Monday Color - All About Gaps

Markets are jumping to start the new week, and that always seems to generate a lot of "what happens..." questions. Monday-morning gaps tend to be emotional reactions to weekend news headlines, and have generated some good signals in the past, both ways.

If you missed it, Troy posted a great weekly summary that's worth reviewing. There are some strong studies that have triggered, with a mostly positive bias as we head into the fall. The investment models that we'll be posting more information about soon are also almost all long.

Most of the indicators that we update over the weekend didn't show much movement, so not much to discuss there, and there were no new extremes of note in the breadth metrics we track for sectors and indexes.

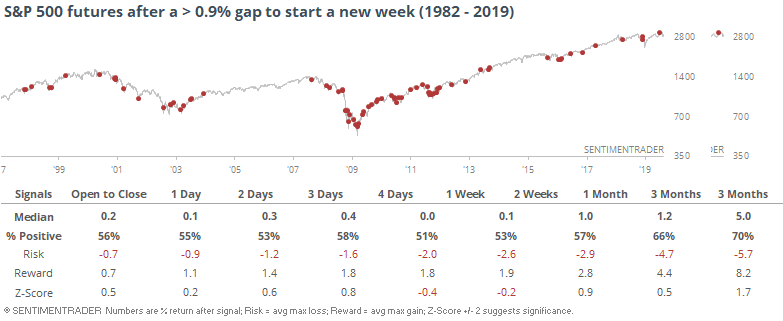

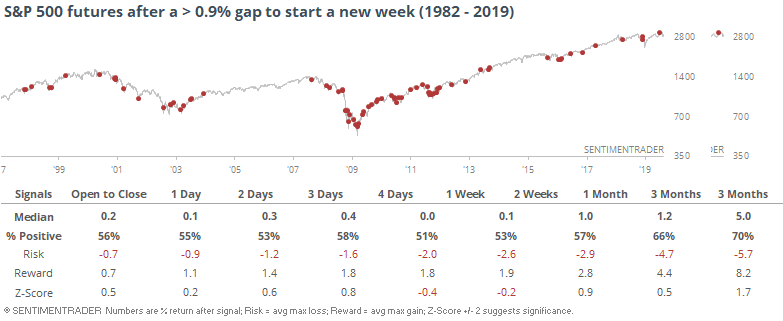

First, let's just look at every Monday (or first day of the week) gap of more than 0.9% in S&P 500 futures since their inception 1982. There were 78 signals, all of which triggered after 1997.

Just the highlights here since it's a long table. And it didn't lead to anything consistent, anyway.

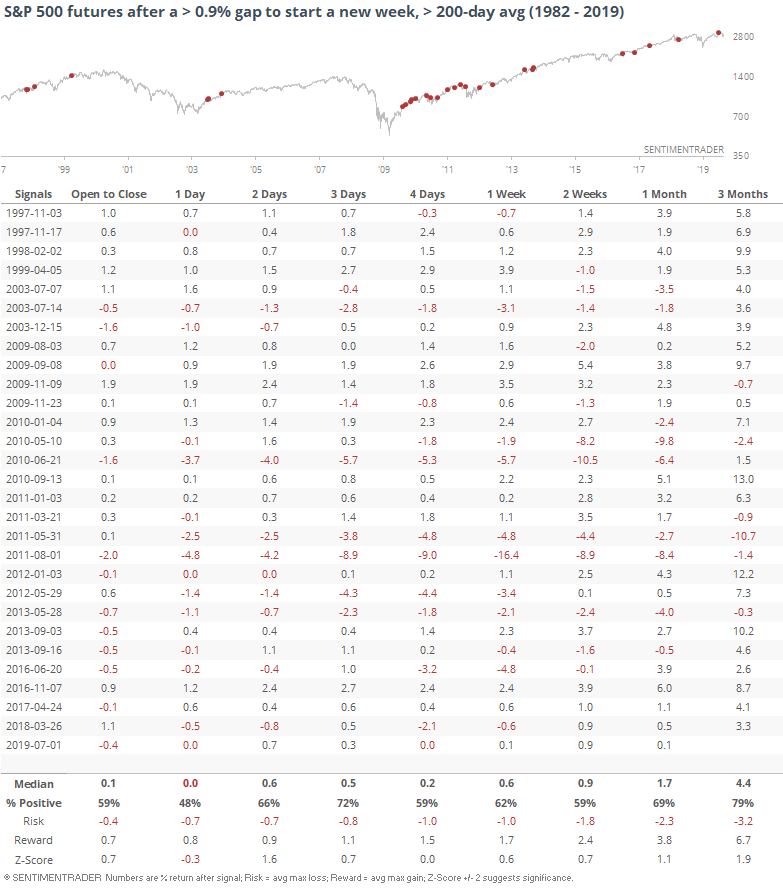

Many of those occurred during protracted downtrends, which we're clearly not in. So let's filter the table to only include times when the S&P had been trading above its 200-day average as of the prior day.

Buying into the gap led to a slight negative return over the next day, but then mostly good things after that. Only 4 of the 29 signals led to a loss of more than -10% at some point over the next 3 months.

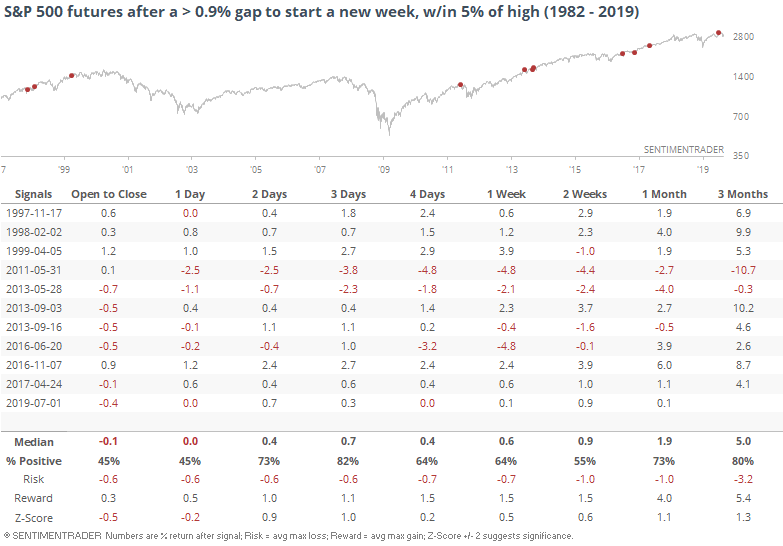

It was even more rare to see these gaps to start a week when stocks weren't even in pullback mode. It's only happened 11 other times when the S&P had been within 5% of a multi-year high.

These were a bit weaker (very) shorter-term, and a bit stronger longer-term. Only 2 of them showed losses over the next few sessions and only 1 of them showed a largish loss at some point over the next few months (in May 2011).

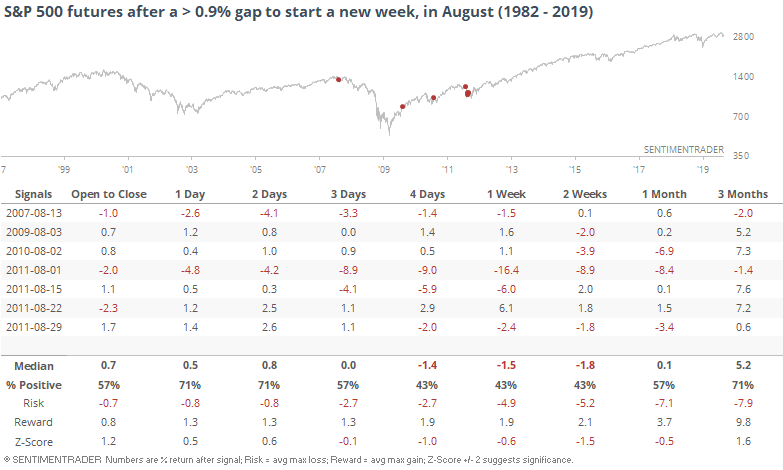

It's rarer still to see this kind of movement in August, especially late August. The next two weeks should be some of the lowest-volume, lowest-volatility of the entire year. The last sessions in August tend to be the slowest of the entire year.

Not sure we can read much, if anything, into these moves. They mostly showed stronger returns very short-term, but weaker longer-term. But again, all but two of these triggered before the midpoint of August. The only two that triggered in the last half of the month were both in 2011.

Overall, the signals which seem most applicable due to similar environments showed a slight bias toward very short-term weakness and a strong bias toward strength over the next few days and weeks. There was only a small probability of a large loss.