Monday Color - Easy Conditions, Canadian Surprises, Gold Rush, Sector Breadth

Here's what's piquing my interest on a slow start to the week. For stocks, anyway. Gold is going gangbusters.

Easy Does It

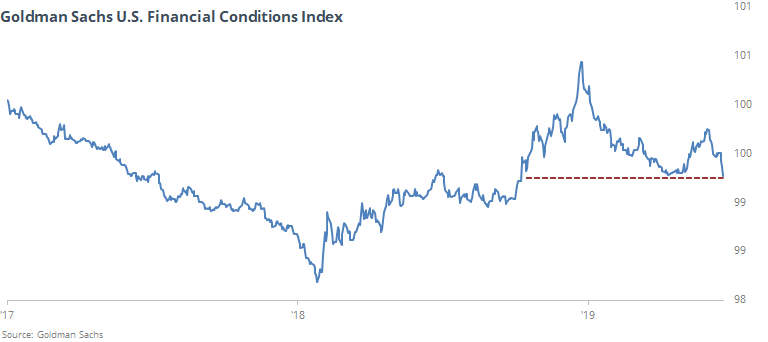

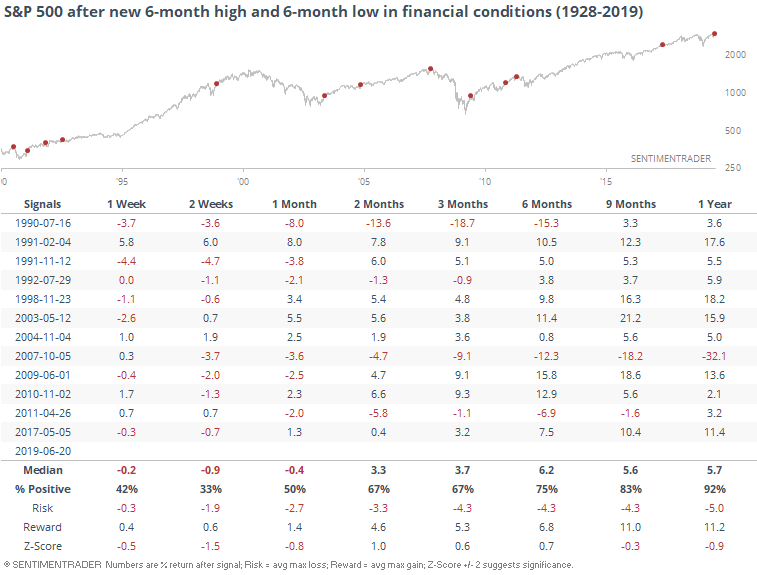

With the rise in stocks, relative calm in currency markets, and drop in interest rates, financial conditions have continued to ease. As stocks hit new highs late last week, financial conditions hit a new 6-month low (the lower the indicator, the easier financial conditions are).

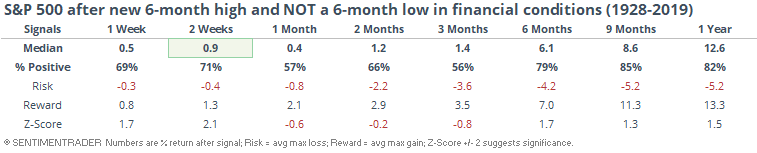

This is taken as a positive sign that the push to new highs in stocks is accompanied by a background of positive fundamental and market-based expectations. For the most part, that take is a good one. Over the next 9-12 months, the S&P 500 had a strong tendency to keep rising, though it didn't prevent a horribly false signal in 2007. Also, the average returns over that time frame weren't very impressive.

If the S&P hit a new high and financial conditions were NOT the easiest in at least 6 months - if there was some kind of stress in the system somewhere - then shorter-term returns were better for stocks.

Medium-term returns in these cases were worse, but long-term ones were better, even if there were a few more failures. There were 35 signals here, so also a larger sample size.

Easier financial conditions are usually a good thing, and as long as it's trending lower, should be a positive for stocks. That's kind of a truism since stock prices are part of the calculation for financial conditions, and it's also worth keeping in mind that when they hit extremes at the same time, it's often with "good as it gets" conditions and that has been a damper shorter-term.

We The North

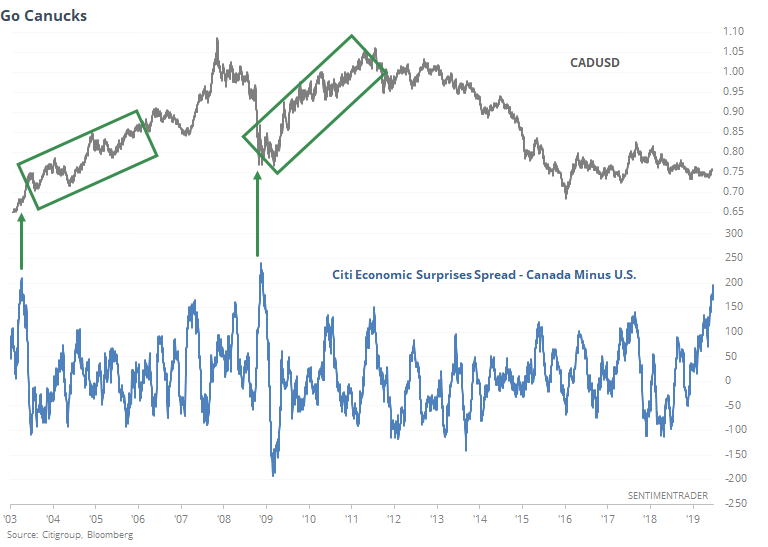

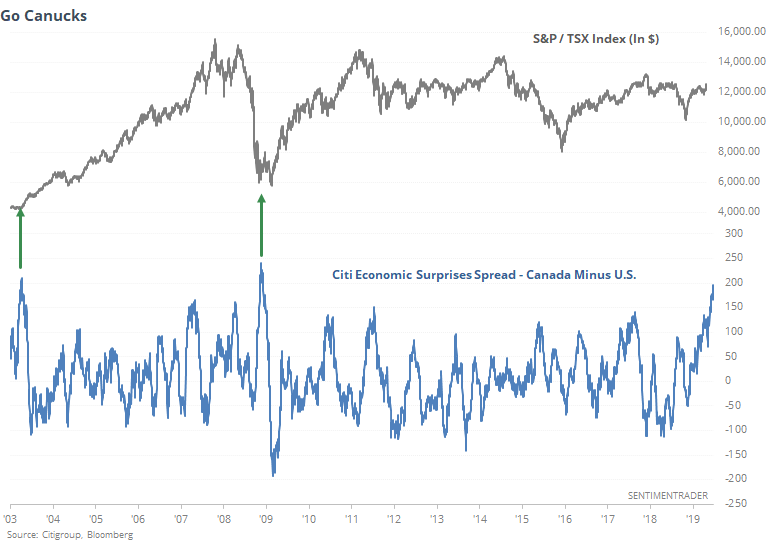

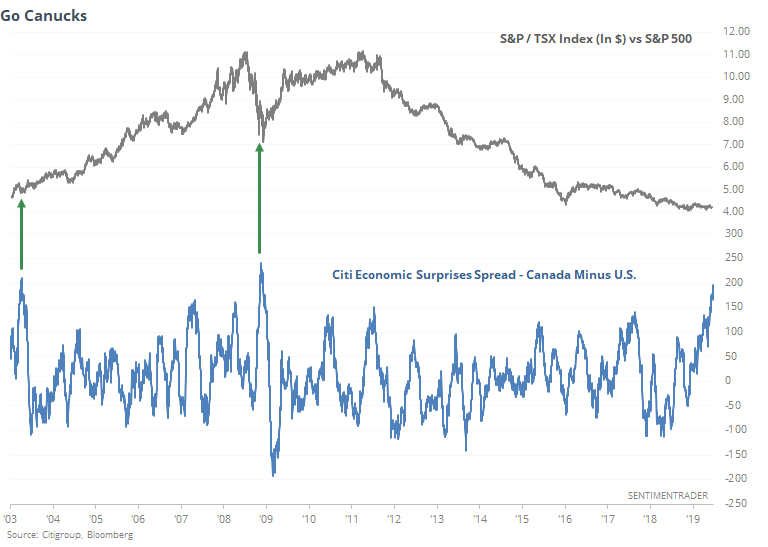

The WSJ notes that economic surprises for our neighbors to the north have been much better than domestically. The Citi Economic Surprise Index for Canada has soared relative to those in the U.S. so much that the spread between the two is nearing an all-time high.

It's interesting to note how the Canadian dollar did relative to the U.S. dollar after the only other precedents.

The TSX did very well, too, when expressed in U.S. dollars.

It also did better relative to the S&P 500 (both expressed in $).

Lesser extremes showed a few failures, so that's a caveat, but the opposite extremes also showed a pretty strong contrary basis. This looks to be a good sign for the loonie and those stocks, at least relative to the U.S.

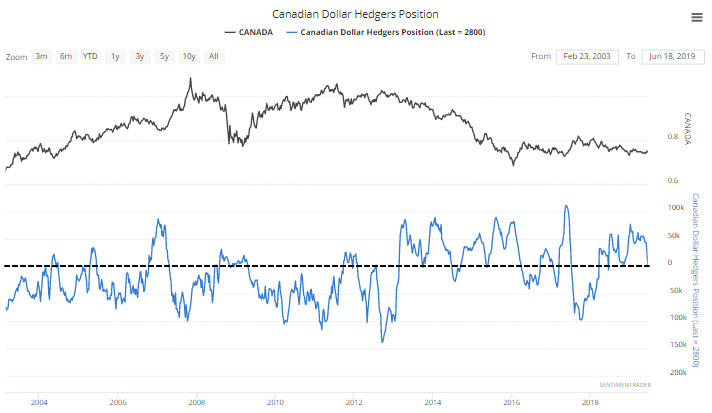

In the futures market, "smart money" hedgers are coming off an extreme net long exposure and are about to flip net short, which is more good than bad. They have a long way to go before we should be concerned about their positioning.

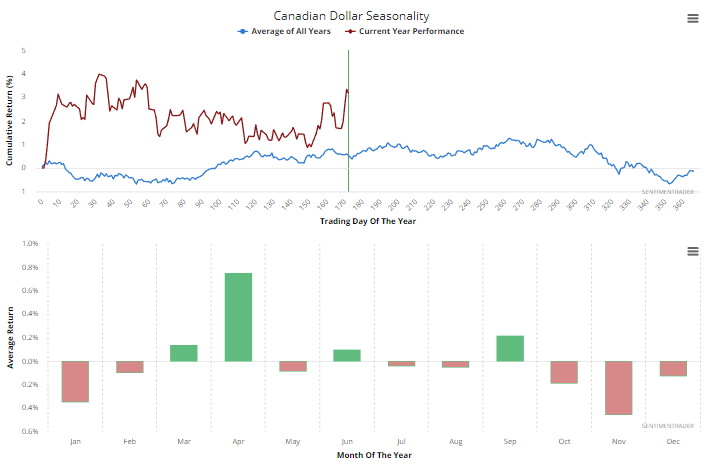

I'm not sure how much, if any, seasonal influences impact the currency, but for what it's worth the Canadian dollar has tended to bottom about now and head higher into the summer months. It violated its usual pattern earlier this year.

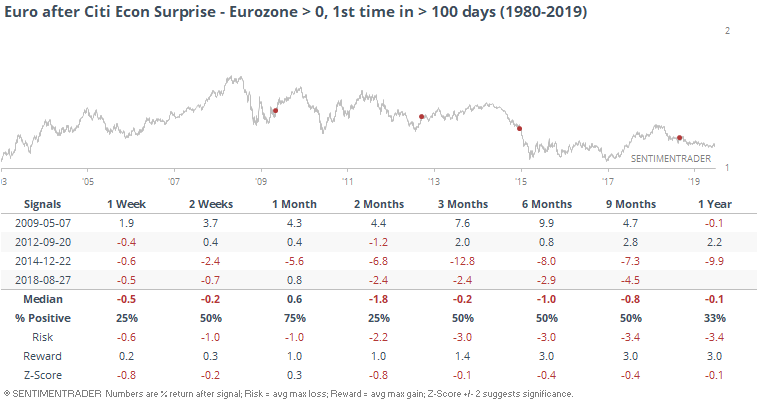

Canada isn't the only region enjoying a pickup in economic activity, or at least a pickup relative to what economists have been expecting. The Citi Economic Surprise Index for the eurozone is about to move into positive territory for the first time in more than 6 months.

There have been 4 other times it went this long in negative territory. Once it emerged, the euro jumped over the next few months twice and collapsed twice, so...?

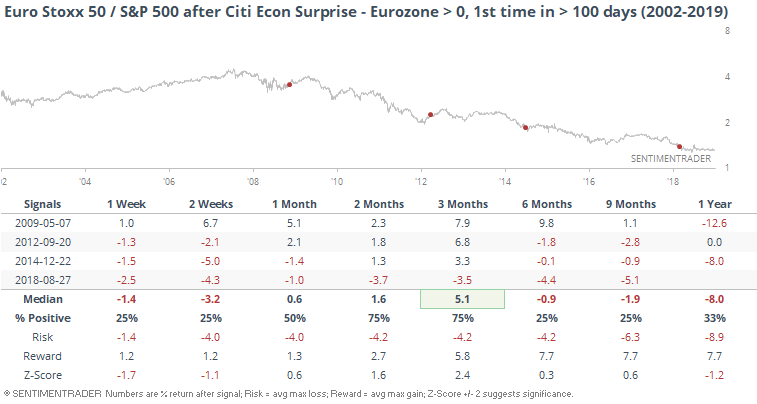

The performance of the Euro Stoxx 50 (in U.S. $) relative to the S&P 500 was similarly mixed.

Gold Interest

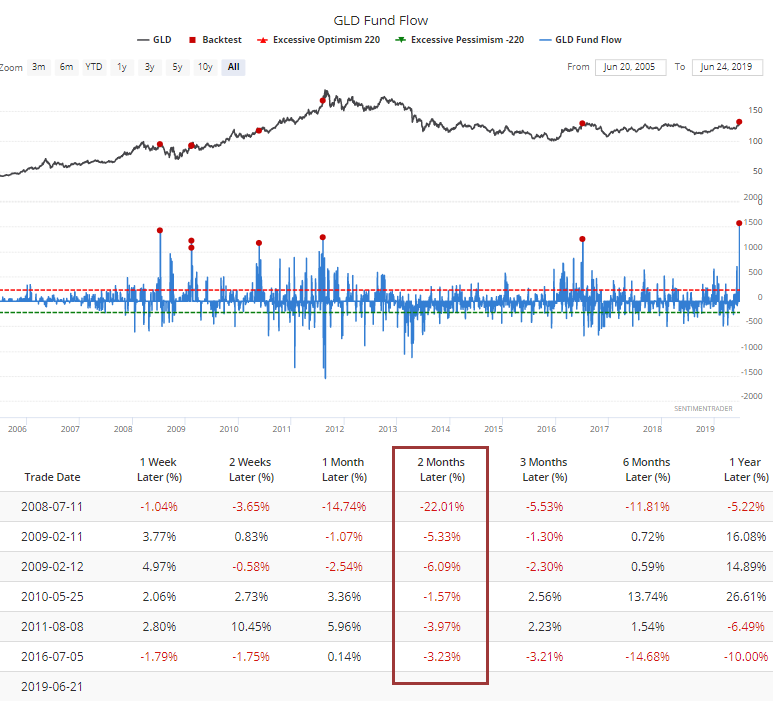

Traders have been glomming onto the breakout in gold, which continues today. On Friday, they shoved more than $1.5 billion into GLD, its largest one-day intake of assets in its history.

The other times GLD absorbed more than $1 billion in a single session, it fell each time over the next two months according to the Backtest Engine.

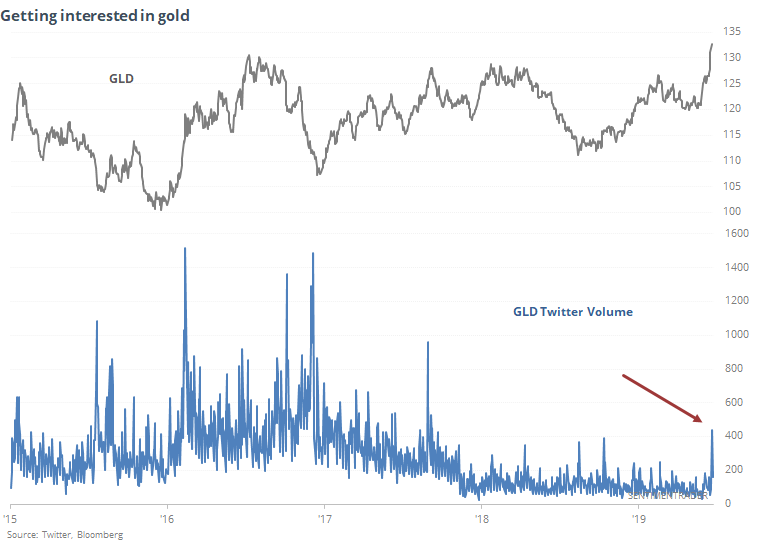

The breakout in gold and GLD has sparked the interest in Twitter users, with message volume jumping to its highest level in over a year.

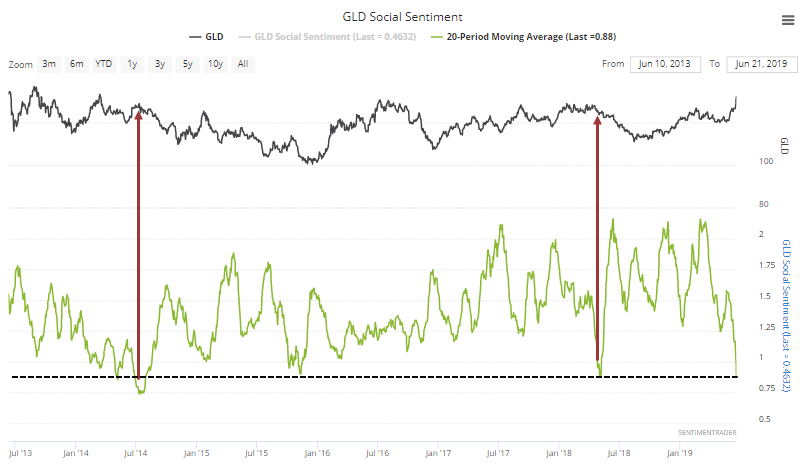

Much of that has been on the positive side of things, with one of the most persistent ratios of positive Twitter messages to negative ones in the past 5 years.

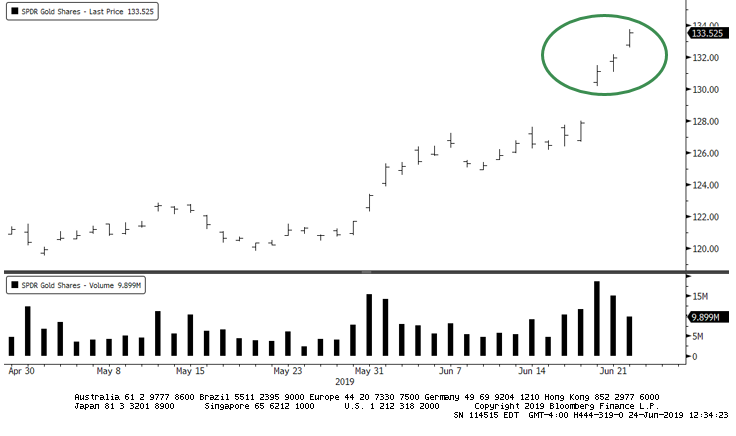

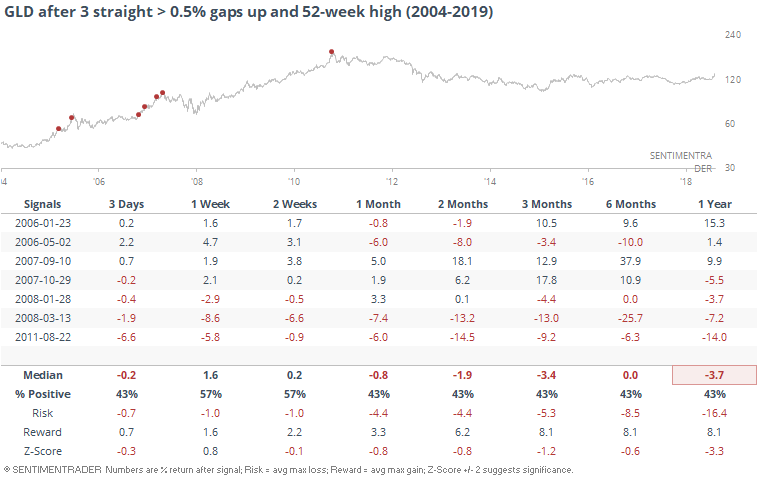

For GLD, today marks the 3rd straight gap up open of more than 0.5%, showing eager overnight anticipation.

It's been awhile since it's put in this kind of streak while trading at a 52-week high.

Breadth Review

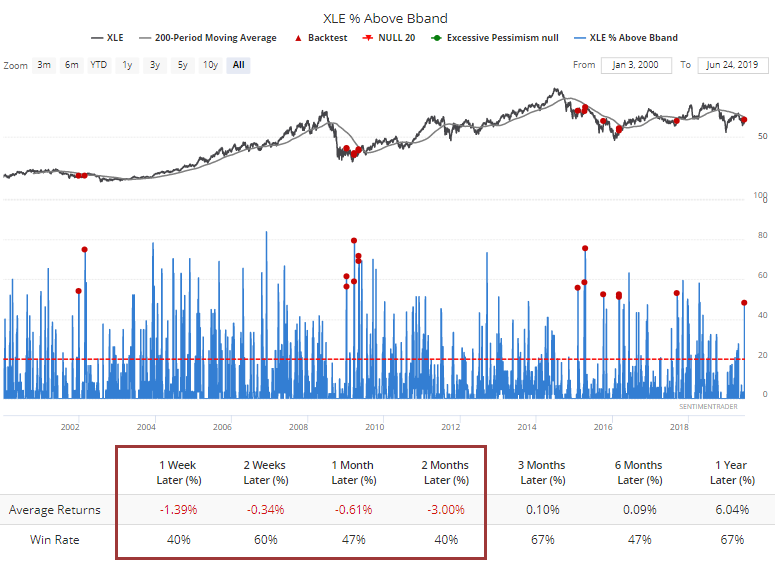

Energy stocks are setting up with an interesting test here. They've jumped in recent sessions, and more than 45% of them are now trading outside their upper volatility bands. When XLE was still trading below a downward-sloping 200-day moving average at the time, it's been a sign of too-much-too-fast.

Several of them were the initial kick-off after extended declines, and a very rough (and imperfect) heuristic is that if buyers persisted in the shorter-term, they tended to keep at it longer-term. Further short-term gains had a loose positive correlation with long-term gains.

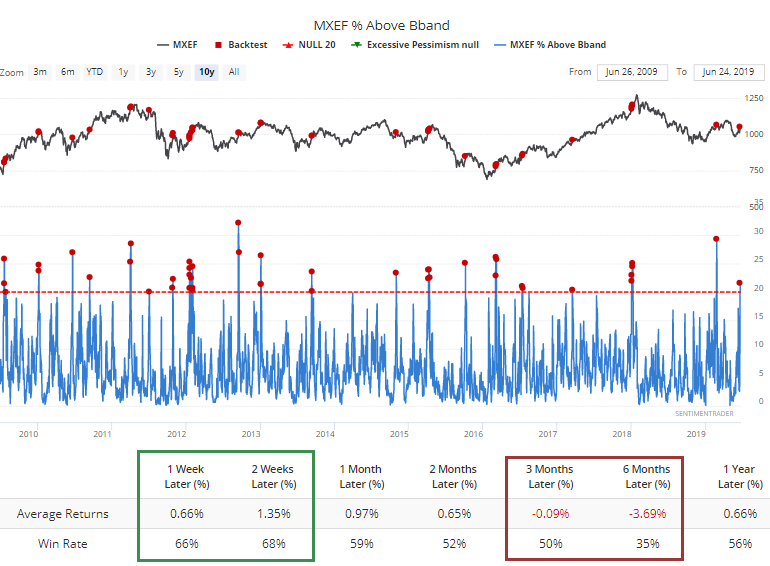

Emerging market stocks have jumped as the dollar has slid, and more than 20% of them are above their bands.

They have behaved differently, with better short-term returns, and poorer long-term ones, at least over the past decade.

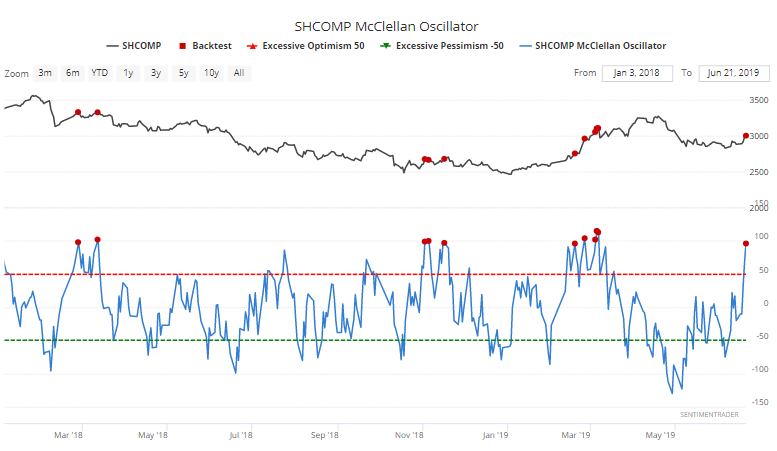

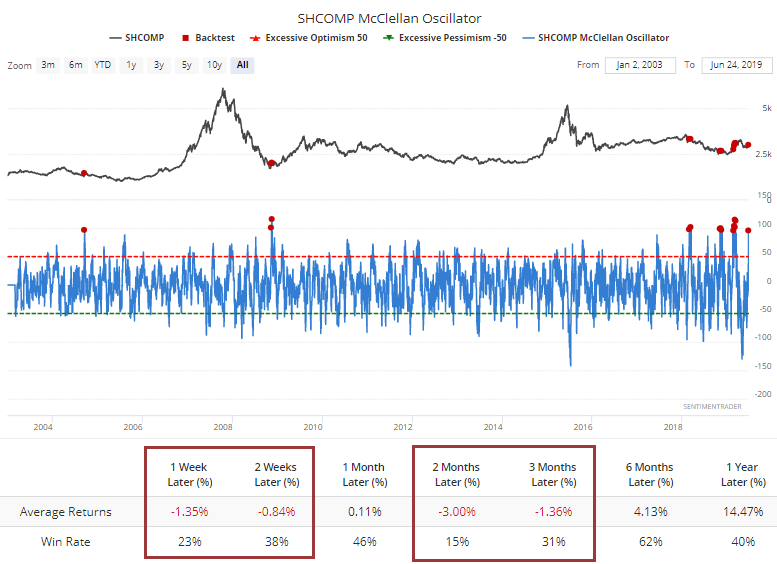

Chinese stocks have been among the beneficiaries, and the McClellan Oscillator for the Shanghai Composite has neared 100, one of its most extreme readings in 15 years.

Zooming in on the most recent signals, we can see just how tough it was for those stocks to build on gains, especially in the short-term.