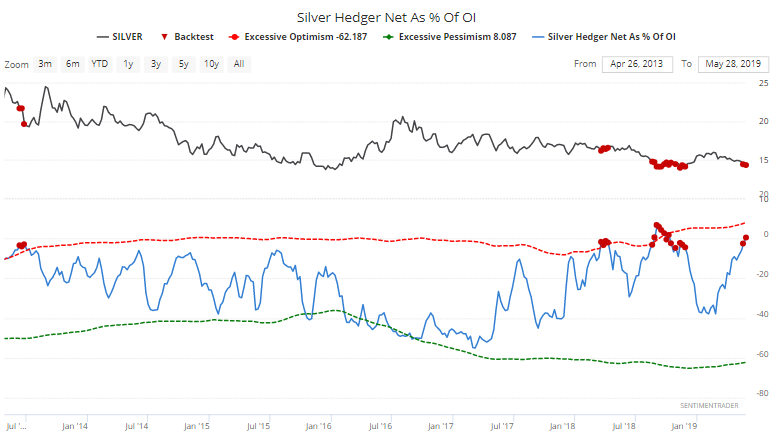

On Friday, we saw that "smart money" hedgers were net long silver futures for one of the few times in history. They have a good record in that contract.

This is one of the only weeks in the history of the contract when hedgers flipped to a net long position. Other times they held less than 5% of open interest net short tended to lead to rallies, and even those times were rare. It happened in 1997, and since then only recently.

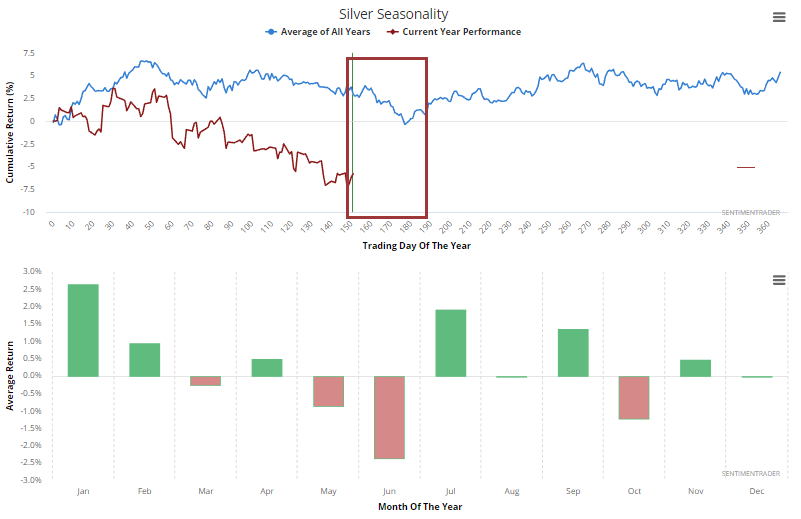

Maybe speculators are betting that silver's seasonally weak June is going to reassert itself. This month is when the metal has traditionally bottomed.

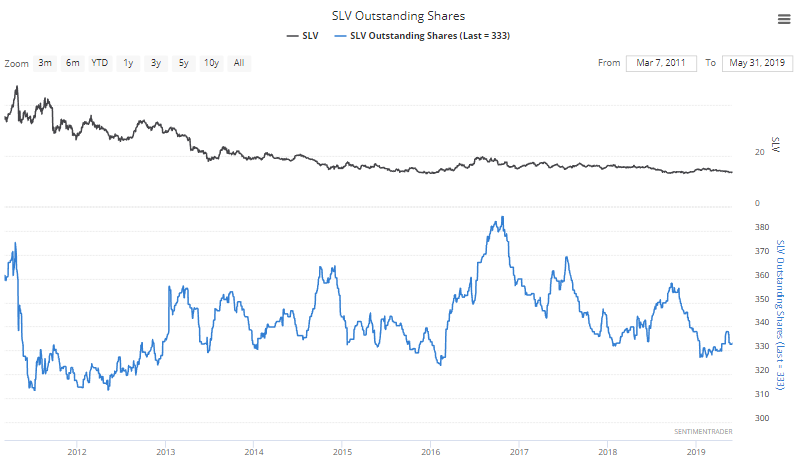

Along with traders in the futures, ETF traders aren't sticking around. Shares in SLV have dropped to one of the lowest levels since the bear market began in 2011.

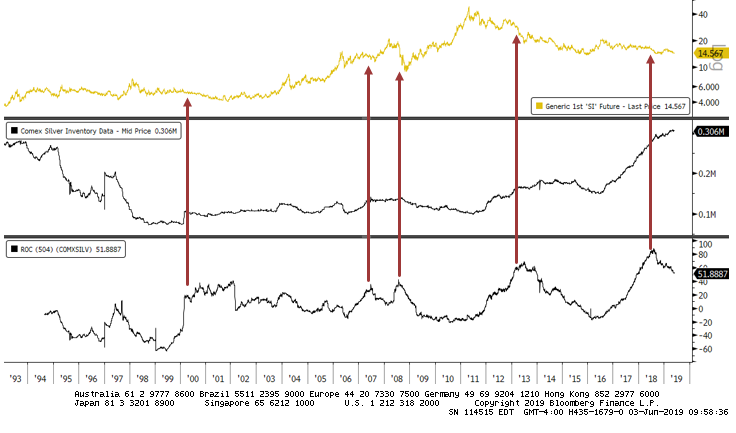

The WSJ notes there has been a big increase in silver held in inventory, likely to push prices down even further. Inventories nearly doubled over the past two years. Below is a two-year rate of change in silver held at the Comex. Hard to make much of this.

Breadth Review

The slide to end last week triggered a number of extremes across indexes and sectors.

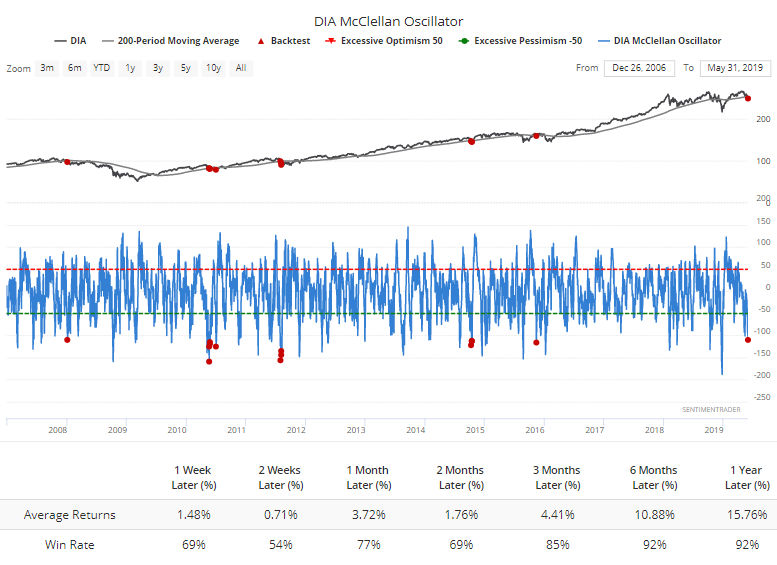

For the Dow Industrials, the McClellan Oscillator hit -110 while the index itself was trading below an upward-sloping 200-day average. Similar setups show times when short-term selling pressure was severe and the index was threatening to lose its long-term uptrend. Typically didn't happen, though.

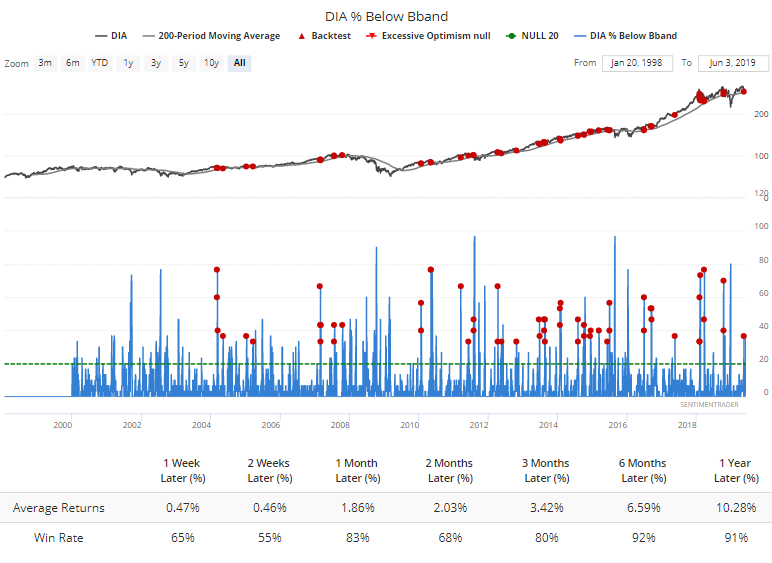

And more than a third have fallen below their lower volatility bands.

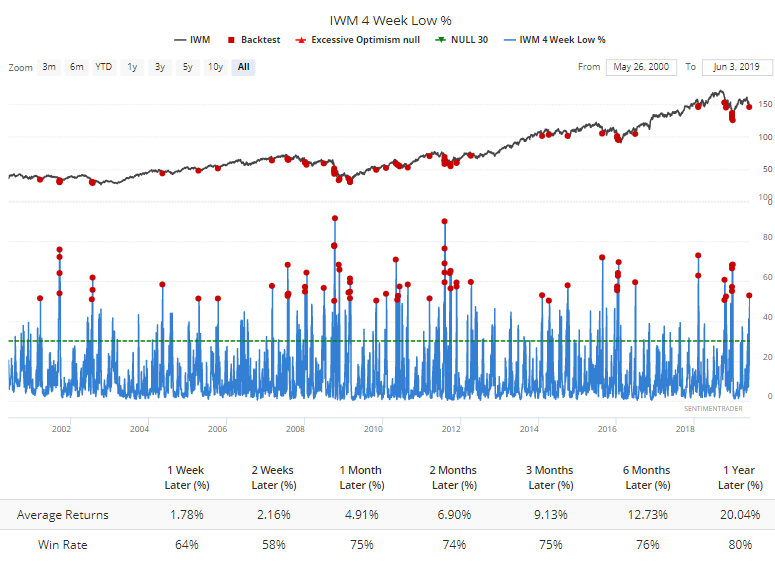

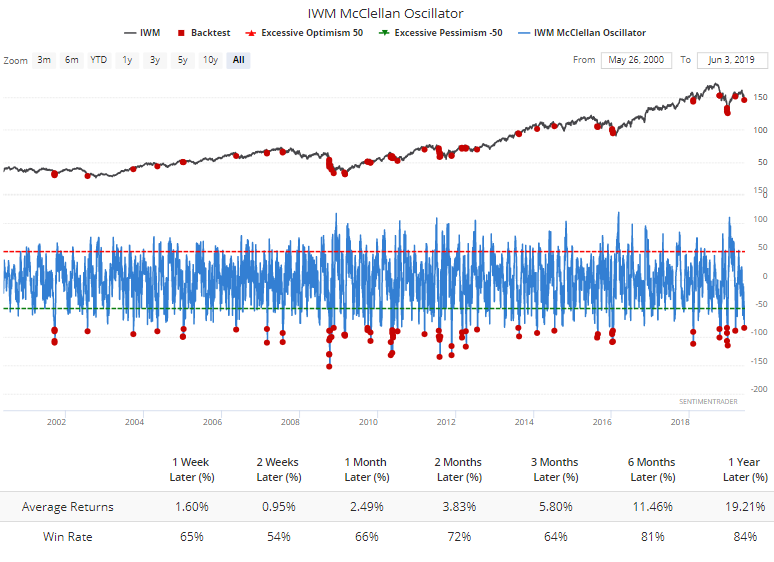

In small caps, some of the internal breadth extremes are "getting there" but aren't quite to levels that suggest overwhelming odds. More than half of stocks in the Russell 2000 have now dropped to one-month lows.

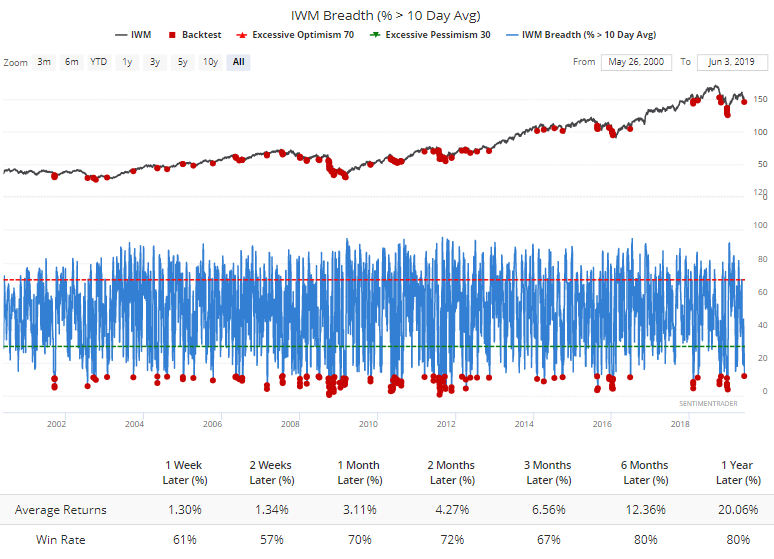

Fewer than 12% of them have held above their short-term moving averages.

That has pushed the Oscillator to a very low level.

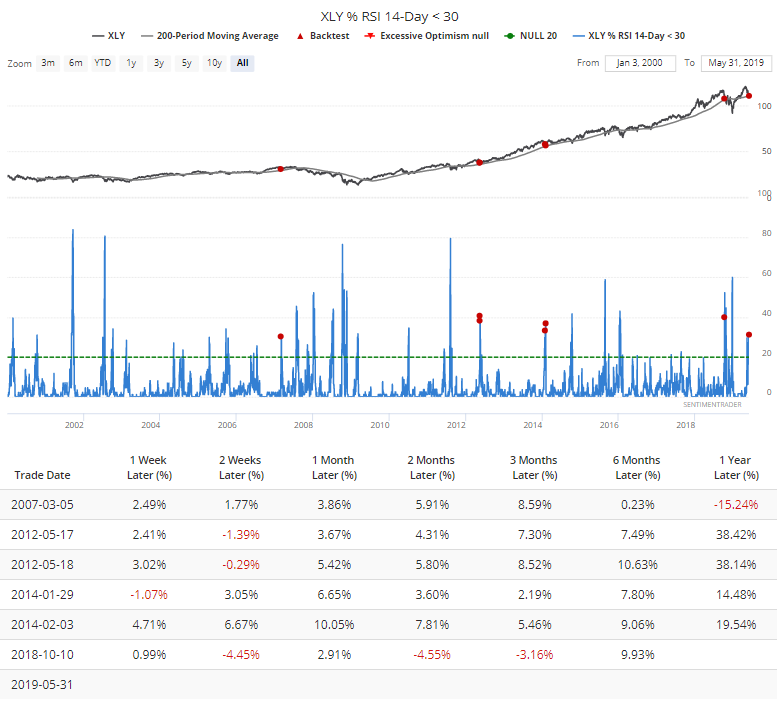

Consumer discretionary stocks got hit hard, and more than 30% of them have reached oversold levels, while XLY is still holding above its 200-day averages. That's only triggered a few times before, and XLY managed to rebound each time.

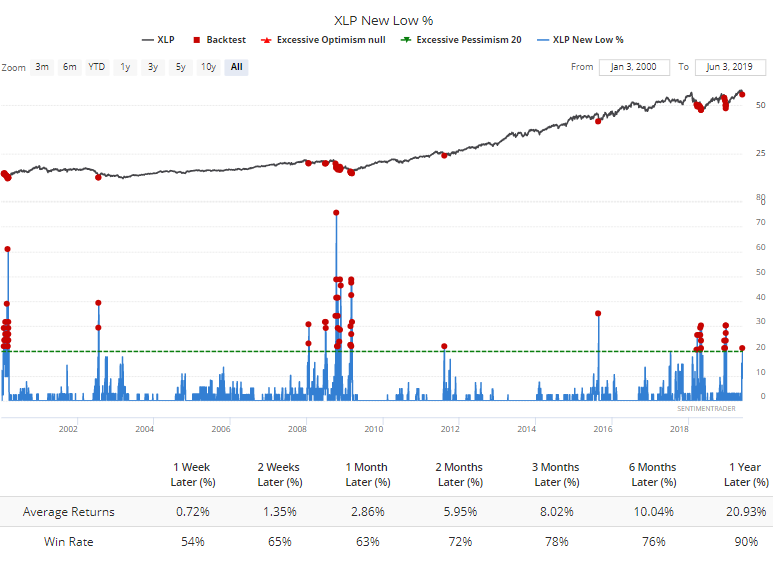

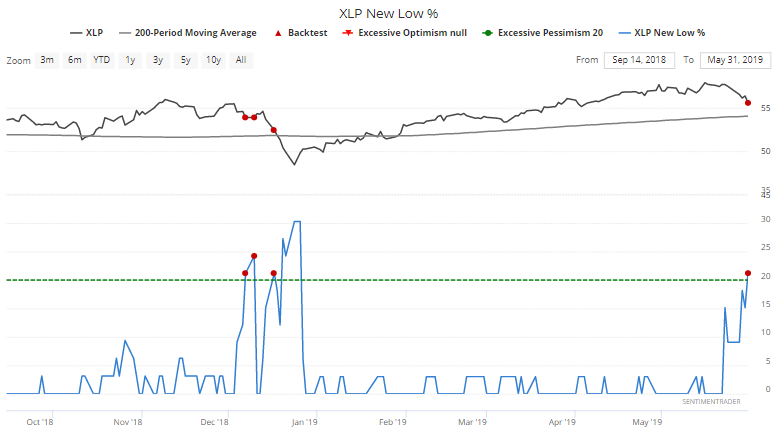

While rocky markets tend to see investors gravitate toward "safe" stocks, consumer staples have also been nailed. More than 20% of them just hit a 52-week low.

While it has gotten much more extreme, with 30-50% of them hitting a new low at the same time, this is still a big figure, and the sector has tended to rally afterward. It's extremely unusual to see this kind of widespread losses when XLP is still above its 200-day average - it's only happened once before, last December.

That was definitely not a good time to assume the sector was about to bounce, so we're getting a mixed message here.

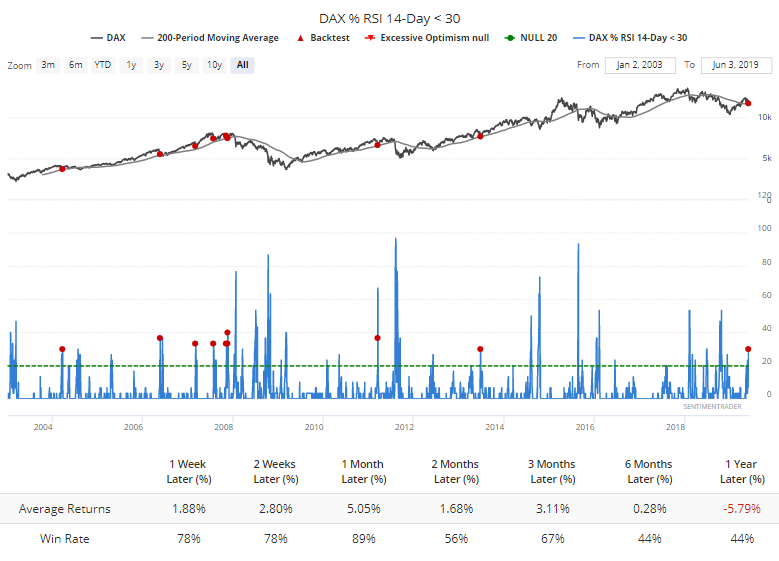

Overseas, 30% of members in the German DAX have hit an oversold reading, while the index itself holds above its long-term average. That has been a decent indication that a bounce was forthcoming.